The Liontrust GF Global Technology Fund continues to invest in global leaders and disruptors within the technology sector that are well positioned to benefit from the new AI-driven technology cycle.

- March rounded a quarter characterised by a renewed bout of volatility, spurred by uncertainty over tariffs and their impact on business activity. This market dislocation presented an opportunity to strategically increase our holdings in the hardest‐hit investments across our portfolios.

- Fundamentals remain strong; an exceptional Q1 earnings season for global innovators was possibly the best experienced in over two years.

- Our quarterly research trip – with 40 management team meeting and over 100 transcripts reviewed – has increased our confidence in the outlook for innovators across various sectors, with the ability to strengthen their competitive positioning against a difficult market backdrop.

Performance overview

The Liontrust GF Global Technology Fund returned -11.4% in March in US dollar terms, compared with the -8.9% return from the MSCI World IT Index comparator benchmark.

This rounded out the first quarter of 2025 where the fund returned -14.5%, behind the MSCI World IT Index return of -11.9%.

Fund commentary

In the short term, market sentiment often drives share prices; however, over the longer term it is underlying fundamentals that determine investor returns. March rounded a quarter characterised by a renewed bout of volatility, spurred by uncertainty over tariffs and their impact on business activity. This new market cycle is now nearly two years old, characterised by both high returns and pronounced volatility. We believe now presents an opportunity for investors who have thus far remained on the sidelines, for three key reasons:

Strong fundamentals

We recently concluded an exceptional Q1 earnings season for global innovators – quite possibly the best we have experienced in over two years. These companies are generating strong momentum in the new market cycle as they capture market share or enter new markets. Just as in every prior cycle, the new winners this time around will differ from the past cycle. As in July 2024, when we experienced the last major severe market downturn, we are fortunate that this has occurred during a time when we are inundated with information from our companies and can underwrite our conviction in our holdings.

During sharp market sell‐offs or resets, the best‐performing stocks from the preceding period often suffer the steepest declines. This has indeed been the case: holdings across the fund – including Broadcom, Nvidia, Shopify, and Upstart - have experienced pronounced drawdowns. Nevertheless, these companies' outperformance was because their fundamentals continued to run ahead of their share prices; that is now the case to an even wider degree. As such, they are likely to be among the first to see their share prices recover.

For example, Broadcom continues to demonstrate strong progress despite recent share price weakness, the stock a key detractor in both March and the quarter as it sold off amid broader market uncertainty and concerns about AI infrastructure spending following the release of Deepseek’s more efficient AI model. As we have written previously, we believe these concerns are both overstated and misdirected: the collapsing cost of intelligence is by no means a new phenomenon and is crucial in facilitating the widespread adoption of AI across the economy.

Moreover, breakthroughs in reasoning and the emergence of new scaling laws - post-training scaling and inference-time scaling - continue to support a strong long-term demand outlook for AI infrastructure, as reflected in the significant multi-year data centre roadmaps from hyperscalers and sovereigns alike. In this context, Broadcom – alongside Nvidia – has been a key beneficiary, and remains exceptionally well positioned going forward. The company delivered extraordinary AI-driven growth throughout 2024, with AI-related revenues surging 220% year-on-year to $12.2 billion. Key AI connectivity products such as Tomahawk and Jericho quadrupled their revenues, and AI XPU shipments to key hyperscaler customers Alphabet, Meta, and ByteDance doubled. Looking ahead, management expects this momentum to accelerate further, capitalising on their first-mover advantage in transitioning to next-generation XPUs built on 3-nanometre nodes. In its last update, CEO Hock Tan emphasised the exponential increase in networking requirements as hyperscalers expand to clusters approaching 1 million XPUs – a substantial growth driver uniquely suited to Broadcom's expertise. With a serviceable addressable market projected at $60-90 billion by 2027 for just its major ASIC customers alone, Broadcom remains well positioned to capture value from this surging AI infrastructure demand.

Another winner of 2024 that pulled back in March despite accelerating fundamentals, Shopify, the digital backbone of modern commerce powering millions of merchants across both digital and physical retail, was ultimately a key detractor to fund performance in March despite strengthening fundamentals and mounting evidence that it is building upon its first-mover advantage as an early AI pioneer. Shopify is using intelligent automation across its platform and offerings to enhance the merchant experience, boost customer retention, and deepen engagement, with AI features like semantic search, Sidekick, and predictive inventory tools improving conversion and driving operating efficiency while strengthening Shopify’s flywheel of merchant adoption and platform expansion. The company’s innovation velocity is also ramping, now launching 100–150 new features every six months, with 90% of merchants using multiple products as of their Q4 update. At the same time, the company is demonstrating accelerating traction in new segments such as B2B (gross merchandise volume, GMV, +132% in Q4), consumer-facing products like Shop Pay and the Shop App (GMV +84%), and offline retail, where its point of sale delivers lower costs and faster implementation than peers. All together this is helping grow the company’s total addressable market, which sits at c$850 billion today (up from $46 billion a decade ago) and of which only 1% is currently penetrated. Q4 results in February demonstrated the power of this model, with revenue up 31% year-on-year, GMV up 26%, and same-store sales growth across merchant cohorts nearing 50%. Operating leverage is also improving, with adjusted operating margin above 20% and a free cash flow margin of 22% - a profile management is confident it can sustain while maintaining elevated reinvestment and delivering durable topline growth. With its modular architecture attracting brands from small businesses to global enterprises, and AI supercharging user value and internal efficiency, Shopify is well placed to extend its leadership and drive sustained earnings growth in the years ahead.

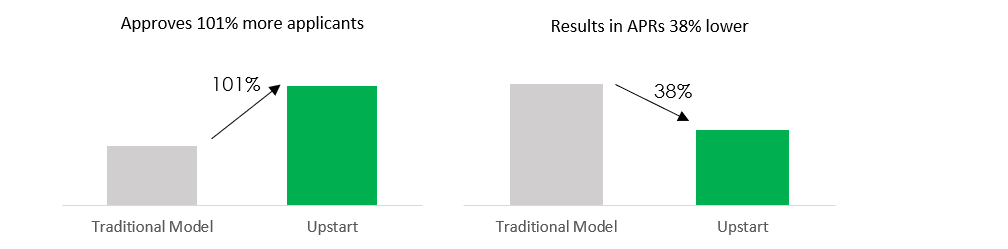

Similarly, Upstart was also a key detractor to fund performance in the month, despite having posted arguably its strongest earnings update to date in February which saw the company beat on earnings by a whopping 200%. A company we held through 2024 and most recently visited during our Q4 research trip to Silicon Valley, Upstart operates one of the most sophisticated AI lending platforms in the US, focused on reducing the cost of credit and expanding access to underserved borrowers. Central to its momentum is the rapid pace of model innovation. Where it once refreshed models every three to six months, it now does so every few weeks – each update integrating more nuanced risk signals, product-level insights, and intermediate repayment data. These improvements are delivering higher approval rates, better risk separation, and more competitive loan pricing – benefiting both borrowers and lenders alike.

This innovation is leading to accelerated adoption across Upstart’s core personal loan offering, while also opening up new white space in areas like auto refinance, HELOCs, and small-dollar loans – expanding the company’s TAM. At the same time, the company has improved model calibration, scaled automation, and lowered unit costs – creating a far more resilient and efficient business. Importantly, this progress is flowing through to the company’s financials: revenue was up 56% year-on-year in the quarter, with loan volumes up 89% and profitability improving significantly – the company nearing break-even for the first time on a GAAP basis. With 93% of new loans now fully automated and cost per loan down 50% year-on-year, Upstart is demonstrating clear operating leverage alongside accelerating top-line momentum.

Upstart’s more accurate model allows lenders to approve more applicants at lower annual percentage rates (APR)

Source: Upstart (2025)

2. Dislocation presents opportunity

We recently returned from our quarterly US research trip, having met with 40 management teams and reviewed over 100 transcripts. The message is clear: our portfolio companies remain well‐positioned to capitalise on multiple innovation cycles across a range of sectors.

In periods of market volatility prompted by macroeconomic factors, we strategically increase our holdings in the hardest‐hit investments across our portfolios. Accordingly, we have raised our positions in a range of companies including Nvidia, Broadcom, and CrowdStrike. Although these stocks had fallen over 20% from their earlier Q1 peaks, their fundamentals are in fact accelerating. Notably, we have just experienced a highly positive earnings season, highlighting that recent market capitulation—both at the overall market level and within the technology sector—has been driven by sentiment rather than fundamentals.

For example, we topped up our position in CrowdStrike early in March, the leader in AI-native cybersecurity, down 21% from its February peak. Broad negative sentiment ultimately weighed on shares after the company posted a slightly softer-than-expected guide in its Q4 update. However, this overshadowed a strong set of results and a business that is scaling rapidly in an expanding market. As AI adoption accelerates, so too does the complexity and surface area of cybersecurity threats—driving greater urgency among enterprises to adopt comprehensive, unified security platforms. In Q4, CrowdStrike recorded the largest threat intelligence quarter in its history, with China Nexus state-sponsored attacks rising 150%, and targeted attacks on sectors such as financial services, media, and manufacturing surging up to 300%. This ramping threat landscape is translating into stronger demand across CrowdStrike’s platform, with customers adopting more modules and accelerating uptake of emerging offerings like exposure management and identity protection. Next-gen tools such as Charlotte AI are materially improving outcomes – reducing threat response times from 30 minutes to just 15 seconds – while internal AI adoption has saved the equivalent of 24,000 work weeks. These gains are flowing through to the financials: Q4 revenue grew 25% year-on-year, net new annualised recurring revenue was $224 million, earnings per share beat by 21%, and the company generated over $1 billion in free cash flow for the year. With strong platform adoption, high retention, and a rich proprietary dataset, CrowdStrike is well placed to consolidate its leadership in a structurally growing market.

We have also been establishing new positions across the Fund in companies that have long been on our watchlist, and where we have awaited a suitable market dislocation to initiate positions. For example, in recent months we added positions in Confluent (a leader in data streaming infrastructure that enables enterprises to process and react to real-time data - an increasingly critical capability in AI-driven environments) and Doximity (which operates a cloud-based professional network and telehealth platform for medical professionals, with over 80% of U.S. doctors engaged on its platform).

Additionally, given the improving outlook for China’s technology sector – underpinned by strategic government initiatives such as the ‘Made in China 2025’ policy – we also initiated positions in Alibaba and Xiaomi. Alibaba remains a foundational player in commerce and AI, with plans to invest $50 billion over the next three years in cloud and AI infrastructure to support long-term growth. AI-related revenues in its cloud division have now posted six consecutive quarters of triple-digit year-on-year growth, helping to drive broader group margin expansion. Xiaomi is a strengthening player in the global smartphone market, which we believe is poised to benefit from an on-device AI upgrade super-cycle, with only around 10% of the world’s seven billion smartphones currently equipped to support these capabilities

To finance these purchases, we have reduced a number holdings of which have performed well, such as Chinese stocks Pinduoduo and Tencent (two top contributors to fund performance in March) and structural winners such as Netflix. We also exited certain companies whose upside potential is no longer sufficient, such as Uber – which achieved our price target – and MongoDB, a company that remains well positioned to provide the data infrastructure for the AI era but which we moved back to the watchlist as we saw more compelling upside opportunities emerging elsewhere.

3. Innovators remain well positioned for a new cycle

Following our research trip, we have increased confidence in the outlook for innovators across various sectors. These companies remain well‐positioned to benefit from the significant opportunities ahead. As sentiment, rather than fundamentals, has primarily driven this recent sell‐off, it has created an attractive entry point for those seeking to establish or expand positions.

April has started with further volatility following the US government’s ‘Liberation Day’ event, with markets digesting the impact of new wide-spread tariffs from the Trump administration. While the breadth and scale of these tariffs appear significant, at this stage we are still waiting on further information from both the Trump team and other governing bodies around the globe.

During such protracted periods of uncertainty, it is critical to remain focused on the business fundamentals which underpin longer-term growth potential. We look to the upcoming earnings season and further research trips in the quarter ahead where we expect to see further evidence of innovative companies proving their resilience and adaptability, strengthening their competitive positioning against a difficult market backdrop. As always we will continue to maintain our valuation discipline, taking advantage of further market dislocations to invest in innovative companies at attractive prices.

Key Features of the Liontrust GF Global Technology Fund

|

The Fund aims to achieve capital growth over the long-term (five years or more) through investment in shares of technology and telecommunications companies. There can be no guarantee that the Fund will achieve its investment objective. The Investment Adviser will seek to achieve the investment objective of the Fund by investing at least 80% of the Fund’s Net Asset Value in shares of technology and telecommunications companies across the world. A technology or telecommunications company is a company that primarily focuses on the development and distribution of technology/telecommunications products or services. These companies are often involved in industries such as software, hardware, electronics, telecommunications, artificial intelligence, and information technology. The core operations of a technology/telecommunications company typically involve the creation, innovation, and enhancement of products or solutions that leverage technology/telecommunications to solve problems or improve efficiency. These are companies which, at the time of purchase, are included in the Global Industry Classification Standard (“GICS”) Information Technology and Communication Services sectors. The Fund may also invest up to 20% of its Net Asset Value in other companies as well as in collective investment schemes (which may include funds managed by the Investment Adviser), cash or near cash, deposits and Money Market Instruments. In addition the Fund may invest in exchange traded funds (“ETFs”) (which are classified as collective investment schemes) and other open-ended collective investment schemes. Investment in open-ended collective investment schemes will not exceed 10% of the Fund’s Net Asset Value. The Fund may invest in closed-ended funds domiciled in the United Kingdom and/or the EU that qualify as transferable securities. Investment in closed-ended funds will be used where the closed-ended fund aligns to the objectives and policies of the Fund. Investment in closed-ended funds will further be confined to schemes which are considered by the Investment Adviser to be liquid in nature and such an investment shall constitute an investment in a transferable security in accordance with the requirements of the Central Bank. Investment in closed-ended funds is not expected to comprise a significant portion of the Fund’s Net Asset Value and will not typically exceed 10% of the Fund’s Net Asset Value. |

|

|

The Fund is considered to be suitable for investors seeking long-term capital growth over a long term investment horizon (at least 5 years) with the level of volatility typical of an equity fund. |

|

|

6 |

|

|

Active |

|

|

The Fund is considered to be actively managed in reference to the MSCI World Index (the "Benchmark") by virtue of the fact that it uses the benchmark(s) for performance comparison purposes. The benchmark(s) are not used to define the portfolio composition of the Fund and the Fund may be wholly invested in securities which are not constituents of the benchmark. |

|

|

The Fund is a financial product subject to Article 8 of the Sustainable Finance Disclosure Regulation (SFDR). |

Notes: 1As specified in the PRIIP KID of the fund; 2SRI = Summary Risk Indicator. Please refer to the PRIIP KID for further detail on how this is calculated.

The Fund aims to achieve income with the potential for capital growth over the long-term (five years or more). The Fund aims to deliver a net target yield in excess of the net yield of the MSCI World Index each year.

There can be no guarantee that the Fund will achieve its investment objective.

The Investment Adviser will seek to achieve the investment objective of the Fund by investing at least 80% of the Fund’s Net Asset Value in shares of companies across the world. The Fund may also invest up to 20% of its Net Asset Value in other eligible asset classes. Other eligible asset classes include collective investment schemes (which may include funds managed by the Investment Adviser), cash or near cash, deposits and Money Market Instruments.

In addition the Fund may invest in exchange traded funds (“ETFs”) (which are classified as collective investment schemes) and other open-ended collective investment schemes. Investment in open-ended collective investment schemes will not exceed 10% of the Fund’s Net Asset Value. The Fund may invest in closed-ended funds domiciled in the United Kingdom and/or the EU that qualify as transferable securities. Investment in closed-ended funds will be used where the closed-ended fund aligns to the objectives and policies of the Fund. Investment in closed-ended funds will further be confined to schemes which are considered by the Investment Adviser to be liquid in nature and such an investment shall constitute an investment in a transferable security in accordance with the requirements of the Central Bank. Investment in closed-ended funds is not expected to comprise a significant portion of the Fund’s Net Asset Value and will not typically exceed 10% of the Fund’s Net Asset Value.KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

- This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments.

- The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties

(e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. - Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.