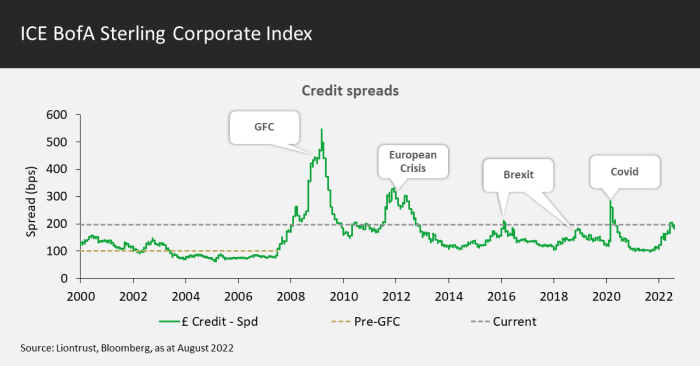

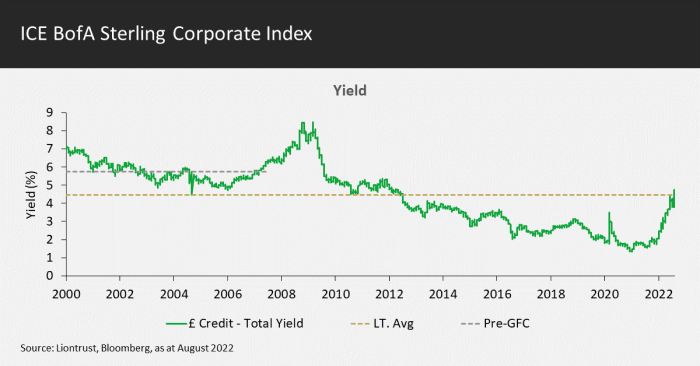

The ICE BofA Sterling Corporate Index has returned -18% this year (as at 31.08.22) due to a combination of rising government bond yields and widening corporate bond spreads.

While an outlook of persistent inflation, higher interest rates and a cost of living squeeze suggests that some businesses face a very challenging operating environment, we think the average investment grade company is in reasonable shape to face this and, as a result, spreads on corporate debt have now widened – as shown in the chart below – to what we believe are attractive levels.

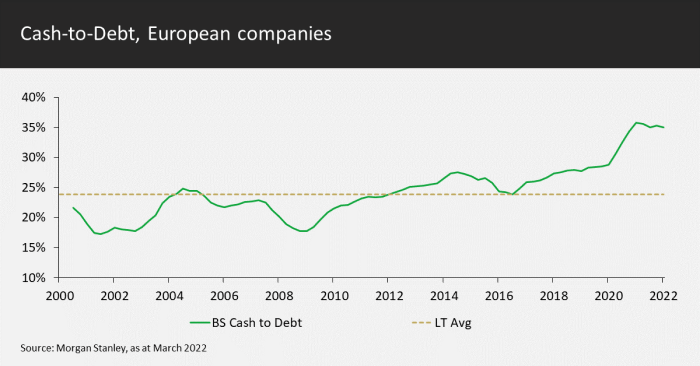

Looking at balance sheets, corporates are in a healthy position. Over the course of the pandemic, many corporate treasurers took advantage of favourable refinancing conditions to lock in low funding rates over longer time periods.

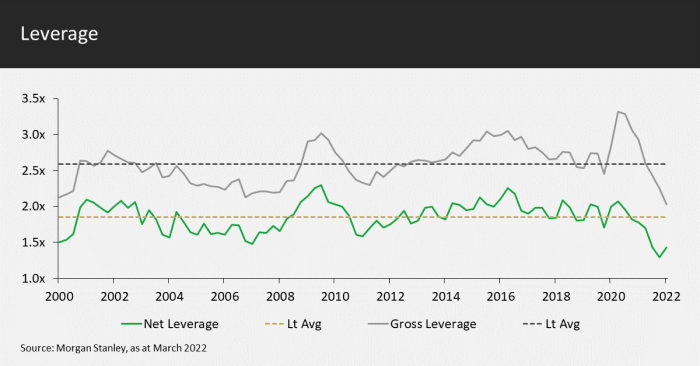

Average leverage (debt as a multiple of earnings) is also very conservative across the market. Both gross and net leverage are at, or close to, record lows, as illustrated in the following chart; net leverage simply offsets cash on the balance sheet against gross debt.

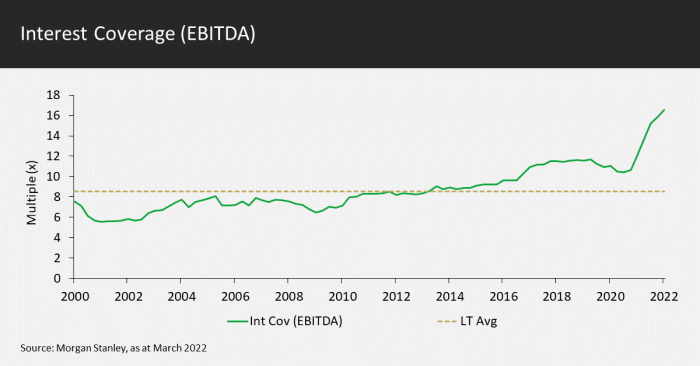

In combination with the favourable interest rates locked in during refinancing, this means that interest payments are much reduced. At the same time, earnings have been relatively resilient, meaning that interest payments as a percentage of EBITDA (earnings before interest, tax, depreciation and amortisation) have fallen or – viewed conversely – the interest coverage ratio of earnings to interest payments has risen, as shown below.

Added to this, a conservative approach to M&A and growth capital expenditure has placed less stress on corporate balance sheets. Cash to debt levels are high, providing corporates with ample liquidity buffers to navigate short-term uncertainties.

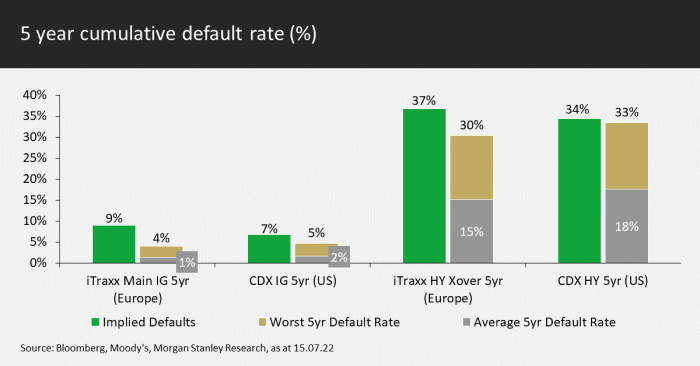

Default rates are currently low but credit spreads have widened to around 200bps, as high as they’ve been in the last decade aside from the shocks associated with the eurozone crisis, Brexit and Covid-19 outbreak. At these levels, the investment grade market is pricing in a 5-year default rate of 9%, according to Bloomberg data.

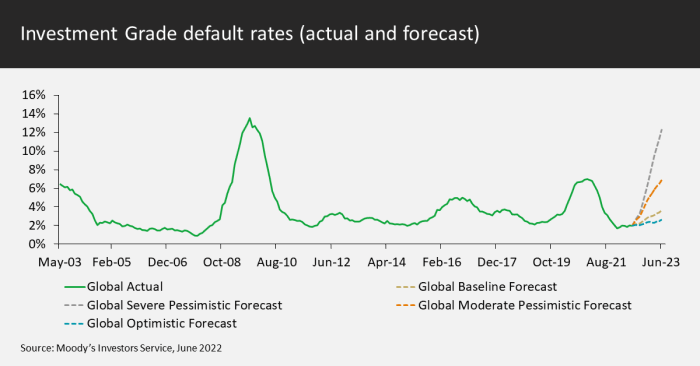

This compares against a long-run average default of around 4% and Moody’s baseline scenario of a 3.7% default rate.

As the chart above shows, only under the most severe, pessimistic forecasts do we get default rates which justify today’s spreads.

With corporate spreads at such wide levels and underlying government bond yields having risen to fair value this year, the yield available on corporate bonds looks very attractive at over 4.5%.

Supply dynamics within the market also look supportive of current valuations: following the glut of refinancing during the pandemic, rising yields now mean that new issuance is starting to fall. Consensus estimates are that issuance is down 18% so far this year. With investors still having cash to invest, we think it is unlikely yields will go much higher than current levels.

These conditions are creating attractive investment opportunities for the funds, allowing us to generate a yield of around 5% currently without deviating from our high-quality, sustainable approach to credit selection. For example, we have healthy allocations to sectors offering some of the highest yields – including banks and insurance – as well as to those likely to prove most resilient to inflationary pressures, such as telecoms. In turn, we are underweight cyclical areas that are vulnerable to a downturn in the economy or which may struggle to pass on cost increases; these include consumer-facing companies and industrials.

Although the economic outlook is challenging, we believe the prospects for corporate bond investors are very good. Company balance sheets are, on average, much healthier than long-run averages, while bond valuations price in a level of default that we don’t see materialising. We think investors should view current yields as an attractive entry point, which also offers the real potential for capital upside should spreads tighten if default rates beat the very pessimistic levels currently priced in.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.