The Liontrust Strategic Bond Fund returned -2.5%* in sterling terms in February. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was -2.1%.

Please note that the Fund return includes a negative impact of 0.2% from temporarily moving to a bid pricing basis.

Market backdrop

The two key events that impacted bond markets in February were Putin’s unprovoked war on Ukraine and central bankers’ highly provoked reaction to surging inflation.

Central bankers’ hawkish pivot

The month started off with the ECB finally coming to the realisation that it needed to do something about inflation. As the last of the major central banks to proverbially raise the monetary policy anchor, this had huge ramifications for bond yields. 10-year Bund yields rose 13 basis points (bps) in February, spending the whole month in positive yield territory. The spread between Italy and Germany widened by 29bps to reach 157bps; if we saw 200bps I’d expect the ECB to intervene. The pivot from ECB members has been to say that they expect QE (quantitative easing) to finish this year; rate rises are now a distinct possibility. Indeed, the market was pricing in over 3 rate rises (10bps a time) before the end of 2022, albeit this pricing was back down to 1.5 rate rises by the end of February.

So why has the ECB, as well as previously dovish members of the Fed, pivoted towards tightening policy sooner. The answer, in my opinion, is the risk it sees of inflation becoming embedded in economies. The manifestation of this is in corporate and consumer expectations – when higher inflation levels become entrenched in the mindset of economic agents, they alter their behaviour accordingly. The most important factor is wage inflation; with tight labour markets and pressures on the cost of living, it is completely rational that there is upward pressure on wages. Once the circularity of higher inflation and wages gets started it can lead to a sustained period of core inflation exceeding central bankers’ targets. Headline inflation will start falling later in the year, but if central bankers have said they are focusing mainly on core inflation whilst headline was so high, they cannot simply switch their methodology once headline inflation starts falling.

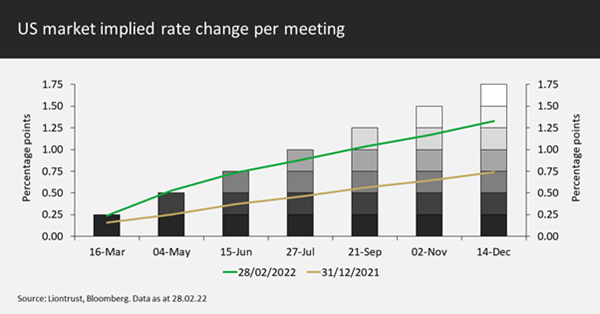

Examining core inflation in the US (excluding food and energy), February saw an annualised rate of 6.0%. Some Fed officials favour PCE deflators as an inflationary measure and the PCE core deflator came in at 5.2% in February. I have been saying for a while that core inflationary pressures are rising. Crucially, the housing element – proxied by owner equivalent rents which makes up almost 40% of the CPI basket – is now above 4% and still rising. The Fed will raise rates at its 15-16 March meeting. The only question is whether it is a 25bps or 50bps hike. Unless Putin ceases his war on Ukraine between now and then, my bias would be to expect a 25bps rise. A further 4.3 hikes are then priced in for the remaining Fed meetings in 2022:

It is clear from the chart above that market expectations have shifted a long way in the first two months of this year. Before the Ukrainian war started, the market was pricing in close to seven hikes. The corollary of the rise in rates expectations over the first two months of 2022 is that parts of the bond market are now looking reasonable value for the first time in a long while.

It would be remiss of me not to mention the Bank of England where four out of nine monetary policy committee members voted for a 50bp rate rise in February. Market forecasts are that the next four meetings will all witness a 25bps hike and the pace will then slow after that.

Putin’s war with Ukraine – potential economic impacts

The humanitarian impact on the Ukrainian population should not be understated. From the perspective of global bond markets, we do need to examine the economic contagion from the war.

The most obvious contagion is via higher energy prices. These are effectively a tax on consumers and there will be a wallet substitution effect as people spend more on energy costs. The impact will vary across Europe depending on the energy mix in the economy and the amount of government subsidies. The impact of higher energy prices should just be to trim growth forecasts – post-pandemic excess savings can absorb the extra costs, albeit this mitigating factor is not evenly distributed. Across in the US there will be far less of an impact due to energy self-sufficiency and the offsetting effect of higher shale gas activity when energy prices are high.

The typical US consumer will base their spending decisions more on equity market levels and their own disposable income (provided the war does not spread beyond Ukraine). With the probable exception of those countries sharing an eastern border with Russia, consumer confidence should remain robust. Notwithstanding this, one has to assume that the war will give ECB members an excuse to delay monetary policy action for three to six months as it seeks greater clarity.

An accelerated move to reduce European reliance on Russian energy supply must surely be a priority too. This also has the benefit of helping to reduce carbon emissions. At the time of writing, all the sanctions seem to be trying to hit every Russian economic sector except energy, with a ring fence effectively around oil and gas exports. Another obvious consequence is a greater proportion of government budgets being allocated for defence spending; Germany has already committed to raising spending from the last decade’s 1.2% average to 2% of GDP, in line with the NATO advocated percentage.

Rates

The Fund finished the month with a duration of 3.75 years, having added when US 10-year yields went above 2%. The duration remains below our neutral level of 4.5 years. We believe that the broad sovereign bond market does not yet offer value, but pockets of it do now look OK. Explicitly, the US 5-year, with a yield of 1.72% at month end, has a decent cushion priced in for rate rises. Admittedly, the intra-month yield high of 1.95% was obviously more appealing. The Fund has a little over 2 years’ duration contribution in the US, the majority of this is at the 5-year tenor.

The remaining duration is found in Europe at the 10-year area. The Fund has a ‘butterfly’ yield curve position – out of the wings (5-year and 30-year) and into the body (10-year). The German 10s30s curve is too flat at 27bps, hence the preference for the middle maturity area.

On the cross-market front, the Fund retains its strategic position of long New Zealand relative to Australia. Long France versus Germany was exited during February, with an addition to credit being a better use of risk budget given that both tend to trade directionally with the risk on/off environment. Finally, profits were taken in Switzerland versus Germany. The mean reverting nature of this relationship has led to it adding incremental performance numerous times over the last couple of years.

Allocation

High-quality high yield is the one part of the market that we find very attractive. At a yield above 6.5%, it represents a level where good long-term returns can be made and, historically, new money starts to be allocated to the asset class. The Fund has a weighting of 28%, split between 23% in physical assets and a 5% overlay; we deem 20% to be neutral. We have plenty of risk budget to add more, with a limit of a 40% weighting. Greater clarity around Putin’s war on Ukraine or further improvements in valuations would entice us to increase the weighting further.

The Fund’s investment grade weighting was increased during February as valuations improved significantly. The net weighting of 45% (50% physical bonds minus a 5% overlay) is still below our 50% neutral level. This is only due to our overweight exposure in high yield, otherwise we would be buying more high-grade credit.

Selection

For the avoidance of any doubt, the Fund has zero exposure to any Russian or Ukrainian sovereign or corporate debt. Stock level activity was mainly about rotating out of relative outperformers and increasing weightings in any laggards. A holding in Citigroup subordinated debt was sold completely and various others were trimmed. Additions to weightings included Vodafone and Castellum. One relative value switch was undertaken, moving from BBB-rated Danaher Euro-denominated debt into the same tenor from single A-rated Medtronic for a drop in spread of only 4bps – a negligible amount of yield for the increase in credit quality.

Discrete 12 month performance to last quarter end (%)**:

Past Performance does not predict future returns

|

Dec-21 |

Dec-20 |

Dec-19 |

|

|

Liontrust Strategic Bond B Acc |

-0.47% |

5.87% |

8.70% |

|

IA Sterling Strategic Bond |

0.77% |

6.55% |

9.26% |

*Source: Financial Express, as at 28.02.2022, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 31.12.2021, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12-month periods due to the launch date of the portfolio (08.02.18).

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

Key Risks