A look back at 2023

As fixed income investors, we’re naturally cautious human beings and are consistently testing our theories for how things might pan out. However, before we look forward with optimism to what lies ahead in 2024 and beyond, we wanted to first look back at how we fared last year.

2023 was supposed to be ‘The Year of Fixed Income’, as the level of yields on offer looked incredibly attractive, both outright on a long-term basis and relative to history, following a period of heightened volatility in bonds.

This was a view that we largely agreed with, and while this opinion certainly didn’t go unchallenged by developments over the course of the year, we maintained our conviction and it did indeed prove to be a fantastic year for our Sustainable Fixed Income strategies, with incredibly strong absolute and relative performance.

Both the Sustainable Future Monthly Income Bond Fund and Sustainable Future Corporate Bond Fund delivered net returns of 13%, finishing the year as the second and third best performing funds in the IA Sterling Corporate Bond sector peer group (a comparator benchmark)*.

This strong performance was driven by our effective active management of the portfolios, through a combination of our strong credit selection, with sterling credit spreads tightening 58 basis points over the year, as well as our long interest rates position, which particularly benefited over the final quarter of the year as government bond yields fell sharply. This was due to markets pricing in a far more aggressive central bank policy easing than previously expected.

After coming off the back of one of the most painful years for total returns for the asset class in recent memory in 2022, January 2023 got off to a good start and supported our belief that the impact of the fastest rate hiking cycle in decades would result in a tightening of financial conditions, slowing both economic growth and inflation, which would start to trend back towards targets in the major developed market economies.

As UK 10-year gilt yields fast approached the top end of our 2.5 – 3.0% target range, we elected to reduce the overweight interest rate risk position within the funds.

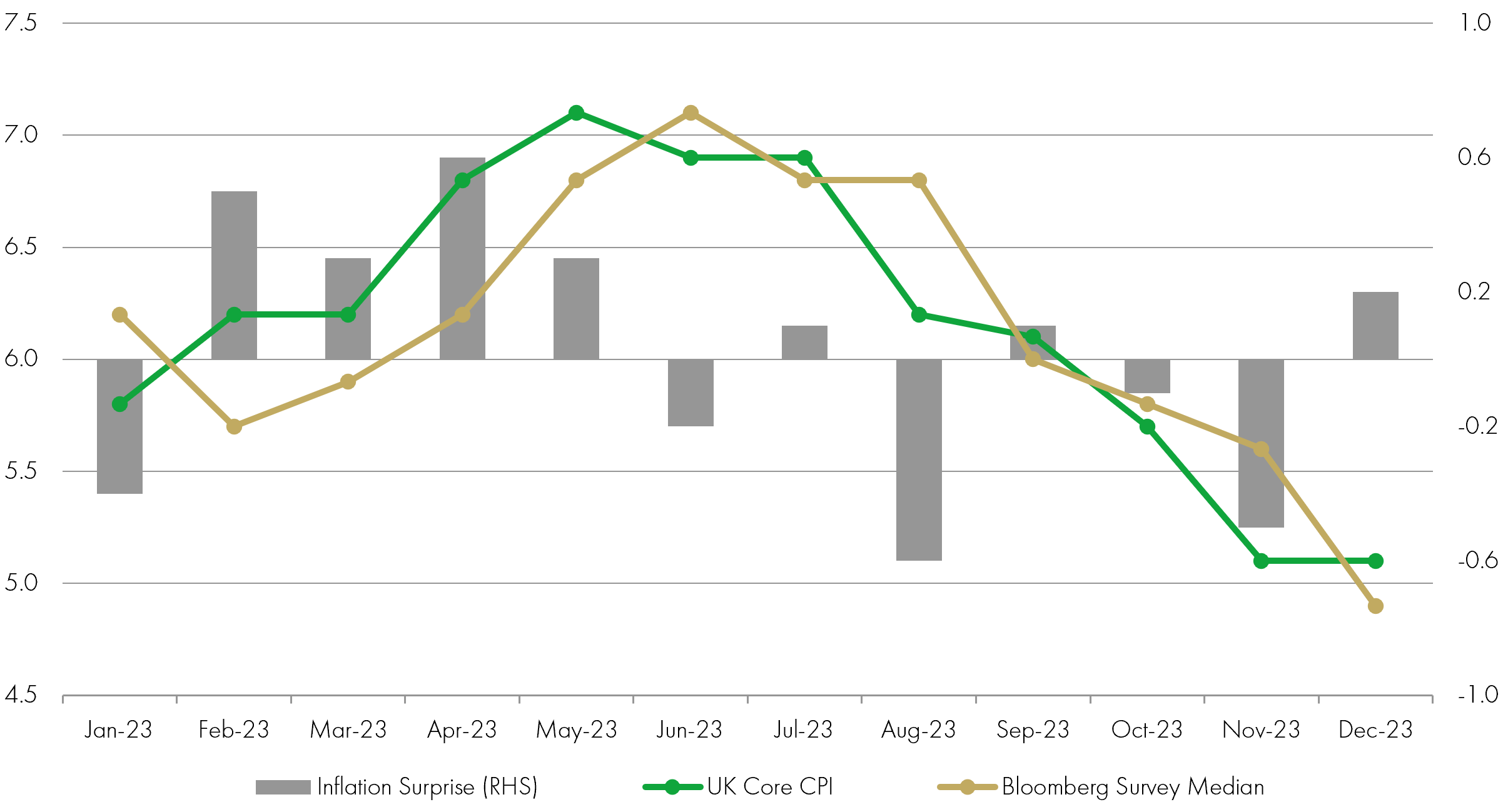

This proved to be a prudent decision, as these supportive early developments turned out to be a false start, and soon macroeconomic data releases were consistently pointing to a far more resilient economic backdrop than we expected. A series of upside surprises in UK inflation (as shown in the UK Core CPI chart below) and persistent labour market strength in the US, amid a theme of generally better than expected data, saw global yields push higher as central banks increased rates further to lean against this strength.

UK Core CPI 2023, % year-on-year

Source: Liontrust, Bloomberg. January 2024

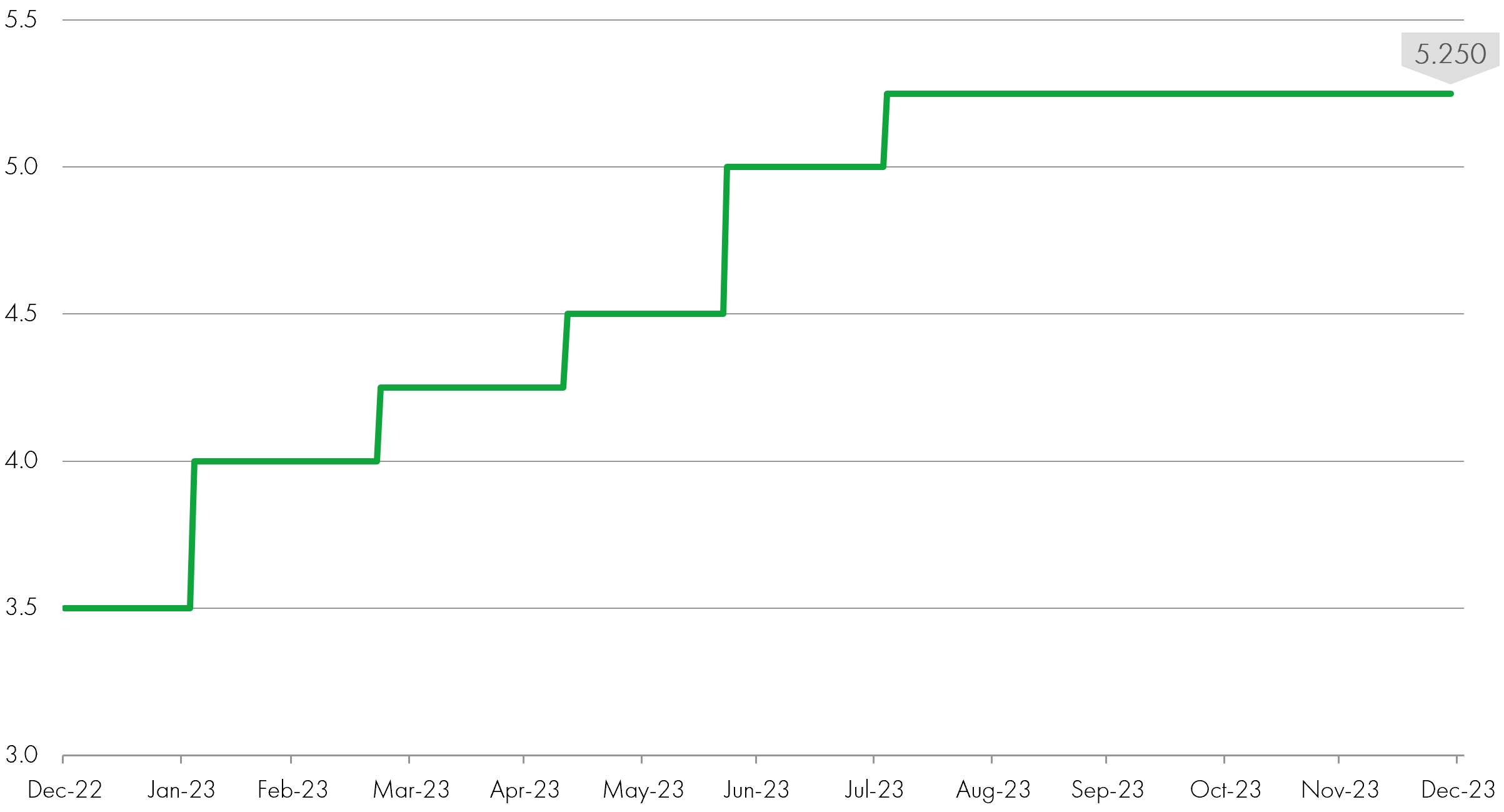

UK Base Rate, %

Source: Liontrust, Bloomberg. January 2024

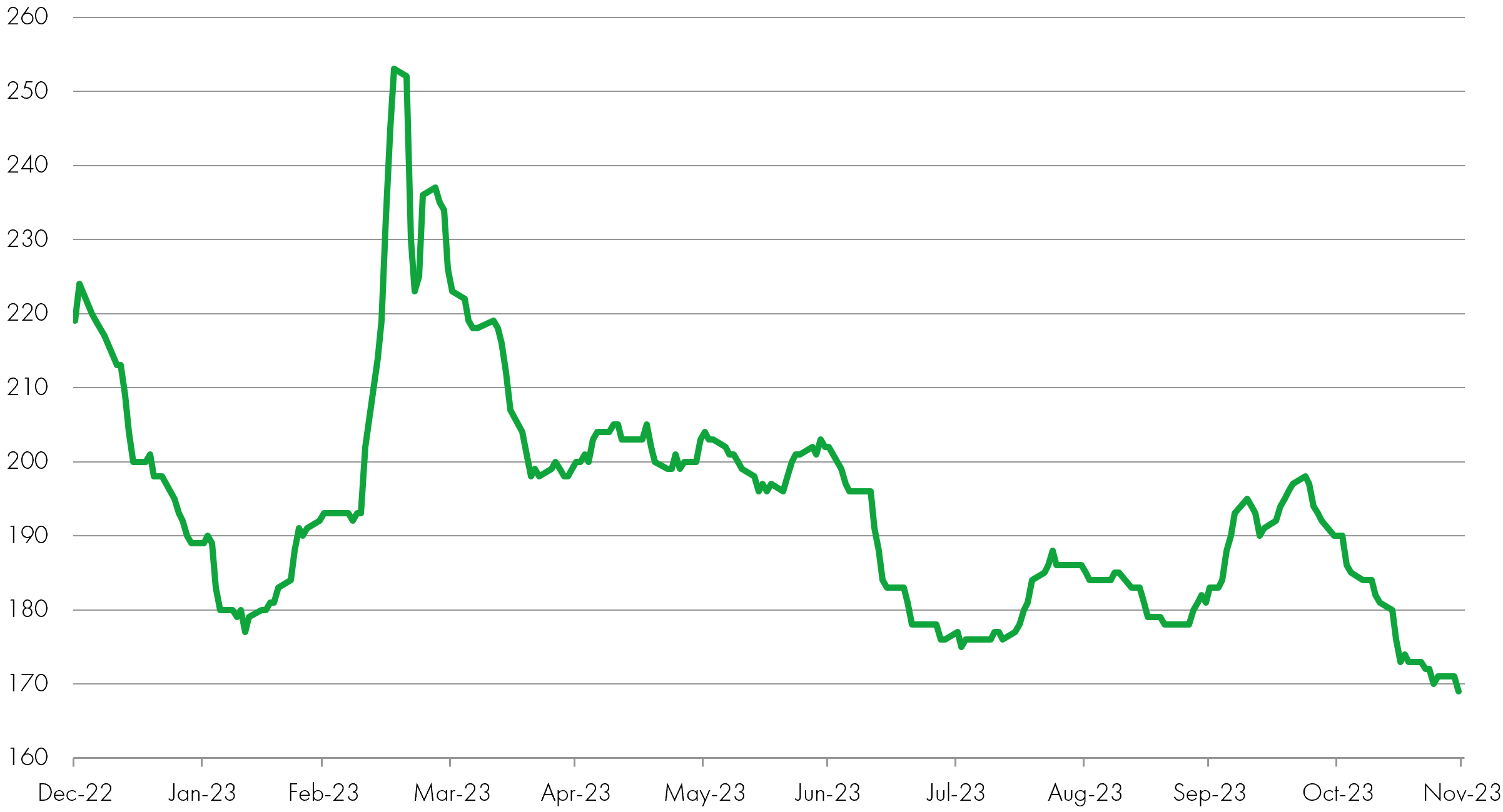

Similarly, after a relatively uneventful start to the year for corporate bonds, the funds’ overweight credit position suffered amid the extreme volatility following the US banking crisis in March, ultimately leading to the collapse of Silicon Valley Bank, Signature Bank, and First Republic. This was swiftly followed by the collapse of Credit Suisse, with the Swiss regulator invoking the full write-down of its AT1 bond issuance. This saw our overweight position to financials, and particularly higher beta subordinated financials, detract from performance.

However, after reviewing our credit portfolio, we remained confident in the high quality, sustainable issuers held, with European and UK banks in a far greater position of strength than their US counterparts. Likewise, we viewed the issue with Credit Suisse AT1s as contained to the Swiss market, with wider European and UK banking regulators subsequently announcing their support for the asset class. This ultimately proved to be the correct decision as sterling financials bonds spreads tightened over the remainder of the year.

ICE BofA Sterling Financial Index credit spread (basis points)

Source: Liontrust, Bloomberg. January 2024

Turning back to government bond yields, these continued to rise for much of the year through to mid/late-October as economic data and inflation continued to surprise to the upside. Looking at the underlying picture however, especially in the UK, we continued to believe that the domestic economy would struggle with these higher rates. We felt the passthrough to mortgage holders would continue to erode the strength of the consumer, and that businesses would eventually become constrained in their ability to continue to award large pay increases to staff.

As a result, we incrementally added back interest rate risk to the portfolios as yields rose between March and October, firmly believing that the economy would start to eventually show signs of strain over the latter half of the year.

While there had been ongoing strength, particularly in US data, going into Q4, cracks were beginning to appear. The eurozone in particular looked to be slowing rapidly, with PMI readings declining, inflation coming off sharply, and growth faltering.

While not as stark as Europe, economic data also started to consistently surprise to the downside in the UK and to a lesser extent still, the US. This coincided with large inflation misses across each of the US, UK and Europe, leading markets to reprice interest rate expectations sharply lower.

Having attempted to pushback somewhat on the market moves the week before its meeting, the Fed surprised the market by changing tack with more interest rate cuts included in its dot-plot. Somewhat surprisingly, it was the Bank of England and the European Central Bank (ECB) which maintained the consistent message that rates would have to stay higher for longer to tame inflation and stamp out the threat of persistence. However, following the Fed surprise, markets duly ignored their protestations, and were rewarded for their scepticism, as the weaker readings continued in key growth, labour and inflation releases.

Expectations for sooner than anticipated easing in monetary policy and broader financial conditions, also buoyed credit markets, with sterling credit spreads tightening markedly into the year end. This drove strong credit performance across the funds, with our overweight to financials outperforming, coupled with strong bond selection across our core sectors, including banks, insurance and telecommunications.

The combination of all of these factors, alongside the courage of our convictions behind our views and positioning, ultimately resulted in one of the strongest ever years for total returns for the Sustainable Future fixed income strategies.

Where does all of that leave us for 2024?

We firmly believe than our Sustainable Future fixed income strategies continue to offer a very attractive opportunity for investors. The asset class offers all-in yield levels of more than 5.5%, so we believe that 2024 is set to be another strong year for total returns.

We remain confident that both the economic slowdown and strong disinflationary momentum from late 2023 are set to continue throughout 2024. While we don’t expect that the path to reach the 2% inflation target will be a smooth one, as evidenced by December’s stronger-than-expected inflation release, we continue to believe that we will reach 2% far quicker than central banks and the broader market expect.

As inflation comes back to target, we believe that central banks will become more cognisant of the weakening growth outlook and will have to acknowledge that maintaining rates for a prolonged period will cause more harm than good. Therefore, we expect central banks to pivot to monetary policy easing through interest rate cuts. This provides a supportive backdrop for fixed income valuations, while also increasing the likelihood of a soft economic landing.

Broadly, UK ‘tier 1’ data has started to weaken materially – with growth, inflation and wages all coming in below market expectations. While it might be too early to declare outright victory, things are trending in the right direction for our positioning.

Having reduced our overweight interest rate risk position into the year-end following the significant moves in Q4 2023, we view the back up in yields seen since the turn of the year as an attractive entry point, and we added back to the overweight duration position recently with UK 10-year yields approaching 4%.

We continue to believe that corporate bonds remain an attractive investment opportunity, despite the more challenging economic growth outlook.

Firstly, credit typically performs well through periods of low economic growth, while the high level of yield carry on offer helps protect investors against any potential spread widening during the year. Alongside this, corporate fundamentals remain robust, with low levels of leverage, high interest coverage and ample liquidity. Though corporate fundamentals will inevitably weaken through a period of economic deterioration, the incredibly strong starting point means investment grade companies are more than capable of withstanding a prolonged period of low growth.

The underlying strength of corporate balance sheets, coupled with our high quality, sustainable portfolio, leaves us looking forwards to what should be another strong year ahead for our Sustainable Future fixed income strategies, as we continue to transition to a cleaner, healthier, and safer economy.

Discrete years' performance (%) to previous quarter-end:

|

|

Dec-23 |

Dec-22 |

Dec-21 |

Dec-20 |

Dec-19 |

|

Liontrust SF Monthly Income Bond B Gr Inc |

13.1% |

-15.4% |

-0.2% |

5.5% |

9.4% |

|

iBoxx Sterling Corporates 5-15 years |

11.3% |

-19.2% |

-3.3% |

8.6% |

10.7% |

|

IA Sterling Corporate Bond |

9.4% |

-16.1% |

-1.9% |

7.8% |

9.5% |

|

Quartile |

1 |

2 |

1 |

4 |

3 |

|

|

Dec-23 |

Dec-22 |

Dec-21 |

Dec-20 |

Dec-19 |

|

||||

|

Liontrust Sustainable Future Corporate Bond 2 Inc |

13.0% |

-19.1% |

-2.0% |

7.0% |

11.8% |

|||||

|

iBoxx Sterling Corporate All Maturities |

9.7% |

-18.4% |

-3.2% |

8.6% |

11.0% |

|||||

|

IA Sterling Corporate Bond |

7.3% |

-20.5% |

1.3% |

4.2% |

9.0% |

|||||

|

Quartile |

1 |

4 |

2 |

3 |

1 |

|||||

*Source: FE Analytics, as at 31.12.23, B share class, total return, net of fees and interest reinvested.

**Source: FE Analytics, as at 31.12.23, primary share class, total return, net of fees and interest reinvested.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Sustainable Future Team:

Are expected to conform to our social and environmental criteria. May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. Hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Future Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.