The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income above the FTSE All Share Index. December (+493bps) was a good month, with equity markets rallying post the widely perceived ‘FED Pivot’ in the first half of the month. As a result, performance for 2023 further improved, taking the total return to 8.58%, and helping to widen our outperformance vs. the benchmark (+66bps). The fund finished the year in the second quartile of IA UK Equity Income comparator group, a position replicated on a trailing three-year basis. We are pleased to have delivered: i) a high-single-digit absolute return with income above the FTSE All Share Index yield; and ii) post-fee outperformance – we aspire to do even better for our clients in 2024.

The top contributors to performance in December were audio-visual equipment distributor Midwich (+49bps), rental equipment leader Ashtead (+42bps), trading platform IG Group (+38bps), and Bank of Georgia (+37bps) - generally lacking much by way of a common thread. The bottom performer was repeat-offender Anglo American (-34bps) which delivered a deeply disappointing annual outlook early in the month, leading to a total share price decline of >15% in December. We are conscious of this as a large single stock move in what had already been a material underperformer up to that point but have switched our exposure into Rio Tinto, which has managed to avoid significant negative surprises around production, costs, and capital allocation. During the month we initiated a position in logistics REIT SEGRO, the UK’s largest listed REIT, seeing an attractive entry valuation and signs of a trough in asset values. We also started positions in Alfa Financial Markets, a consultancy business with a stellar growth record since IPO, and investment platform AJ Bell – we see both of these businesses as leaders in their respective areas trading at attractive valuations. While we started to sell in November, we fully exited our position in Computacenter during December, taking profits after a strong run that we felt did not reflect risks around its important German market in 2024.

Looking back at 2023, a top contributor was 3i (+162bps) which was exited gradually through the year on strong performance. This, however, was bittersweet, as the shares continued their rally and we’d have been better served holding onto this high-quality business. Leaders in their respective markets of kitchens and personal lines insurance, Howden (+126bps) and Admiral (+123bps) were also top contributors for the fund and remain positions at year end. The biggest detractor for the year was Anglo American (-136bps), about which enough has already been said, though clearly we have lessons to learn here as this level of negative performance from a single position is not something we would hope to see again. Beverage brand-owner Diageo (-49bps) and distributor RS Group (-46bps) were also notable detractors, with losses from the latter exacerbated by (in hindsight) poorly-timed position reductions ahead of the year-end rally.

Overall, we enter 2024 pleased to have delivered positive absolute and relative returns for our clients, learning from mistakes and successes alike to be better investors going forward.

Dividend paying companies with Competitive Power: Kitwave

Over the course of the year, we have built a position in Kitwave. It is now a Top 10 position representing c.3.3% of fund NAV. Kitwave is a food wholesale business headquartered in the northeast of England. It was founded in 1987 by current CEO Paul Young. It serves >42,000 customers who are primarily independent retailers and catering firms, making nearly 5,000 deliveries a day. It is a smaller company which, having listed relatively recently (May 2021), many of our readers may be unfamiliar with. But it is one where we are very optimistic about its future prospects.

Young, an accountant by training, recognised early in Kitwave's existence that competing against the big beasts in the industry, such as Booker and Brakes, would be very challenging given their superior scale and purchasing power. Rather than try to compete on 'price', therefore, his strategy was for Kitwave to differentiate itself based on 'service'. He positioned the company to focus on two niche specialisms – small accounts and frozen foods.

From the bottom-up Kitwave's logistics network has been designed to service small accounts. To illustrate this, Kitwave's average order value is c.£400 compared to Booker's minimum order value at £1,000. It operates a hub-and-spoke network, not dissimilar to Ocado, with its distribution centres and vehicles optimised to move crates rather than pallets (the opposite of a typical cash & carry). It also uses sophisticated routing software which enables precise calculation of cost of serve for each customer dependent on their location. From this, it calculates an individual price file for each of its customers, ensuring target profit margins are achieved.

Kitwave's second specialism is frozen and chilled foods, which requires operation of a cold chain and refrigerated fleet. The additional investment and operational complexity associated with this creates a barrier to entry for many firms. Indeed, some of the UK's largest wholesalers (e.g. Booker, Bestway) actually outsource their frozen delivery to Kitwave. A further anecdote demonstrating Kitwave's expertise is that it recently won a national contract to supply ice cream to all Domino's Pizza UK outlets, having been recommended to Domino's by Ben & Jerry's manufacturer Unilever.

In establishing these service driven niches, Kitwave has become indispensable to its customers. And this permits it a degree of pricing power. Over its last reporting period (six months to April 2023), while most consumer staple companies were experiencing inflation-driven volume pressure and margin erosion, Kitwave delivered c.17% organic sales growth (including c.4% volume growth), while also seeing its margins improve.

The business has delivered strong growth over recent years through a combination of organic and bolt-on growth. Organic growth has been driven by a combination of customer wins and increased wallet share via cross-sell across its different categories (ambient, chilled, frozen, impulse, fresh); roll-out of an enhanced digital order capture system; plus, good old-fashioned sales and account management. Kitwave has also acquired 13 businesses since 2011, typically these are small family-run businesses, acquired in off-market processes, with it paying multiples of <5x EBITDA. All acquisitions are integrated into a single enterprise resource system to help capture operational and financial synergies.

Our investment philosophy is that ‘quality dividend investing works best’ and we apply a systematic framework to understand and identify quality. In our view Kitwave is a competitively advantaged market share winner operating in a fundamentally attractive, stable market. It demonstrates the five building blocks we look for across our portfolio holdings.

1. It generates strong returns on invested capital (ROIC), achieving c.16% in 1H23a (post-tax), a number which has pleasingly trended higher over recent years. These returns create distributable cashflows for reinvestment into both organic and bolt-on M&A growth opportunities - Kitwave has achieved a 5-year EPS compound annual growth rate (CAGR) of c.56% (2018a-23e).

2. As dividend-focused investors we want clean, cash generative financial models. Kitwave reports straightforward accounts with minor adjustments to earnings around M&A expenses and amortisation. Free cash flow to net profit conversion has been c.100% over recent years.

3. Kitwave periodically uses debt to fund bolt-on M&A, but operates with a prudent balance sheet. Its net debt / EBITDA ratio is a conservative c.1.1x (1H23A). It has no pension deficit to service or material provisions booked.

4. Food wholesale is a fundamentally attractive underlying market. Although relatively low growth in volume terms, spend tends to be resilient (people gotta' eat) and risks of disruption are low (we're pretty sure that independent retailers and caterers are going to exist in 10-20 years' time and that they will need a delivery service). The market also offers significant organic and acquisition growth potential – Kitwave is the 14th biggest player in the UK but with only c.2% share of the overall market and c.5% of its target independent market.

5. We look for skilled, motivated management. Founder and CEO Paul Young will be retiring in March and passing the baton to Ben Maxted (also an accountant) who has been with the group since 2011, while acting as chief operating officer since 2021. We have met Ben several times and been impressed by both his operational focus and broader vision for the company. Continuity is also provided by CFO David Brind (you guessed, an accountant too!) who has been in his role since 2011.

The future is the only thing that matters in investing and, as with all our investments, we apply a Competitive Powers framework to get comfortable that Kitwave's superior financial performance can sustain over time. As a reminder, Powers are strategic traits that underpin potential for a company to generate persistently attractive returns. They have dual attributes – benefits to the company, manifest through pricing power or lower costs; and barriers to competitors, who would ordinarily attempt to arbitrage away supernormal financial returns (for further discussion see here). We believe Kitwave has three of the seven Competitive Powers – Counter Positioning, Switching Costs and Scale Economies, which we think will underpin its continued profitable growth.

- Counter Positioning: As discussed, Kitwave's business has been oriented towards market niches that bigger incumbents are either unmotivated or poorly set-up to service. This is a classic example of Counter Positioning, a power often exploited by smaller companies to gain foothold in their markets. To try and mimic Kitwave's model would make little economic sense for big players operating from much larger, inflexible cash and carry footprints, given the additional operational complexity it would impose on their businesses. Thus, within its target markets, we think Kitwave can continue to scale.

- Scale Economies: Although Kitwave operates outside the Top 10 UK wholesalers, it is large relative to the mom-and-pop type businesses it typically comes up against. Its scale benefit can be demonstrated through the c.2-3ppts margin uplift it typically achieves when acquired businesses are integrated into the group. This is driven through a combination of procurement, as Kitwave generally obtains better terms from suppliers (who value access to the hard to reach independent sector); sell-out benefit, as price files are aligned and optimised; and, better fixed cost absorption across head office, route density and depot efficiencies.

- Switching Costs: As discussed above, Kitwave serves parts of the industry where competition is more limited. And it does so with high service levels, typically achieving >98% of deliveries on time and in full. This means its customers have few alternative suppliers and little incentive to seek them. As discussed above, we think there is good evidence of this business having pricing power.

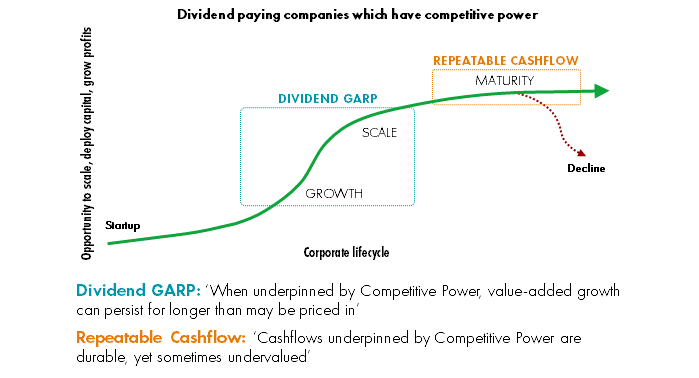

Kitwave sits within the Dividend GARP portion of portfolio, formed of companies in the growth phase of the corporate S-Curve. Our hypothesis with this group of stocks is that 'when underpinned by competitive power, value-added growth can persist for longer than may be priced in.' They generally pay a dividend, though still with plenty of runway to reinvest their cashflows and grow their businesses, we expect returns to be driven primarily by compound profit (and ultimately dividend) growth.

Kitwave offers a prospective dividend yield of c.4.9% (FY1-2e) and we believe its Competitive Powers, aligned with attractive market structure, will allow it to continue delivering double-digit growth in earnings, cashflow and dividends over the medium term, consistent with management targets. The stock trades on a blended forward P/E of 8.7x (FY1-2e) and is on a prospective FCF yield of c.11.5%. We'd consider such low valuation multiples to normally be associated with highly cyclical, fragile, or ex-growth companies. But, as discussed, we think Kitwave is defensive, resilient and with high growth potential. Should the stock merely hold its current multiple, which is undemanding given its defensive growth and returns profile, we would see a prospective annualised shareholder return in the 'mid-high teens', driven by a combination of yield and growth.

But food wholesalers can be very attractive businesses to equity investors – the end market is robust and the businesses are much less capital intensive and price competitive than the supermarkets. It is noteworthy that Booker, the UK's biggest wholesaler, in the five years prior to being acquired by Tesco in 2017, traded on an average P/E of c.25x. Kitwave generates similar margins and is growing faster than Booker was at the time. Of course, any re-rating of Kitwave's shares could meaningfully augment our return on investment.

Fund performance over the past year has been pleasing. We are, though, focused on the more substantial opportunity that exists to grow our investors' wealth and dividend income over the long-term (and indeed our own, as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk adjusted returns. As ever, we thank you for your interest and continued support.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. The level of income is not guaranteed.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.