In this new series, 'AI - tried & tested by the Global Innovation team’, the fund managers focus on the key industries and products where AI is democratising technologies and capabilities, opening up new markets and growth opportunities for certain companies. In this article, fund manager Storm Uru tests OpenAI’s generative AI model, ChatGPT, to develop his own GPT co-pilot.

You can read the other articles here:

Animal Spirits: Using large language models to forecast US growth

The democratisation of AI: what Copilot means for Microsoft and us

Firefly – a small step for AI, a giant leap for Global Innovation

Artificial Intelligence (AI), a once niche domain, has risen spectacularly to spearhead innovation. It is more than a passing trend – AI will have a large impact in many sectors, ushering in an era of accomplishing ‘more with less’, while also catalysing new market developments and growth.

The crux of this paradigm shift is the widespread accessibility of AI tools. Like us, you may have used and experimented with the likes of OpenAI’s ChatGPT, but the recent introduction of GPT (Generative Pre-trained Transformers) co-pilots marks a step-change in the usability of this toolset, making it much easier to apply AI in elusive domains from legal analytics to economic projections.

Co-pilot customisation tools allow users to easily make their own domain or subject-specific GPTs trained on bespoke datasets, catering to their own unique requirements. To explore this landmark in AI application further, we opted to develop our own GPT co-pilot using publicly available products and data.

Tailoring your AI co-pilot: a primer on customising GPT models

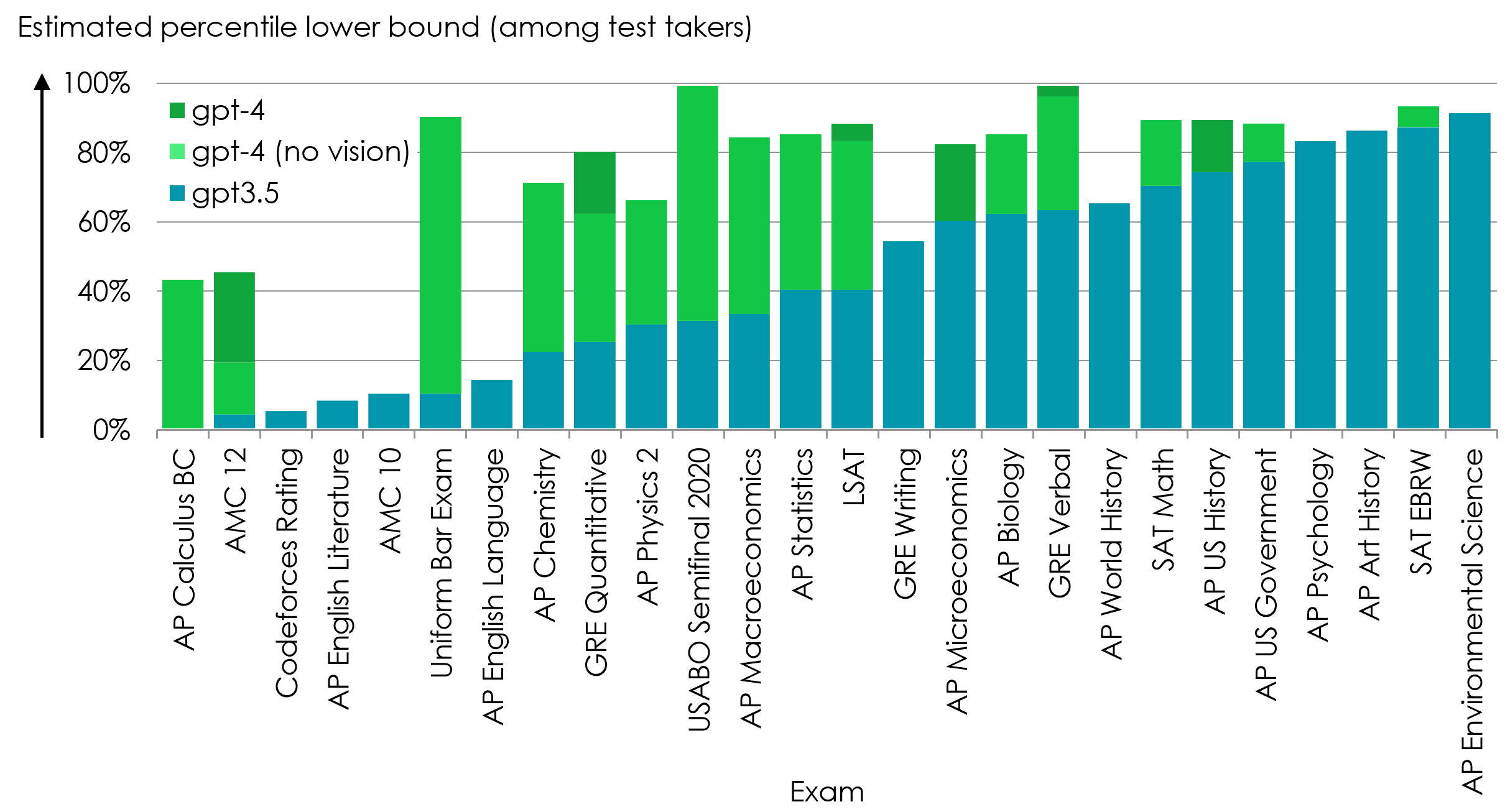

Step 1: Selecting a Large Language Model (LLM): we opted to use OpenAI's ChatGPT 4, a leader in critical performance metrics, over alternatives like Anthropic’s Claude or Meta’s Llama.

LLM Leaderboard from “Chatbot Arena”

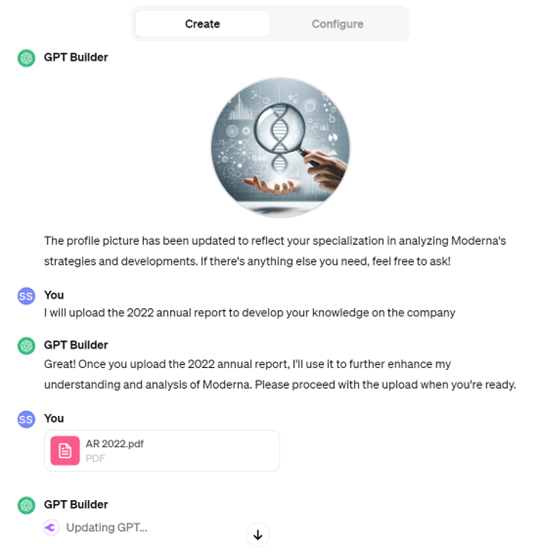

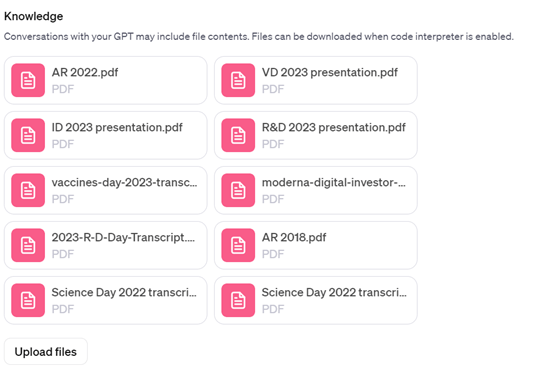

Step 2: Identify the co-pilot’s purpose: We thought it would be interesting to build a co-pilot to help us prepare for our upcoming visit to the pharmaceutical company Moderna in Boston. We fine-tuned ChatGPT 4 with expertise in Moderna's domain, uploading extensive Moderna-related materials, from annual reports to trial outcomes.

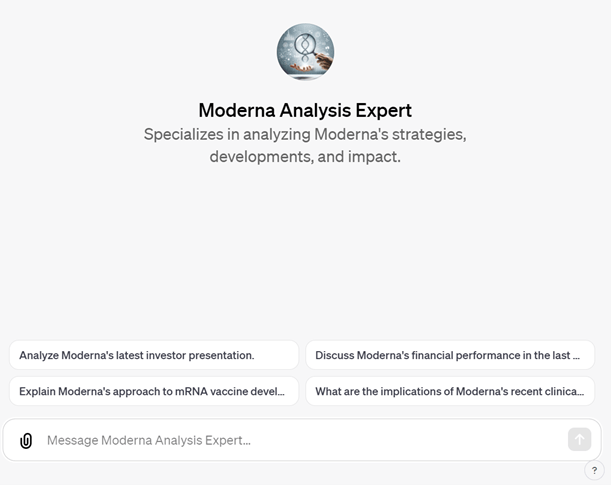

Step 3: Initiating the fun phase: The user-friendly interface on OpenAI’s platform enabled us to create a "Moderna Expert" in mere minutes. The model ingested over a thousand pages of Moderna knowledge before reaching its capacity limit.

Step 4: Model optimisation: The next challenge was enhancing the model's responses by refining the set and prioritisation of uploaded documents. Despite us using only the consumer-level subscription to Open AI (a limitation on the amount of data resources one can upload compared to enterprise-level), after a little experimentation we were able to settle on a few key base documents which could deliver high quality, useful outputs from our model.

The final iteration represents a significant advancement in access to knowledge. In less than two hours, a new subject matter co-pilot was crafted and deployed. Feel free to get in touch with us if you’d like access to our “Moderna Analysis Expert”.

Takeaways

We were able to quickly develop an AI-driven co-pilot domain expert, which exemplifies the transformative potential of AI. Such speed and ease is crucial for adoption into workflows, though for optimal utility, access to increased computational and storage capabilities is imperative and companies across the economy will have to upgrade their IT equipment in the coming years. Despite the cost, it is hard to dispute the potential of AI in revolutionising sectors such as accounting, legal and consulting, potentially reducing service costs dramatically and making the total cost of ownership very attractive.

We need not build every co-pilot ourselves. For those preferring ready-made solutions and for highly common workflows, Microsoft’s recently launched co-pilot suite (from software developer co-pilots to the hotly anticipated Office 365 co-pilot) is proving groundbreaking. The impact of these tools is already visible, with software developers reporting over 50 percent productivity gains and office professionals experiencing significant improvements in document handling efficiency. This ability to streamline complex tasks and promote a more inclusive, efficient workplace marks a revolutionary phase in our interaction with technology.

The brilliance of co-pilots is also highlighted in their ability to navigate the challenge of AI’s tendency to “hallucinate” (a response generated by an AI which contains false or misleading information presented as fact). By meticulously training a GPT model on a specialised dataset, it is transformed into a domain expert, substantially mitigating the risk of erroneous data generation. That said, the performance enhancements achieved by OpenAI over the past 18 months highlight the speed in which this underlying technology is progressing, and means the risk of hallucination from these models is on the decline.

Exam results (ordered by GPT-3.5 performance)

The integration of AI co-pilots in professional contexts is pivotal for enhancing productivity, precision, and unlocking innovation. The rapid evolution of AI heralds a future of extraordinary prospects. Embracing AI co-pilots puts individuals and organisations at the vanguard of this technological revolution, where better work through AI is a reality. As AI continues to progress, the integration of AI co-pilots in our professional and personal spheres becomes increasingly imminent, signalling a new era of human-AI collaboration.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.