"From what we have seen to date, the impact of the changing health of the macro-economy is an earnings issue rather than a material, systemic rise in defaults."

Executive summary

It seems almost facile to note the world has changed since our last strategy document from late-December 2021. As investors, we are grappling with the economic and market impact of drastically different geopolitics, supply shocks, risk of central banks overshooting and Chinese lockdowns. This year will likely go down in the history books as one of the worst bond bear markets, whilst equities are also in red – deeply so, depending on sector.

Growth expectations have been revised lower and inflation revised higher. However, we believe US inflation has likely peaked, whilst economic growth should show resilience, buoyed by the consumer with savings and wage rises.

Although the 5-year area of the US curve has not been a safe haven, we continue to like this position. Indeed, we have added to it in recent weeks. As central bankers progress with raising rates, curves tend to steepen. This has still yet to really happen but, with peaked but sticky inflation, we believe it will. Meanwhile, we also believe other developed countries will catch up and the spread between US/Germany and US/UK will contract. This explains the significant exposure our funds have to US, which now accounts for ~75% of fund duration in our strategic bond funds.

Spread product is cheaper and looks attractive over the medium to long term. However, although we are overweight, we retain dry powder as the market learns to operate without the central banks having our backs to the same extent, meaning we expect continued volatility through the next few weeks and months.

The key risk to our view is a harsh recession, perhaps from conflict escalation or central banks over-tightening. Indeed, many in financial markets have come to the conclusion that the US Federal Reserve and European Central Bank must raise rates so far as to engineer a deep recession in order to stamp out inflation. Undoubtedly, the monetary journey to bring inflation back under control is one that should have started much sooner, but higher rates and quantitative tightening will be powerful tools given the amount of debt outstanding in the world. Whilst wage inflation will remain elevated in the face of tight labour markets, wallet share substitution effects of higher energy and food prices will take some of the heat out of aggregate demand within discretionary spending.

There are reasonable risks to worry about, but we believe the amount of monetary tightening already reflected in the 5-year maturity area of the US curve, combined with the value in decent quality high yield and our avoidance of the most equity-like parts of the corporate bond market, leaves us well positioned to generate good returns through the cycle.

Macroeconomics

Using JPM as a guide to consensus expectations, key economic forecasts are lower since the invasion of Ukraine. For example, JPM expects global real GDP growth to be 2.9% in 2022, 1% lower than its expectation in mid-February. The Euro area, given its proximity to the conflict, has seen the biggest change, with real GDP growth expected to be 1.9%, 2.7% lower than the view only two months ago. Indeed, very recently, the German government has cut its 2022 GDP forecast from 3.6% to 2.2%.

There are various drivers at play. We might have hoped covid wouldn’t be mentioned in this strategy note, however China’s ‘zero covid’ policy and the major urban lockdowns that have come with it also add to the global growth concerns in the market. The government seems to be fairly entrenched in this policy, although they are increasing liquidity into markets to help mitigate the negative impacts. As we have come to learn with the virus, we would expect the spike to be a relatively short-term phenomenon.

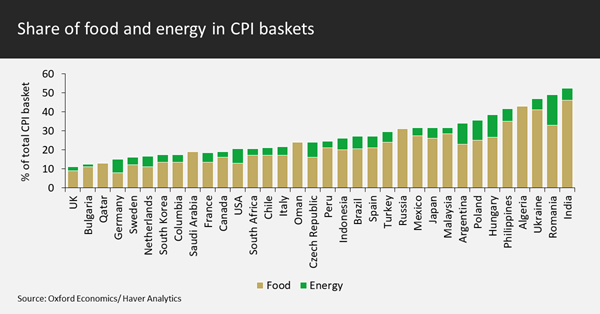

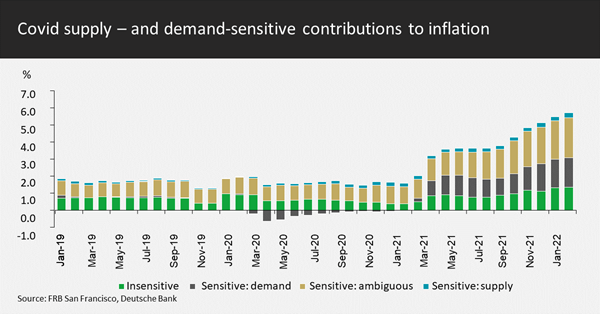

Supply constraints have been a theme for many months, which until the conflict had been primarily pandemic and semiconductor chip related. Given the extent to which Russia, Ukraine and Belarus supply the world, the conflict has introduced a shock to food, energy and some metals. It is, however, worth flagging the extent to which these shocks impact, at least from a CPI basket perspective, emerging countries more than the developed world.

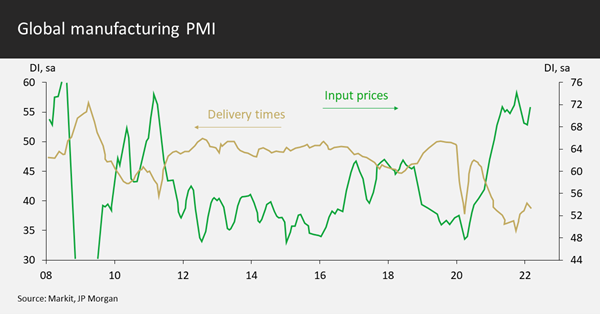

Manufacturing supply constraints have seen continued, small improvements, whilst construction has seen a small deterioration. The reality is the global supply chain has still much more to go to be back to normal, whilst the conflict may be changing our understanding of what normal is.

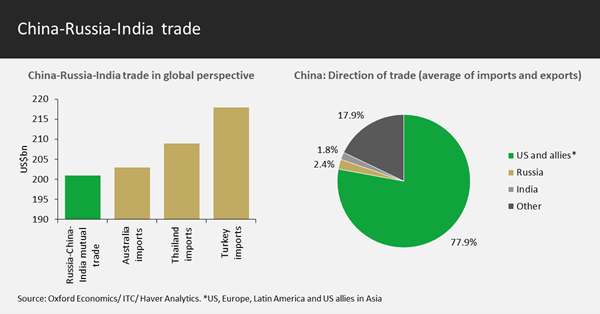

To what extent should we be worrying about ‘deglobalisation’? It is not our intention in this note to go too far into the realm of politics. However, one thing seems clear: the US and Europe have not obviously been backed in condemnation of the Russian government’s actions to the extent they might have hoped. What does this say about the future world order and the outlook for global trade? Our view is that, although we will see a displacement of trade, particularly in hydrocarbon flows, the US and allies are still dominant trading partners. For the time being, we do not believe trade between, for example, China, India and Russia is substantial enough to displace the ‘the West’ in any great way.

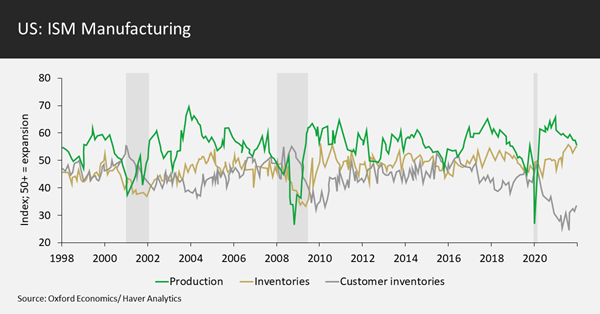

In corporate land, we continue to believe the rebuilding of inventories will be a positive theme in 2022, although progress to date has been a little slow. Although corporate earnings have and will likely continue to be softer, in general company profitability is coming from a decent base, indeed higher than going into the pandemic.

To be clear, the risk of recession has increased in recent months. However, the dynamic of rising nominal growth as a result of inflation is a reasonable backdrop for companies indebted with fixed-rate debt which have some degree of pricing power. From what we have seen to date, the impact of the changing health of the macro-economy is an earnings issue rather than a material, systemic rise in defaults.

Consumption

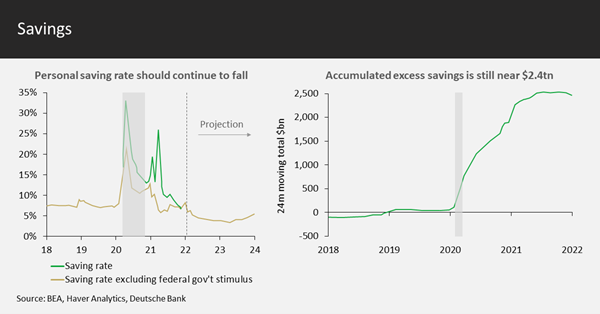

Savings has been central to our optimistic view on consumption in the US and, indeed, Europe. The evidence continues to suggest a slow release of pent-up demand is ongoing. Perhaps notably, there has been an uptick in consumer credit, particularly credit card volumes, which suggests the marginal propensity to consume remains supportive.

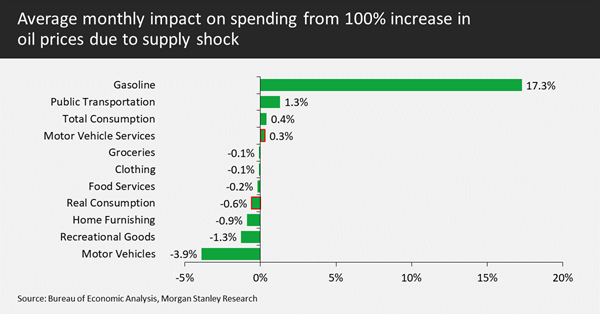

As we grapple with Chinese lockdowns, the prospect of central bank overshoot and major supply shocks, there are some variables more measurable than others. For example, the following chart from Morgan Stanley provides a useful guide as to how impactful the oil shock might be. In the US, a 100% oil price increase hits real consumption by about -0.6%. However, evidence suggests the poorest in society are hit disproportionately by an oil price shock, therefore wage inflation is required to support consumption.

Employment

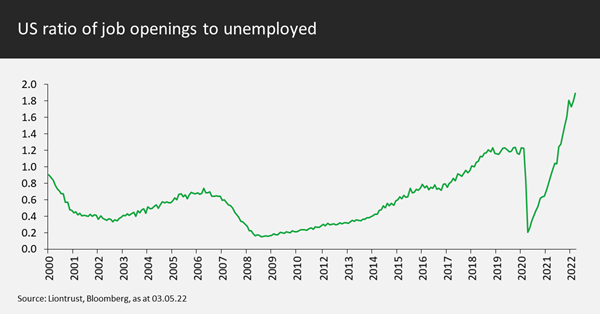

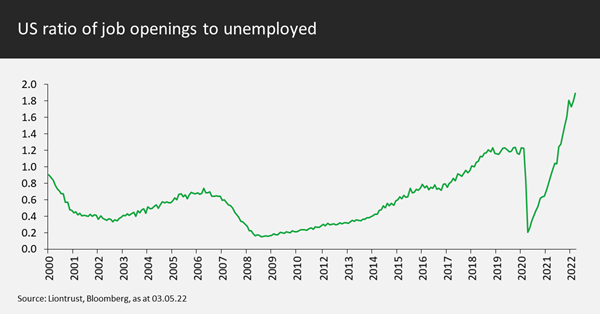

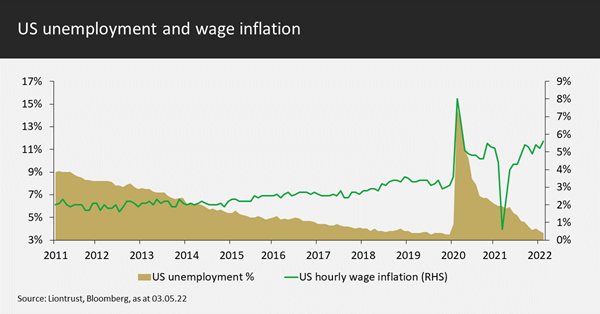

Consumption’s ability to absorb inflation and rising interest rates will also crucially be supported by jobs and wages. We have utilised various charts on this topic in recent quarters. This is one is stark: currently, there are 2 jobs available for every unemployed person in the US.

This is a strong support for continued wage growth. As we have previously stated, wage inflation is the key condition to sustain higher inflation. Central bankers have a fine line to tread between reducing inflation expectations and associated wage demands, whilst not impoverishing the socioeconomic groups within society for whom spending on food and energy constitutes a significant proportion of earnings.

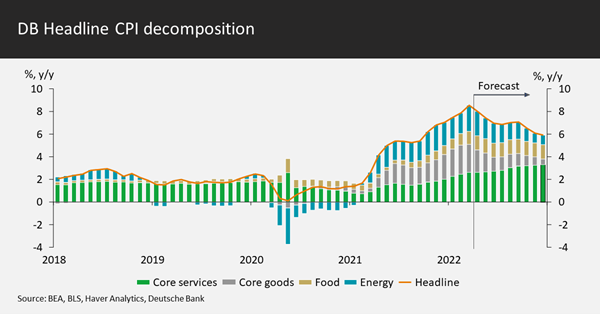

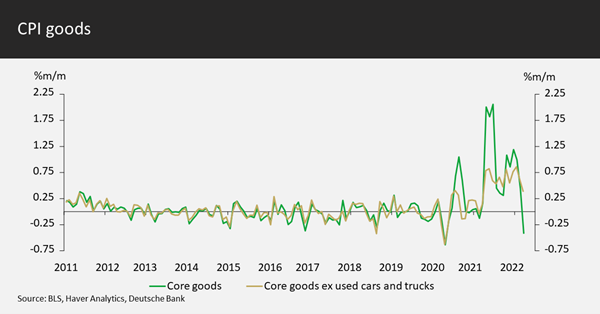

Inflation

JP Morgan’s CPI (consumer price inflation) forecast has increased 1.7% since the early part of the year and is now 5.4%. Note that this reflects inflation having a lower rate at the end of the year than the intra-year peak, with 6.4% expected in Q2 year-on-year. There are various contributors that will make inflation slow in the second half of the year. For example, used cars and trucks alone are 1 percentage point of US CPI, which should begin to unwind. However, core inflation will be sticky; owner equivalent rents (the cost of housing) represent approximately 40% of the CPI basket and theses costs continue to gather at a roughly 5% annual pace, thus contributing 2% to CPI.

It’s clear from the data that it’s not just supply effects driving inflation. This is important for the successful transmission of monetary policy and the ability of central bankers to ‘tame the beast’.

Rates Positioning

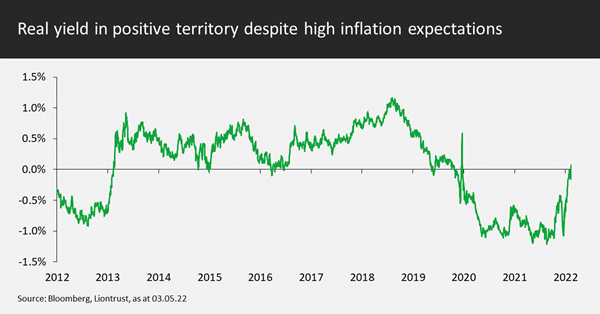

Encouragingly for bond investors, real yields, as measured by market expectations of inflation, have crept into positive territory. We believe this is a crucial point when considered alongside the likelihood that inflation has peaked. Any drift higher will likely be an opportunity for us to add duration to the funds. Over the period since our last quarterly strategy meeting in late December 2021, we have increased duration in the strategic funds by a year to 3.75 years.

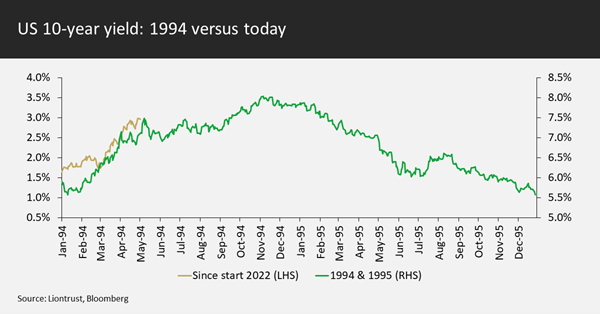

A key uncertainty is the risk of the Fed overshooting on rates. It is uncontroversial to accuse them of being slow to react last year. We could perhaps speculate that they were intentionally slow, given a bit of inflation may be desirable for an economy with lots of debt. Whether knowingly or not, last year’s slow pace feels like a distant memory and the aggressive re-pricing of inflation risk this year has been remarkable. Indeed, bond market historians will know 1994 as a year of a substantial sell-off, yet 2022 to date has seen even sharper moves. Today, forward rates suggest a 3.4% terminal rate, a whopping increase on a 2-year horizon from today’s 0.25% to 0.5% band. This suggests there are roughly 12 additional hikes priced into the market as compared to our last strategy write-up at the end of 2021. It should also be noted that every $1trn of reduction in Fed bond purchases, or quantitative tightening, has been estimated to equate to a 25bp rate hike.

A year ago, we felt it was quite likely that inflation would surprise to the upside in the next 12 months. However, today, in our view, this is much more difficult to call and even somewhat likely that inflation has peaked. Meanwhile, we believe central bankers have been happy to sound much more hawkish than they will ultimately be prepared to act. After all there is a natural lag between monetary policy changes and the impact on the economy; the impact of more front-loaded rates rises will be clearer to see toward the end of 2022. Furthermore, the sooner and faster that central bankers act, the lower the likely terminal rate will be as consumers’ inflation expectations and marginal economic activity are both curtailed.

The extent to which hikes are priced into the short-medium part of the curve, with the likelihood that inflation will be sticky in the 3.5% to 4% vicinity, leads us to continue to favour five-year US bonds, now yielding close to 2.8%. When the 5s30s curved inverted back in early April, we removed the small amount of >15yr exposure within the Funds.

Perhaps we might have been expected to increase duration more than we have, given the scale of the moves year-to-date. It is largely our aversion to longer-dated bonds that explains this, and we believe we are expressing a high conviction view on the belly of the US curve.

We are back to being largely unconvinced by euro sovereign bonds. Indeed, as the spread between German and US bonds has increased, we have reduced the strategic funds’ exposure to European rates, with the funds now taking around 75% of the duration from US bonds.

Spread product

Corporate fundamentals at this point look good given profitability has climbed above pre-pandemic levels. Capacity utilisation remains at decent levels and “ratings drift” is still positive, albeit showing signs of slowing. At the time of writing, we are in the midst of earnings season, and this is looking more mixed than recent quarters.

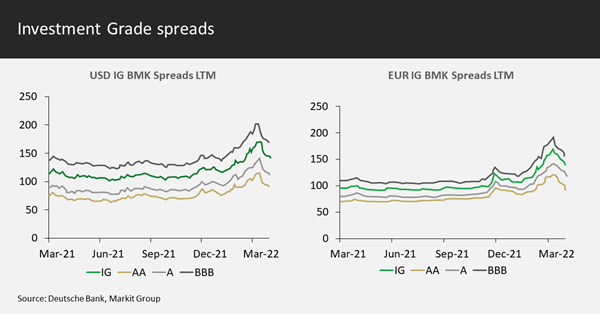

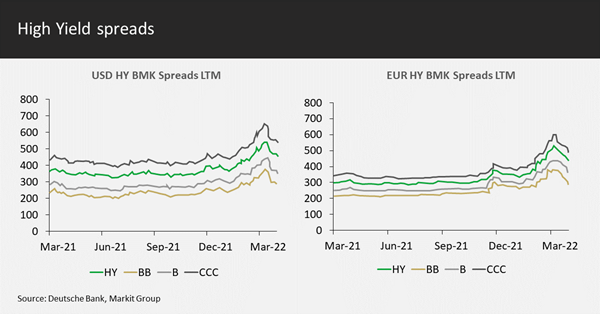

Spreads have widened along with bond yields and risk assets in general. Global high yield spreads are around 80bps wider year to date. US high yield has a spread around 4%, sitting atop a treasury yield that we believe is closer to fair value than it’s been in years. Investment grade spreads are about 50bps wider.

In short, we like spread product, with the strategic funds around 50% in investment grade and just under 30% in high yield – in aggregate, an overweight position in our process. However, we have dry powder. The corporate bond market, and risk assets in general, are dealing with a market where central bankers have our backs to a much lesser degree than in the preceding decade. The result of this is that liquidity is a little bit thinner and volatility higher. Within our holdings, the strategic funds continue with a quality bias, light in cyclicals and largely avoiding the equity-like end of the market, such as AT1. With central bankers striving to slow economic activity we dislike cyclical companies’ bonds even more than usual.