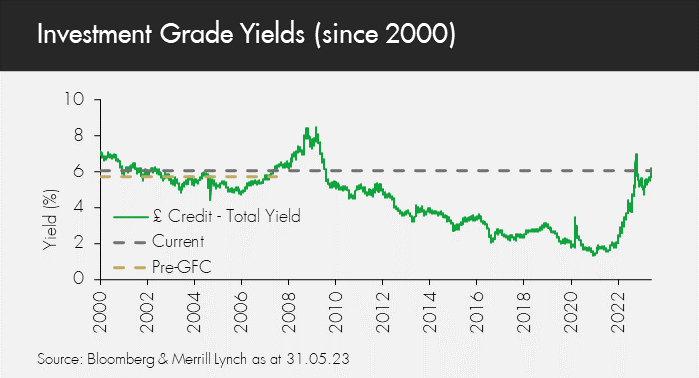

Are bond yields attractive or could they rise further?

Following a significant repricing of government bonds over the last 18 months and a widening of corporate bond credit spreads, we think the total yield available on corporate bonds looks very attractive at over 6%. The chart below shows that yields on investment grade sterling corporate bonds are now back to levels not seen since before the global financial crisis in 2007.

Our positive view on corporate bonds is underpinned by several factors: a significant shift up in government bond yields; our expectation that base rates will peak soon as the impact of cumulative tightening starts to feed through to economic activity; a widening of corporate bond spreads; and our view that underlying corporate fundamentals remain robust.

We believe our funds are well positioned to capitalise on the opportunities the asset class now offers.

Rising government bond yields have been driven by surprisingly persistent inflation

Looking at each of these factors in turn, the repricing of UK government bonds has been dramatic. In August 2020, the 10-year UK government bond yield fell to an all-time low of below 0.1%. In the following three years, bond markets have repriced significantly with the yield rising by over 400 basis points (bps) to 4.4%. Over this time, UK government bonds (measured by the FTSE Actuaries UK Conventional Gilts All Stocks Index) have returned -32%.

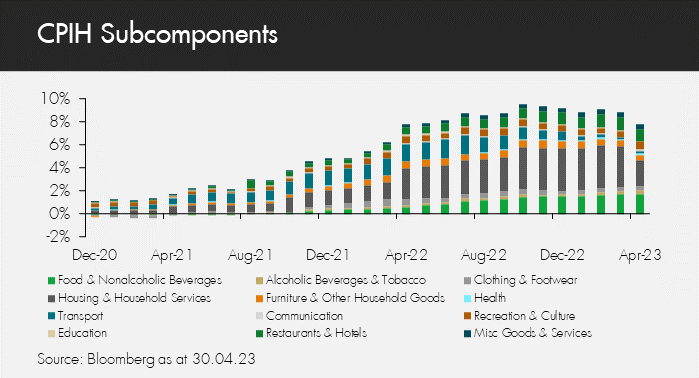

The key reason for this rapid repricing of yields has been the persistence of inflation – greater than central banks predicted throughout 2021, when they described it as transitory.

Both the post-lockdown supply chain issues and the commodity price spike which followed conflict in Ukraine were, to varying extents, expected to be temporary inflationary factors. As time went on, ‘base effects’ were expected to lead inflation rates to rapidly fall back to normal levels as rolling year-on-year price change calculations began to include elevated price levels as their starting point.

Price rises have, however, proven a lot more persistent, feeding through to a broad repricing of goods and services. This is apparent in the consumer price index (CPIH – which includes housing costs), where most subcategories have crept higher over the last two and a half years as shown in the chart below:

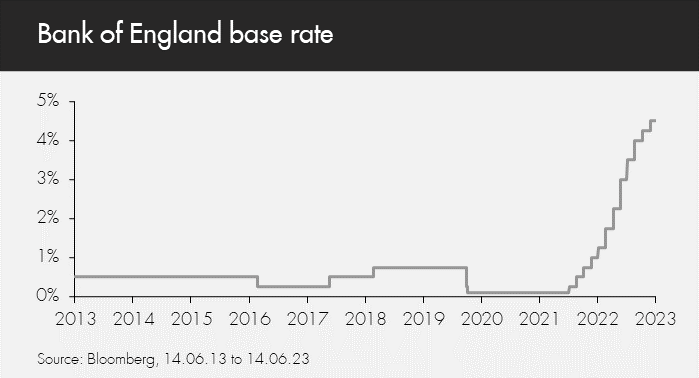

In 2022, the Bank of England (BoE) (along with other central banks globally) ditched its transitory inflation narrative and began hiking rates from their ultra-low levels. It has now implemented 440bps of rate hikes in just 18 months in order to combat inflation.

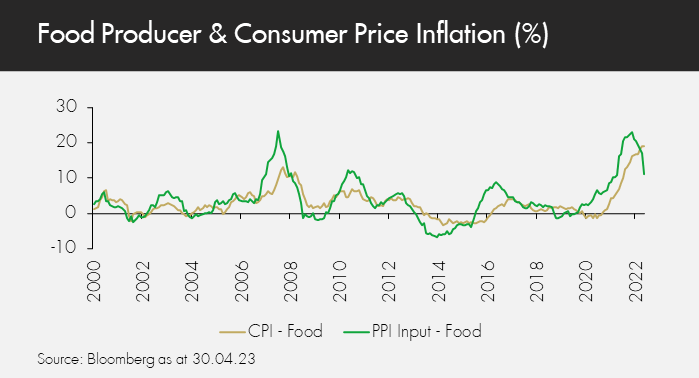

Energy prices are now falling, contributing to a fall in inflation to 8.7% in April from 10.1% in March, but this is still stronger than the 8.2% the market expected. However, leading indicators suggest that CPI should continue to fall. One of the biggest contributors to inflation has been food prices (“CPI – Food” in the chart below), but if we look at the food component of producer input prices (“PPI Input – Food”) we see this has begun to decelerate sharply. This is typically a highly correlated leading indicator of the direction of consumer food prices.

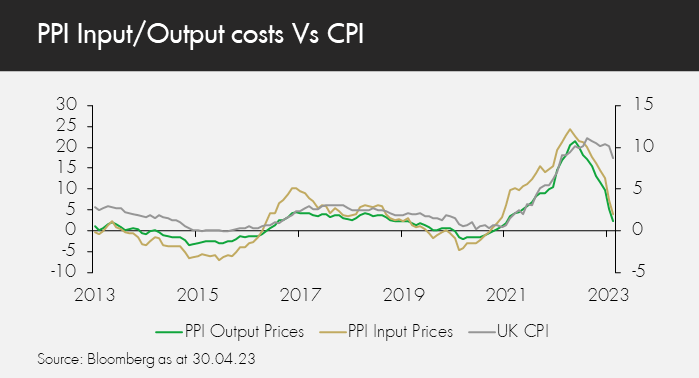

If we look more broadly at producer prices, we see a similar picture emerging, with both input and output price inflation already moderating, indicating that headline consumer price inflation will also continue to fall.

UK economic resilience may fade as lagged effect of rate rises kicks in

What has surprised many investors this year is how robust the underlying economy has been despite the monetary policy tightening over the last year or two.

One potential reason for this is that changes to central bank base interest rates typically affect the economy in a lagged manner.

For example, according to the BoE, the proportion of fixed-rate mortgages has increased from around 30% in 2010 to around 85% presently. Homeowners on fixed-rate mortgages will have been protected against the impact of higher rates, but this will change as they refinance their fixed deals over the coming months and years.

This will be a headwind for underlying economic growth. Household real incomes will be squeezed. While some of the cost-of-living pressures have been offset so far by labour market strength and wage increases, these have still lagged inflation rates, so wages in real, price-adjusted terms are still going down.

Weaker economic growth and falling inflation point to an imminent peak in base interest rates

When we combine already weakening real disposable income with the likelihood of mortgage expenses increasing substantially, the impact on the economy could be significant.

There is a real risk that the UK falls into recession in the coming months and consensus forecasts, while upgraded so far this year, are still for muted growth over the next few years; GDP growth forecasts are currently 0.2% and 0.9% in 2023 and 2024 respectively.

Following recent stronger-than-expected inflation data, markets have priced in four to five further hikes, taking the market-derived peak in base rates to around 5.7%, 120bps higher than current levels. But with the economic growth outlook anemic and inflation likely to belatedly fall back towards the Bank of England’s 2% target next year, we think the case for further rate hikes is limited.

The bond market is currently very focused on short-term trends in macroeconomic data – such as inflation prints – as it attempts to call the peak in base rates, so we expect more volatility over the course of this year as sentiment fluctuates.

But we think long-term investors should view this short-term noise as a mispricing opportunity; with base rates close to peaking, we think current UK government bond yields of 4.4% (10 year bonds) are very attractive.

What about corporate fundamentals?

Turning our focus back to corporate bonds, valuations here have improved not only due to the substantial increase in government bond yields described above but also because spreads – the premium offered by corporate bond yields over government bond yields – have also widened significantly. Investment grade corporate credit spreads on sterling debt have risen by about 75 basis points from their recent lows as investors have priced in a significant jump in default rates.

We think such a jump in defaults is unlikely, however. Moody’s forecasts global default rates trend back to just over the long run average of 4% and remain below previous recessionary highs.

Corporate fundamentals are also very strong. Borrowing is well below long-run averages, interest coverage is significantly above average and cash-to-debt remains at very healthy levels. This suggests the average corporate borrower is well-placed to withstand any deterioration in the macroeconomic environment.

In conclusion, with yields on investment grade bonds having risen to 6.2%, the outlook for investing in corporate bonds looks very healthy.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. The GF SF European Corporate Bond Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.