$50 billion. That is roughly equivalent to the individual market capitalisation of luxury goods maker Kering, or energy producer ENI, British American Tobacco or cyber security company Fortinet. It is also the amount by which Meta Platforms this week upped its share buyback program. In case this music was not good enough for shareholders’ ears, it also announced a dividend for the very first time.

It is not just Meta. In August 2023, NVIDIA said it would buy back $25 billion of its shares; Microsoft returned $18.4 billion to shareholders in the form of buybacks last year and over $20 billion in dividends. And it’s not just the ‘Magnificent Seven’. In October, Visa announced a $25 billion stock buyback plan and increased its dividend by 16%, while leading digital workflow company, ServiceNow, initiated its first ever buyback program in 2023.

It would have been perplexing to have read the above paragraphs a decade ago – indeed, elements would have been very surprising even a year ago − but yes, technology growth companies are now returning significant cash to shareholders. What has changed? Two incredibly important phenomena, which are hard to overestimate in their role in defining the next decade for investing in the technology sector.

Firstly, beginning in Q4 2022, continuing throughout last year, and to the surprise of many, into 2024, the mindset of technology companies changed from ‘growth at all costs’ to ‘profitable growth’. This was a seismic shift, and a necessary one following a bruising 2022 for technology companies faced with the sharpest interest-rate hiking cycle in history combined with a climb down from unsustainable Covid-induced demand. What emerged in 2023 were technology companies with leaner cost bases, a more disciplined approach to spending, and the ability to generate higher profits as a result (which we wrote about extensively in this series here).

Secondly, we have just embarked on a new technology cycle, driven by AI. This is serving up a revenue injection atop leaner cost bases through the creation of new growth markets, as well as providing further avenues for enhancing internal efficiencies, the combination of which is driving significant operating leverage. Higher revenues and lower costs make for greater cash generative abilities, in what is an inherently cash generative sector given the pervasiveness of asset-light business models. And this is the dynamic we are witnessing play out this earnings season: free cash flow inflected 115% for Meta in Q4 2023 results just announced, representing a 29% free-cash-flow margin; ServiceNow’s 32% free cash flow growth in Q4 has driven its free cash flow margin up to an impressive 55%.

How is this new technology cycle, driven by AI, boosting the topline of innovative leaders? In the case of ServiceNow, which plays the indispensable role of automating workflows for enterprises, AI is turbocharging its customer proposition for enterprises hungry to harness the power of generative AI for themselves. Companies come to ServiceNow in order to automate their workflows across the entire organisation with a single platform for digital transformation: every legacy, third party and native software system is unified in one platform, avoiding the need to rip and replace, and with one single code base and one core data platform, ServiceNow automates workflows across entire organisations in roughly half the time of peers. Consolidating 75 systems into one is a powerful selling point on its own, but its appeal is amplified by enterprises seeking to deploy AI and wanting all its data in one place.

But there is more. On top of this demand-pull for ServiceNow’s core platform are the company’s recently launched generative AI products, which are already catalysing its customer pipeline. By infusing generative AI into all workflows (such as virtual assistants), trained on enterprises’ domain specific data, ServiceNow is bringing the productivity gains of AI to the enterprise, and enterprise demand is vociferous. Indeed, IT spend is set to grow to $6.5 trillion by 2027 (from c.$5 trillion in 2024 [1]) with $3 trillion of this spent on AI, underscoring a staggering opportunity set for enterprise software companies leading the charge in AI where revenue is poised to grow at 64% compound annual growth rate (CAGR) through the next decade.

ServiceNow’s positioning as the key enabler for enterprises to deploy AI puts it in an enviable position to capitalise on this sea-change, evidenced by stellar Q4 results and management upping 2024 guidance to reflect better-than-expected early generative AI momentum. The company’s generative AI product range drove the largest net new annual contract contribution in Q4 than any new product family release in company history – why? Because, to quote CEO Bill McDermott, “If you're improving productivity, 40%, 50% it just sells itself.” At the same time, use of its own platform internally is driving outperformance on the operating margin side – ServiceNow is making its own cake and eating it.

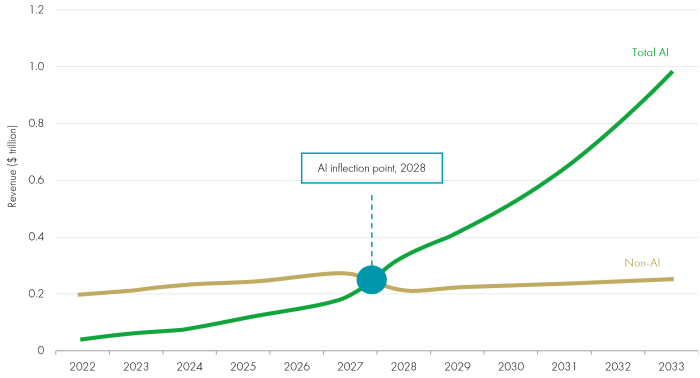

Revenue projection of AI in Enterprise Software

Source: Gartner 2024

The same playbook of heavy investment and adoption of AI in order to power both top line growth and bottom-line efficiencies can be seen across many companies in the sector. Take Meta, where heavy investment is putting it lightly – the company will have 350,000 Nvidia H100 GPUs by the end of this year, worth an estimated $10.5 billion, in addition to other GPUs totaling the power equivalent to 600,000 H100 GPUs – but Meta is already reaping rewards through greater customer engagement and a leaner cost structure.

We all know that the technology sector has the best growth. What is frequently overlooked is that technology companies have the best cash generation. This is not something technology companies used to possess if we hark back to the early 2000s, but something that we on the Global Innovation team believe will become more pronounced as we progress through this new technology cycle. The winners of this AI revolution will be unlocking new markets for growth, driving revenue, while achieving ‘more for less’ and saving costs through productivity. We have just had a glimpse of some early frontrunners.

Highest free cash flow margin

Source: Bloomberg, MSCI World Index, data as at 31.08.23

[1] ServiceNow Q4 earnings release, January 2024, Gartner estimates.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice.