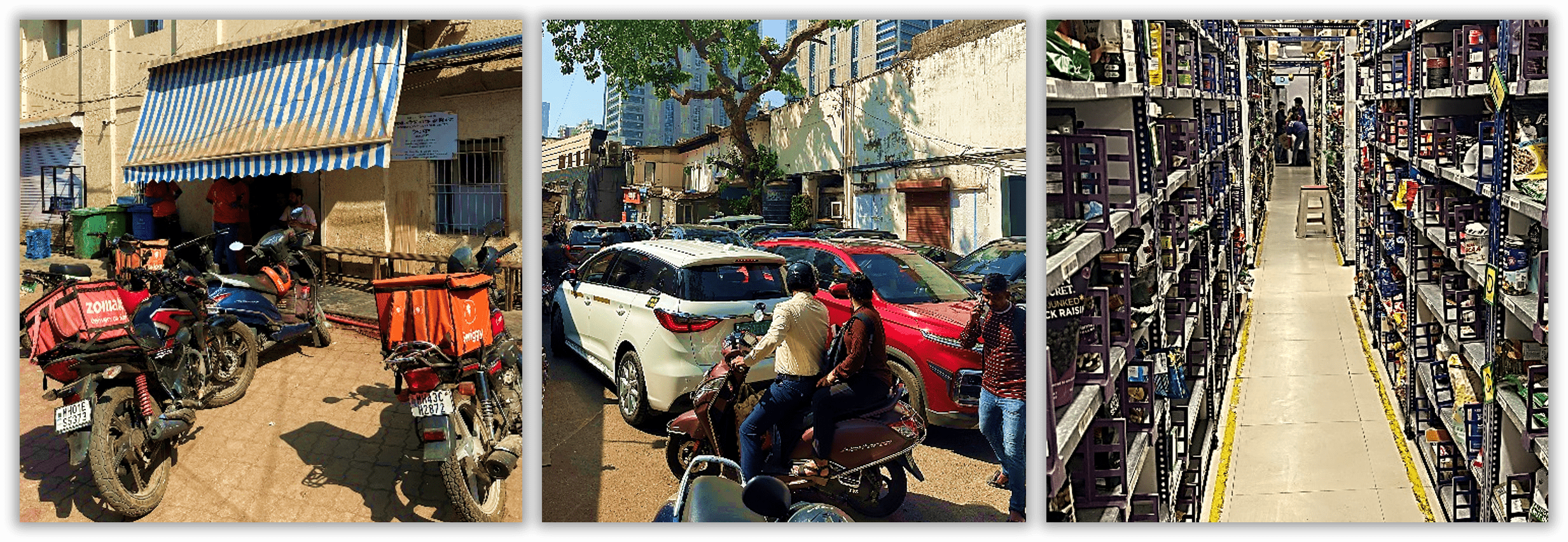

A recent trip to Mumbai was an excellent opportunity to check in on the burgeoning Indian quick commerce market, through meetings with an independent dark store franchisee and visits to dark stores operated by both Swiggy and Zepto, the two main competitors to market leader Blinkit (Zomato). Dark stores are the logistics backbone of quick commerce – small, strategically located warehouses catering exclusively to online orders. Designed to enable ultra-fast deliveries – usually in under 10 minutes, often as quick as just three to four minutes – dark stores are typically within a two to three kilometre radius of key residential hubs, with optimised and localised inventory, ranging from fresh foods and hot coffees to consumer electronics, personal care and children's toys. When an order arrives, 'pickers' have as little as 90 seconds to collect items and hand them over to the waiting delivery driver. The progress of each order is tracked in real-time through handsets and QR codes, with the average times for store and individual pickers prominently displayed on monitors.

Photos: Ewan Thompson

By necessity, the layout of the store is highly optimised for one-way traffic of fast-moving pickers (running, in fact) and the order frequency of individual items. With traffic snarled continually outside in the street, an army of pedal bikes and scooters weave between jammed cars to deliver their orders. Close central monitoring allows operators to respond rapidly to consumer trends and "not found" messages, with approximately 10% of store content localised. For example, several unfulfilled searches on Blinkit for goggles at an apartment complex with a newly opened swimming pool led to stock availability within 24 hours. And, of course, inventory is carefully calibrated ahead of upcoming events such as Valentine’s Day or religious festivals.

Given the huge growth in demand, the major quick commerce players are currently in a phase of rapid store roll-out. Typically, operators set up an initial dark store for an area, and once it hits 1,500 orders per day, it will be 'split' by opening another nearby to service the area. Stores generally break even within three to nine months at roughly 1,000 orders per day. Blinkit – Zomato's quick commerce arm – is currently at the forefront of this rapid expansion, adding 216 stores in the last quarter of 2024, more than it added in the year to March 2024. Furthermore, it lifted its store-count guidance to hit 2,000 by December 2025 compared with December 2026 previously – essentially front-loading its expansion plans. With Swiggy listing in November last year, and Zepto planning an IPO for August this year, the key debate in the market in recent months has centred on the issue of competition and whether such strong store additions from multiple players can be sustained.

Zooming out to the big picture, India's local small vendor network – known as Kiranas – control up to 95% of the grocery market, with online quick commerce penetration merely 1%. The key to India's rapid growth potential is the fact that quick commerce operators can combine economies of scale with extremely low labour costs to supply products within a matter of minutes for less than they cost at local stores. Given India's extremely high internet penetration relative to its stage of economic development, this removes key barriers to rapid penetration growth. Comparable models in developed markets see labour costs at 25-50% of cart value – this is 15% in China and considerably lower still in India at less than 5%.

Indian quick commerce GOV sat at about $4 billion in March 2024 and estimates range from $50 to $80 billion by the end of the decade – a more than 10-fold increase that would still leave online penetration at around 3.5% of the grocery market. Moreover, geographical expansion and the addition of new categories – for example: basic apparel, electronics and food services – has seen TAM increase from $650 billion to over $1 trillion in just six months. Present in over 80 cities across India, quick commerce is expected to be present in 125 within 12 months.

Quick commerce gross order value by player (Rs. bn)

Source: CLSA, 27.01.25

Given the scale of this opportunity, competition is an inevitable reality – the dark store visits underlined that differentiation is hard and execution is the key. First-mover advantage is therefore significant for Zomato, Swiggy and Zepto, which supports their decision to accelerate expansion ahead of potential additional entrants such as Amazon and Flipkart. The government has made it clear it will not tolerate aggressive price discounting and burning through balance sheets to take market share, and what has been encouraging is relative price stability among new entrants, with most discounting guided towards customer acquisition in new geographies. Unlike for food delivery or ride hailing – where companies needed very high discounting for category creation purposes – in quick commerce, it is merely a shift in channel. The unit economics already undercut organised retail, and with the convenience factor on top driving rapid adoption, discounting is less aggressive.

Adjusted EBITDA margin trend (%)

Source: CLSA, 27.01.25. Past performance is not a guide to future returns

In its December quarter results, Zomato showed GOV growth of 27% quarter-on-quarter (120% year-on-year) in its quick commerce segment Blinkit. While adding a significant number of new stores, importantly GOV per store remained flat, indicating that rapid growth at mature stores is offsetting under-utilised new stores. With customer retention improving and store break-even time extremely low (as little as three months), Blinkit has been able to add significant new customers without diluting AOV (average order value). The faster roll-out schedule has pushed back earnings break-even by a couple of quarters but, given the primacy of early-mover advantage – especially into new cities, which will be much more expensive to break into in coming years – this is an understandable move. In a rapidly growing market, Blinkit remains the clear leader with nearly 50% market share and aggressive plans to establish itself as the dominant player in an increasing number of new geographies and, as such, Zomato remains the best way to benefit from the ongoing rise of Indian quick commerce.

In its December quarter results, Zomato showed GOV growth of 27% quarter-on-quarter (120% year-on-year) in its quick commerce segment Blinkit. While adding a significant number of new stores, importantly GOV per store remained flat, indicating that rapid growth at mature stores is offsetting under-utilised new stores. With customer retention improving and store break-even time extremely low (as little as three months), Blinkit has been able to add significant new customers without diluting AOV (average order value). The faster roll-out schedule has pushed back earnings break-even by a couple of quarters but, given the primacy of early-mover advantage – especially into new cities, which will be much more expensive to break into in coming years – this is an understandable move. In a rapidly growing market, Blinkit remains the clear leader with nearly 50% market share and aggressive plans to establish itself as the dominant player in an increasing number of new geographies and, as such, Zomato remains the best way to benefit from the ongoing rise of Indian quick commerce.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Investments in emerging markets may involve a higher element of risk due to less well-regulated markets and political and economic instability. This may result in higher volatility and larger drops in the value of the fund over the short term. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.