The Federal Reserve (Fed) has (finally) begun to lower US interest rates, cutting them by 50 basis points (bps). With upside risks to inflation having diminished and downside risks to employment increasing, the market is expecting a further 70bps of cuts by year-end and 130bps more next year.

Meanwhile, the Brazilian central bank (BCB) moved in the opposite direction, hiking rates by 25bps and taking them back up to 10.75%. The BCB was one of the first central banks globally to start raising interest rates in the face of higher inflation back in March 2021, a full twelve months before the Fed, and the early and decisive move ensured that inflation fell back to target relatively quickly. This has allowed rates to come down over the past year from a peak of 13.75% to 10.5%. Further cuts were pushed back due to delays in the widely anticipated US easing cycle, and more recently there have been two factors which have started to push inflation expectations modestly higher.

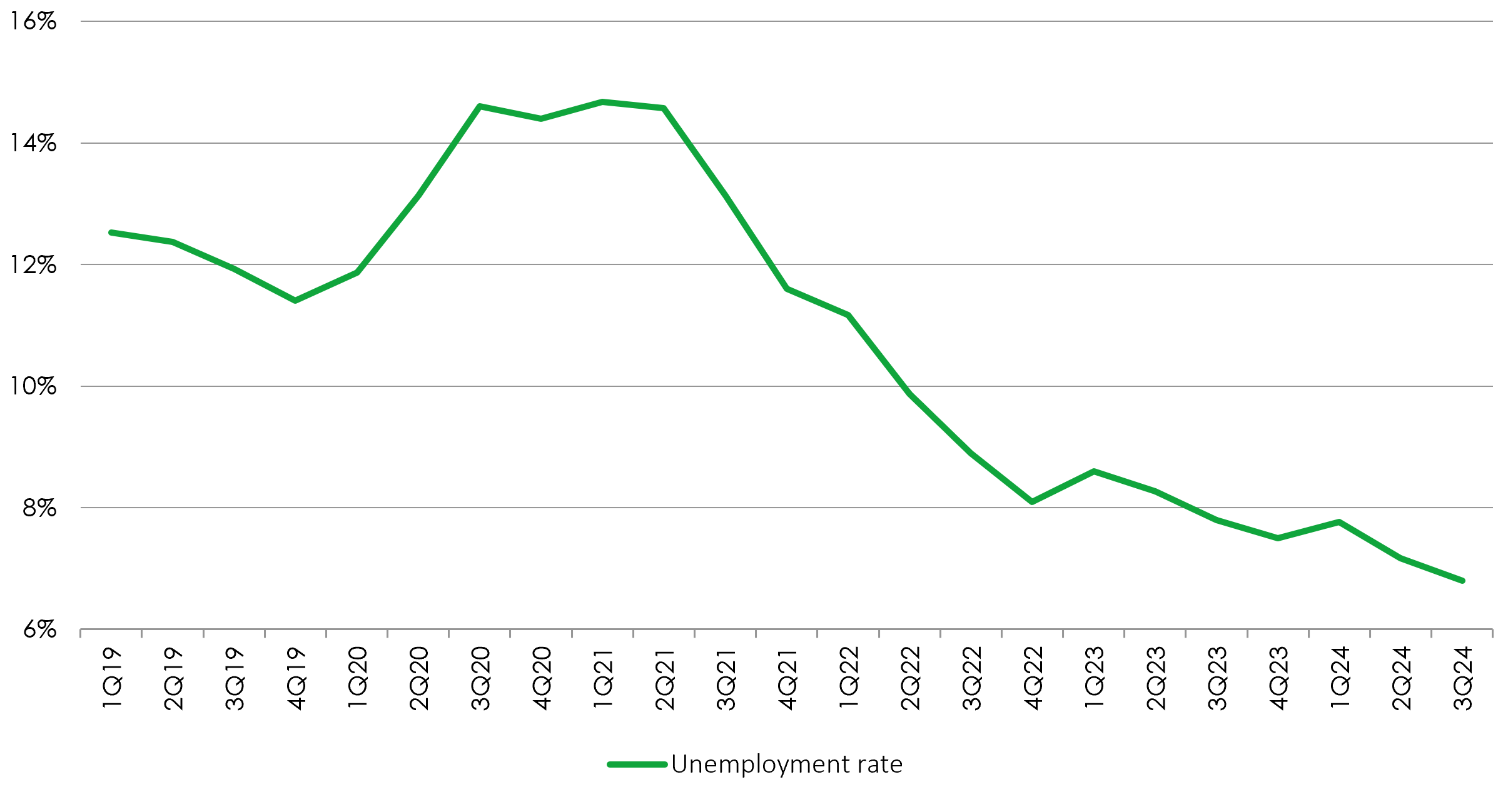

One is the strength of the domestic economy which has consistently surpassed expectations over the past two years, along with a very strong labour market (see unemployment chart below), and the second is the lingering doubt over the government's commitment to fiscal consolidation in order to meet the targets set out in the fiscal framework. This has weakened the currency, which resulted in slightly higher inflation more recently and higher expectations. In order to retain its credibility, the BCB (and the market) determined that a brief hiking cycle was necessary to re-anchor inflation expectations. Brazil already has some of the highest real interest rates in the world, and this move is likely to support the currency which itself will help lower inflation, as well as pushing longer-term expectations downwards. It is important to note that this is expected to be a short cycle, possibly finishing by year-end, and that interest rate cuts can resume next year, especially if the Fed cuts in line with current market forecasts.

Is this meaningful for Brazilian equities?

On the one hand, higher interest rates should weigh on economic growth and lead to a deceleration, while the long-awaited reversal of flows from fixed income back into equities may be delayed as the yields on offer in both government and corporate debt remain attractive. However, given the expected brevity of this hiking cycle, and the stated intention to shore up credibility and anchor longer term inflation expectations, it could well end up being a positive catalyst for equities as longer term yields come down.

From a portfolio perspective, this hasn't resulted in any meaningful changes. Some stocks and sectors tend to benefit from higher rates (like the banks) while others are more geared to lower rates (such as utilities and other sectors with long duration cash flows). The BCB was able to cut rates less aggressively this year than had initially been expected, partly due to the delay in the Fed's easing cycle and partly due to the strength of the domestic economy and labour market, and the prospect of having to raise rates only emerged more recently. However, we should see the BCB resume easing next year and additional confidence in the government committing to fiscal consolidation would only accelerate this transition.

Brazil’s economy shoots past all forecasts

Source: Brazil institute of statistics and geography, Brazil central bank

Strong growth has supported the labour market

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Investments in emerging markets may involve a higher element of risk due to less well-regulated markets and political and economic instability. This may result in higher volatility and larger drops in the value of the fund over the short term. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.