In our last article, we noted that a widening in corporate bond spreads is leading to very attractive yields, especially if you – like us – believe that the average investment grade company is in a robust position to withstand economic slowdown.

Since then, the investment opportunity has only become more compelling as yields have risen following further policy tightening from central banks globally and, in the UK, the impact of the ‘mini-budget’ debacle. In our view, a combination of attractive spread levels, high government bond yields and strong corporate fundamentals supports credit from a total return perspective over the medium to longer term.

More specifically, we think the financials sector provides some of the best value on offer within investment grade corporate bonds at the moment, with banks and insurance sub-sectors the stand-out opportunities.

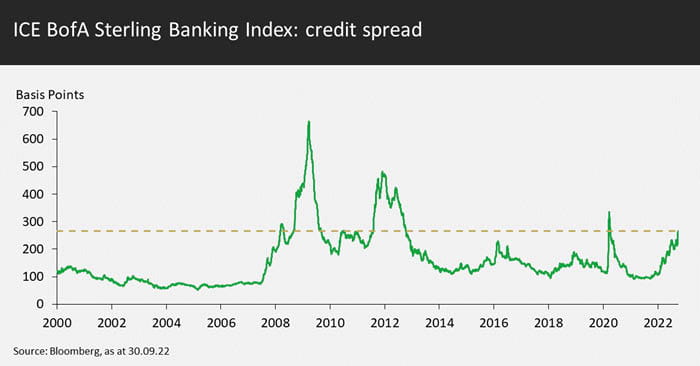

The banks and insurance sectors of the ICE BofA Sterling Corporate Index have returned -18% and -23% so far this year (to 18.10.22). We think this weakness is overdone, stemming as it does in a large part from technical factors and an unwarranted softening in sentiment. Credit spreads in both banks and insurance have only been wider during the Global Financial Crisis, Eurozone crisis and Covid-19 outbreak. At c.270bps for banks and nearly 340bps for insurance, we think these spreads over government bond spreads offer ample compensation for the risk of lending.

Looking at the technical factors in more detail, the banks sector in particular has seen indiscriminate selling, i.e. across all markets and aspects of the capital structure, with little distinction between higher and lower quality institutions. This seems to be a reflection of thin volumes and the (ultimately misplaced) expectation that the sector would conform to historical stereotypes of heavy and cheap issuance as the macroeconomic picture deteriorated.

From a fundamental standpoint, we think the sectors are also undervalued. Investors have priced in a sharp and protracted recession, which would damage bank provisions. However, while economic growth prospects have been significantly impeded by the ongoing war in Ukraine and cost of living squeeze, our base case for the short-term is a low/no growth environment with the likelihood of a short, technical recession (i.e. two consecutive quarters of contraction).

In this scenario, we do not believe that banks and insurance companies would see a negative impact on their credit quality. From a fundamental perspective, they are in good shape, with strong capital, solvency and liquidity positions.

Bank profitability is finally and significantly on the rise, with UK banks in a good position to benefit from the rapid interest rate rises we have seen from the Bank of England since December 2021. Bank margins tend to rise alongside interest rates as not all of the increases are passed on to deposit accounts.

From a balance sheet perspective, banks’ capital levels are well above regulatory requirements, and strong underlying profitability naturally results in strong organic generation of capital. Although banks released some of the pre-emptive 2020 Covid provisions during 2021, provisions remain high. Mortgage books generally have low Loan to Value ratios (40-60%). Consequently, banks are guiding to low loan losses through 2022.

Turning to the insurance sector, its state of health is illustrated by its performance during previous crises. According to Goldman Sachs, only four companies made a loss through the global financial crisis, while only three made a loss after Covid-19 emerged.

As with banks, insurers should also benefit from the higher yield environment. Not only do they see better returns from their investment portfolios as yields rise, they also receive a solvency boost due to the long duration nature of many of their liabilities. Solvency ratios of European insurers are already in a good position, having strengthened through 2021 to an average of over 200%.

Indeed, this positive fundamental outlook is shared by credit rating agencies, which have largely favoured positive ratings announcements for banks and insurers over the course of 2022. For example, AXA has been upgraded by all credit rating agencies to high single A and Fitch withdrew its Negative Watch on Standard Chartered in July.

Our outlook for banks and insurance is reflected in the construction of our portfolios, with, for example, around 40% of the Liontrust SF Corporate Bond Fund invested in financials. Some of our larger issuer allocations include HSBC, Standard Chartered, AXA, Rabobank and Zurich Insurance. Our credit analysis suggests that these companies should prove very resilient to deterioration in economic conditions, leaving their yields – which range from around 7.5% to around 9.5% – looking like attractive core building blocks for the funds’ income profile.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.