A $1.6 trillion industry – the pharmaceuticals industry – is built upon the foundations of its products having a success rate of just 8%. If that sounds ripe for disruption, it should. Today’s global pharmaceutical giants are some of the largest and most powerful companies in the world, but do they have an edge in the unfolding world of artificial intelligence (AI)? For the most part, we think not.

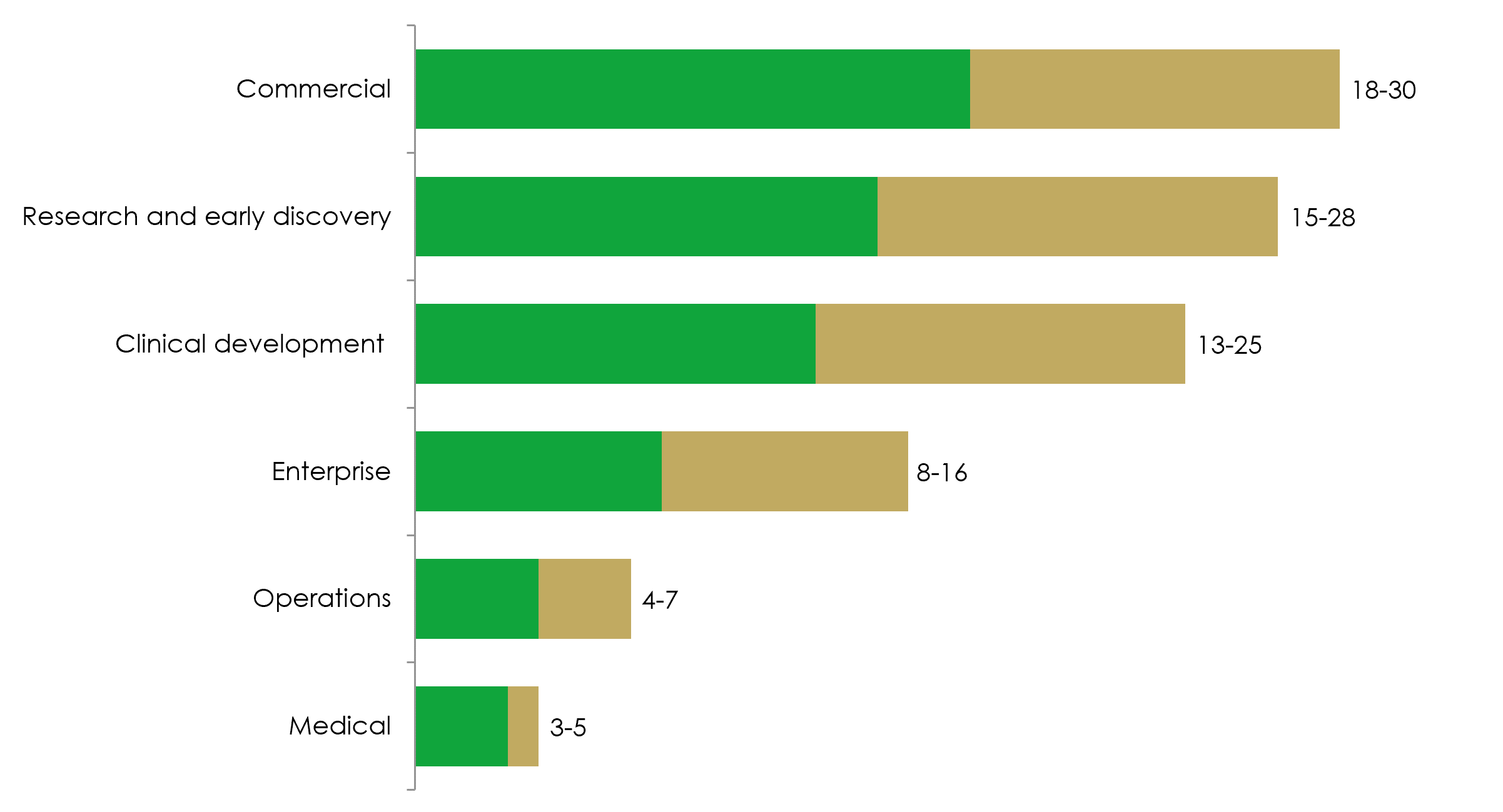

Let us first address the AI opportunity for the healthcare industry, which is twofold: improved clinical outcomes and reduced costs. Recent research from the McKinsey Global Institute (MGI) has estimated that generative AI could create between $60-110 billion a year in economic value for the pharma and medical-product industries. This will be through accelerating the process of identifying compounds for new drugs, speeding up their development and approval, and improving the way they are marketed. All this acceleration results in a longer timeframe to maximise profits from drug patents, the cornerstone of pharmaceutical economics.

Expected value annually, $ billion

Source: McKinsey analysis

Meanwhile in a paper for the National Bureau of Economic Research, Sahini, Stein, Zemmel and Cutler forecast an annualised 5-10% reduction in healthcare costs over the next five years using today’s AI technologies, yielding $200-360 billion dollars of annual savings in the US each year.

On the Liontrust Global Innovation team, we believe that AI will prove to be one of the most deflationary innovation we ever witness, and declining healthcare costs (which comprise c.20% GDP in the US) will be one of the most important demonstrations of this. There is plenty of low hanging fruit for the bloated administration of the healthcare industry to use AI to cut costs without sacrificing quality of care – think of AI interpreting radiology images, expediting claims management for health insurers, optimising capacity schedules for hospital staff and using analytics across the value chain to improve decision making.

This all sounds like a once in a century opportunity – and we believe it will be for some companies, but definitively not for all. Within the multitude of possible AI use cases in healthcare, we see both the greatest potential and the greatest disruption occurring in early research and drug discovery. Big pharma currently spends on average 25% of their revenues on research and development (R&D) to discover and develop new drugs, yet bringing a drug to market takes around a decade, and even then, only 8% of drug candidates make it through phase three clinical trials successfully.

Why is commercial success so scarce and the process so arduous? Well, the majority of drug discovery today is initiated with a human assumption of a drug target (of course, a highly qualified assumption, but a fallible human one nonetheless), and the process is inordinately data intensive – we are talking about sifting through an infinite universe of possible compounds to find those that can effectively treat highly specific conditions.

This is where AI comes in. Generative AI models can ingest structured data as well as unstructured (such as images, patient data and omics), so just as ChatGPT was trained to predict the next word in a sentence, these models are trained to predict the next part in the structure of a molecule. These tools then become capable of predicting the disease-treating potential of various compounds. So the question now becomes, is anyone already doing this at scale?

Recursion Pharmaceuticals, a tech-bio company and holding of ours, is using AI to transform drug discovery. Owning one of the world’s largest and highest quality biological and chemical datasets, and using its own proprietary AI models and software powered by biopharma’s most powerful supercomputer (developed in partnership with Nvidia), Recursion is able to conduct over 2.2 million experiments on its platform per week, which encode for over six trillion biological and chemical relationships, untouched by human bias. The result? The company is validating drug leads 66% faster than the industry average, at 60% lower cost.

Moderna is another company leading in the field of AI within healthcare. The company’s RSV vaccine (Moderna’s first commercialised non-Covid product, approved last week) went from idea through phase three clinical trials in just two years, owing in large part to efficiency gains from AI helping to forecast trial enrolment. This is less than half the time it took for Pfizer’s rival RSV jab to come to market, a company emblematic of the old school bureaucracy that stifles the agility of much big pharma. In contrast, Moderna announced last quarter it had built 750 custom GPTs across the organisation in just two months of collaboration with OpenAI. Productivity gains are already being realised, with the initiative cited as the driving force behind a 10% reduction in the company’s selling, general and administrative expenses in Q1.

What does this mean for big pharma? It is early days for AI’s application in healthcare, but the potential for companies like Recursion and Moderna to identify novel drug targets through AI and accelerate their development could improve millions of lives and upend the pharma industry as we know it today. What sets these companies apart is their digitally native origins, because generative AI cannot deliver results if a proper data architecture is not in place. Building this data intelligence layer takes time and cannot necessarily be stitched together retrospectively – the scientific journal Nature estimates irreproducible biology research costs amount to $28 billion per year.

Furthermore, data is extremely siloed in pharma, with hundreds of petabytes (PB) of biopharma data stored on a project-by-project basis without the annotation required to relate it to other projects. This puts the data estates of the likes of Recursion, which boasts c.50 PB proprietary data fit for the purpose of AI, at a distinct advantage when it comes to utilising AI at scale.

We do not expect disruption to be instant − technology platform shifts always entail time for dissemination, and healthcare has an especially complex regulatory landscape to navigate. However, we anticipate the industry will look very different in ten years’ time. Just as software-as-a-service technology companies were at risk of being made irrelevant if they were not cloud native in the 2010s, we believe that biotechnology and pharma companies which are not digitally native are at risk of becoming redundant as the AI revolution gathers pace.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.