- Fair month for the fund (+191bps; -25ps vs. FTSE ASX)

- Performance driven mostly by larger caps such as Shell, Anglo American and Astrazeneca

- We profile Howden Joinery, a long-standing investment in the fund

The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income above the FTSE All Share Index. Positive performance continued in April with the fund +191bps, although it trailed the FTSE ASX by -25bps. After a choppy start to the year, the ASX was back to level-pegging with the Nasdaq on a year-to-date basis, having at one stage trailed by c.10%. Performance was boosted by a handful of idiosyncratic single-stock movements. Over one year, the fund is in the top quartile of the IA UK Equity Income comparator group, a position replicated over three years.

Large caps dominated small and mid caps in April. The FTSE 100 delivered a total return of +2.72% vs. the FTSE 250 +0.91%, which puts the fund’s -25bps of relative performance into a favourable context, in our view. Our top three absolute performers were Shell (+47bps), Anglo American (+46bps) and AstraZeneca (+34bps), though being underweight in two of these (Shell and AstraZeneca) resulted in drags of 16bps and 43bps respectively relative to the ASX. After having previously exited Anglo American – our worst-performing position in 2023 – we decided earlier this year to reinitiate a position at depressed levels of valuation, commodity prices and sentiment. This has proven to be a beneficial decision as larger peer BHP made an approach to buy the company in April.

The key detractors in April were homewares retailer Dunelm (-42bps) and medical devices provider Convatec (-31bps). Dunelm fell on small downgrades to FY24 results after softer March sales, though we continue to note share gains and see the weakness as more of a market-level issue. Convatec gave back gains made earlier this year on news that the US is investigating the efficacy of Wound Biologics in hard-to-treat applications, which would have ramifications for reimbursement. This is a small part of the business (<5% of sales) but fast growing with good margins. We continue to monitor the situation but consider the fall in the shares of >10% to be an appropriate reflection of the risks for now.

Dividend paying companies with Competitive Power: Howden Joinery

April was a relatively quiet month in terms of significant performers and in light of this the company profile in this newsletter focuses on one of the first stocks we bought after taking over management of the fund: Howden Joinery, the leading manufacturer and vendor of low/mid-priced kitchens in the UK as well as general joinery products. We have followed Howden closely for nearly a decade and we see very clear hallmarks of Competitive Powers. Today, Howden makes up c.2% of the fund NAV, although it has been a much bigger position for the fund at other times.

A former colleague described Howden as the best business they had ever looked at besides Ferrari – praise indeed! It boasts >25% kitchen market share by value, >2x that of the nearest competitor, in what is a broadly fragmented market with many independents. It employs an advantaged go-to-market strategy of focusing on trade customers, offering them always-in-stock, quality- and keenly priced product that is quick and easy to install. This increases the tradesperson’s efficiency and frees them up to take on other work, turning them into brand advocates to the end consumer. Scale efficiencies, vertical integration into manufacture, and depots in cheap industrial locations rather than expensive high street retail allow Howden to create huge value for customers while making industry-leading margins of >60% of gross profit and >15% of EBIT. Despite industry volumes falling –10% to -12% in 2023, per management’s estimates, Howden gained market share with just mid-single-digit % volume declines, and we calculate the business still achieved a c.50% post-tax return on invested capital (ROIC).

Critiques of Howden today may point to the UK kitchen market as being relatively mature, questioning the growth potential of the business. First, that critique has been made consistently for several years, yet since FY18, revenue has grown by c.9-10% p.a, including through a global pandemic. The most important rebuttal, however, lies in the business’s culture – depot managers are incentivised at depot-level profits, and a constant feedback loop between them (and by extension the trade customers) and management through monthly regional board meetings promotes hunger and focus to win, further fostered through incentives. Evidence of the power of this culture can be seen in large initiatives such as the continued UK depot roll-out; the push into higher-end kitchens enabled by the acquisition of a pair of solid worktop businesses as well as into fitted bedroom furniture; and expansion in France with a reinvigorated local management team. It is also evident in the small things: vertical integration allows Howden to tinker, trying out new product variations and seeing what works before pushing a new range. This also led to the development of an innovative kitchen cabinet leg, which has subsequently led to >£10 million of tax savings through the UK’s patent box scheme.

Our investment philosophy is that ‘quality dividend investing works best’ and we apply a systematic framework to try to understand and identify quality. In our view, Howden demonstrated the five building blocks we look for across our portfolio holdings:

- Operating in a fragmented market with an advantaged cost structure, Howden gains market share while generating very strong ROIC, achieving >50% FY18-23 (ex FY20). Management has efficiently reinvested some of the resulting cashflows into growth, delivering a c.8% five-year trailing earnings per share compound annual growth rate (CAGR).

- As dividend-focused investors we want clean, cash-generative financial models, and Howden offers just that. The income statement is very clean, meaning that high returns convert to cash and the company has a history of delivering surplus returns to shareholders.

- Howden’s balance sheet is rock solid. At FY23, cash on the balance sheet was c.£280 million with no financial debt. While some may describe the balance sheet as inefficient, we note that some of the cash position was deployed opportunistically during the Covid pandemic to acquire the first of two solid worktop businesses, a capital allocation decision that management believes today delivers a group-level ROIC on the purchase price. The lesson here is that the value of optionality should not be underestimated.

- While Howden’s end markets are consumer- and cyclically exposed, the fragmentation and advantaged cost structure mean there are highly differential returns on offer between industry participants. Weak competition combined with Competitive Powers make these end markets highly attractive for Howden.

- We look for skilled, motivated management, and we hold CEO Andrew Livingston and CFO Paul Hayes in high regard. The business has become more innovative under Andrew’s tenure and his track record from former employer Screwfix demonstrates skill, in our view. We have also met with members of management below the C-suite on site visits and believe the culture discussed truly permeates the whole organisation.

The future is the only thing that matters in investing and, as with all our investments, we apply a Competitive Powers framework to ensure we are comfortable that Howden can sustain superior financial performance over time. As a reminder, Powers are strategic traits that underpin the potential for a company to generate persistently attractive returns. They have dual attributes – benefits to the company, manifest through pricing power or lower costs; and barriers to competitors, who would ordinarily attempt to arbitrage away supernormal financial returns (for further discussion see here). We believe Howden exhibits at least two of the seven Competitive Powers – Scale Economies and Switching Costs – which can underpin its continued profitable growth.

- Scale Economies: Having market share >2x that of the #2 in a fragmented market gives Howden scale economies, allowing it to offer quality product at competitive prices while still making high margins, which further supports capital investments in future growth drivers such as new depots, refits, digital, and supply chain. Vertical integration into manufacturing and a lower-cost store estate are close to impossible to replicate for competitors.

- Switching Costs: Having a high quality and affordable product appeals to end customers, but also key to Howden’s success is making that product easy to install for the tradesperson and ensuring it is always in stock. This increases their efficiency and either frees them up to take on other jobs or to take time out, making them loyal to Howden and turning them into brand advocates to the end consumer.

The culture at Howden both exploits and reinforces these two Competitive Powers and does make us question whether it has an element of Process Power, too.

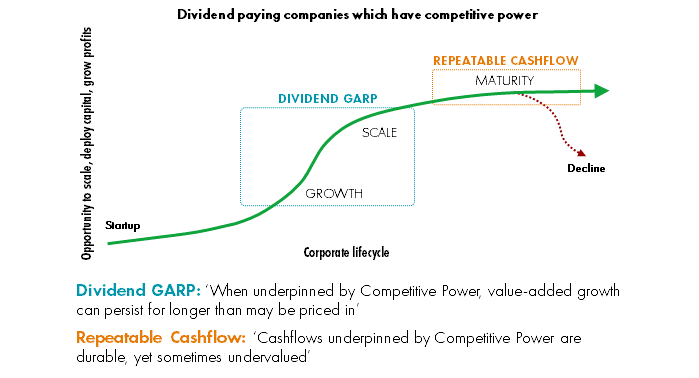

Howden sits within the Dividend Growth at a Reasonable Price (GARP) portion of our portfolio, which is formed of companies in the growth phase of the corporate S-Curve. Our hypothesis with this group of stocks is that 'when underpinned by competitive power, value-added growth can persist for longer than may be priced in.' They generally pay a dividend, though still with plenty of runway to reinvest their cashflows and grow their businesses, we expect returns to be driven primarily by compound profit (and ultimately dividend) growth.

Howden offers a prospective dividend yield of c.2.5% with a history of surplus returns. While its valuation at c.18x PE FY24 may appear high to marginal buyers/sellers, and potentially constrain near-term returns, driving us to a smaller weighting at c.2% of NAV than in the past, , we think the prospects for strong forward returns on this high-quality business that is close to the bottom of its industry cycle remain intact.

Fund performance over the past year has been satisfactory, delivering top-quartile outperformance in a solid year so far for the UK market. We remain focused on the more substantial opportunity that exists to grow our investors' wealth and dividend income over the long-term (and indeed our own as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk-adjusted returns. As ever, we thank you for your interest and continued support.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. The level of income is not guaranteed.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice.