The Liontrust GF Absolute Return Bond Fund (C5 share class) returned -0.4% in sterling terms in Q4 2021 and the IA Targeted Absolute Return, the Fund’s reference sector, returned 0.7%. The Fund’s primary US dollar share class (B5) returned -0.3%.

The combination of fund management value-added during the quarter with the yield carry on the Fund were not quite enough to offset the double whammy of a rise in short-dated government bond yields and credit spread widening. With higher yields providing more carry, steeper short-dated government yield curves discounting rate rises and slightly more generous credit spreads, market conditions are far more favourable entering 2022.

Market backdrop

The mainstream news has saturated coverage of the omicron variant, and its relative infectiousness and virulence, so we focus our attention in this commentary on more mundane matters such as central banking actions.

The US Federal Reserve increased its pace of tapering (slowing the amount of quantitative easing they are doing), with the end now anticipated to be in March. The dot plots now show a median forecast of three rate rises in 2022; there are a further three increases forecast in 2023, albeit with a greater disparity of views amongst the committee. The Bank of England had delayed raising rates at its November meeting but dutifully delivered in December. An honourable mention has to go to other countries seeing rate rises given how prolific monetary tightening is around the world, in December the list included Norway, Czechia, Poland, Hungary, Brazil, Mexico and Chile.

One jurisdiction that remains steadfastly addicted to having loose policy is the Eurozone. The ECB is letting the emergency bond buying PEPP programme expire, but slightly increasing the APP to offset some of this; quantitative easing may be stopped by the end of 2022and they have guided that any rate rise won’t be until 2023. It’s absurd given where inflation and growth are currently and forecast to be, but in a fiat economy you can get away with financial repression for long periods of time (but when it eventually goes wrong it goes very wrong).

For 2022, one of the key themes for bond markets will be whether central bankers are deemed to be “behind the curve” or, in layman’s terms, too slow to raise rates. In 2021, the word “transitory” to describe inflation was officially retired by the Fed, we look forward to seeing what terms they use to describe large negative real rates in 2022. If we had to summarise bond markets in 2021 in two charts, we would use the following:

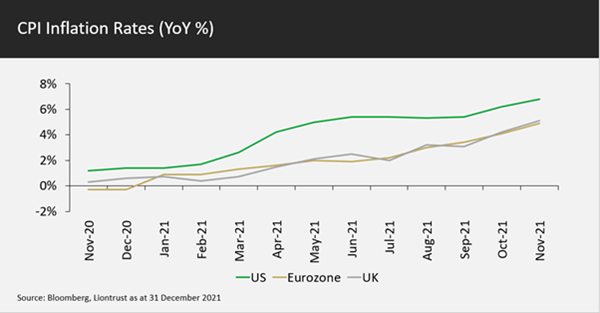

The first chart shows the progression in consumer price inflation (CPI) across the US, Eurozone and UK in 2021. Headline CPI will start to fall in the US in early 2022 as the impact of energy price rises fade but core CPI will continue to rise. Energy prices feed through to CPI with more of a lagged effect in Europe and the UK, so one should expect a peak in CPI sometime around Q2.

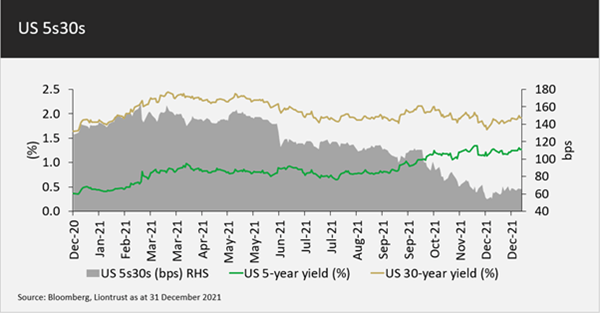

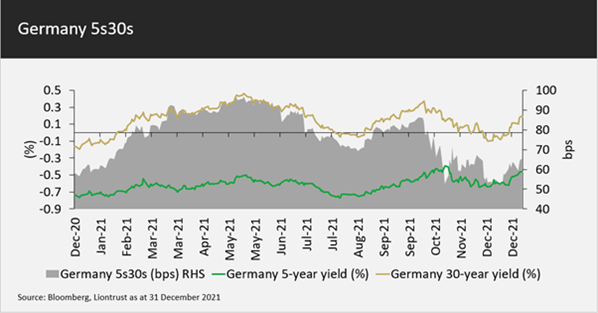

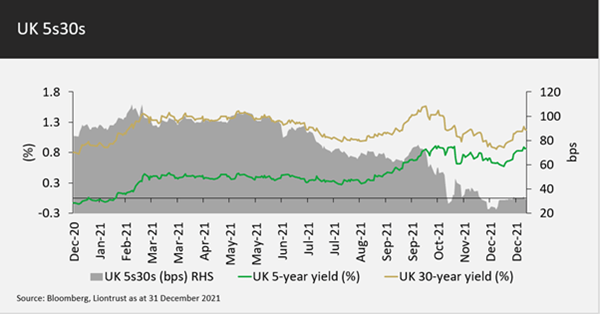

If you’d told us a few years ago we’d see these inflation levels coupled with dovish central banks (in the US and Eurozone), we’d have predicted bond markets flexing their muscles and trying to demand higher yields. The bond market story of 2021 appeared to be more of a reluctant acceptance of a low yield paradigm. Examining the second chart, the blue line is the 5-year US Treasury yield, which rose from 0.35% to 1.25% in 2021, thus pricing in the first few rates rises. The orange line shows the 30-year US Treasury yield, which peaked in the first quarter and rallied significantly since. The theory here is that the Fed tightening monetary policy will choke off growth and lead to a low peak in interest rates. This can be seen by the shaded area showing the difference in yields between 5 and 30-year Treasuries; there has been a huge curve flattening. We’ve shown the same charts for Germany and the UK at the end of this review for those interested.

But what if growth remains stronger given that fiscal policy is still loose and there are huge excess savings to be spent? Or what if inflation remains significantly above central bank targets for the next few years and the bond markets demand more of a “term premium” for owning longer dated debt? Or maybe economies will be strong enough to cope with positive real interest rates? If any of these scenarios occur, then longer dated bonds look vulnerable. Fortunately, the majority of the Fund’s assets are, and always will be, short-dated; we are judiciously hedging out the duration contribution of any longer dated credits we select.

Carry Component

We split the Fund into the Carry Component and three Alpha Sources for clarity in reporting, but it is worth emphasising we manage the Fund’s positioning and risk in its entirety. As a reminder, the Carry Component invests in investment grade bonds with <5 years to maturity; within this there is a strong preference for investing in the more defensive sectors of the economy.

With frequent tenders and maturities within the Carry Component there is a constant need for new purchases; added to this, we increased the weighting within the Fund to closer to 65% during the quarter. Bonds bought were from issuers including AT&T, Mondelez, Baxter International, Daimler Trucks, UniCredit, HSBC and Dell.

Alpha Sources

Rates

The majority of the quarter was spent with a duration of 1 year†, representing the small embedded rates beta that partly enables the Fund to generate excess returns through the cycle; note that the overall permitted range is 0-3 years with a mid-point of 1.5 years. We would need to see significantly higher yields before we even dream of going above 1.5 years’ duration.

The Fund took profits on its strategic position being long Swedish 5-year bonds versus the German 5-year BOBL future. The long 10-year France versus Germany position was maintained; the spread between the two has been remarkably stable in the second half of 2021. Also within Europe, the Fund instigated a long Switzerland 5-year bonds versus the German 5-year BOBL future; the differential gradually moved in our favour during the period. In the antipodean markets we closed out the long New Zealand 10-year bonds relative to the Australia 10-year bond future in early October having broken even on the trade. We believe that with the Kiwi bond market already discounting interest rate rises the differential between the two should narrow. We may look to re-enter this position over the coming months depending on what other rates opportunities present themselves.

Allocation

During late November and early December, the Fund’s overall allocation positioning was adjusted; Canadian 5-year government debt was sold, freeing up the cash to increase the weighting in the Carry Component by almost 10% to just below 65%. Managing the Fund’s shape through the cycle, even within the low beta remit, is all part of targeting incremental returns for unitholders.

There were no market neutral Allocation positions taken during the quarter – valuation discrepancies tend to occur in periods of more extreme credit market dislocation.

Selection

During November’s spread widening, the higher risk investment grade holdings came under the greater pressure. Fortunately, the Fund remains lowly weighted to this kind of risk so Castellum, The Southern Company and Pershing Square detracted 2-3 basis points each from performance during the quarter. We expect this to rebound during 2022. As news surfaced of a potential leveraged buyout of Telecom Italia, the holding was sold; the position has made a very small profit this year and we deemed it prudent to avoid the risk of a re-leveraging event.

November saw the return of an old favourite into the Fund’s holdings list: Eli Lilly. From their mid-summer tights, the credit spread relative to Bunds on Eli Lilly €1.7% 01/11/2049 bonds had widened 35 basis points. We took this opportunity to buy back into the bonds. Aa retracement of half of the widening would generate 5% of capital upside and make the Fund a good handful of basis points (the duration contribution is hedged out using Buxl futures).

Let’s hope for more volatility in 2022, for all the right reasons based on central banks tightening as opposed to pandemic developments, giving us more opportunities to add value.

Appendix

Discrete 12 month performance to last quarter end**

|

Dec-21 |

Dec-20 |

Dec-19 |

|

|

Liontrust GF Absolute Return Bond C5 Acc GBP |

-0.36% |

2.87% |

2.51% |

|

IA Targeted Absolute Return |

3.53% |

2.59% |

4.38% |

Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

*Source: Financial Express, as at 31.12.21, total return (net of fees and interest reinvested), C5 class.

**Source Financial Express, as at 31.12.21, total return, C5 class. Discrete data is not available for five full 12 month periods due to the launch date of the portfolio

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

Key Risks