Last year was unique in the history of the US’ S&P 500 Index. It was the first time the S&P Equal Weighted Index had underperformed the S&P 500 Index by more than 10% for two years running. Will this unprecedented run continue in 2025 or will there be a return to broader market participation? We believe the latter is highly likely and, therefore, stock selection will be critical this year.

Mega rises for equities

Equities enjoyed strong returns in 2024, particularly in the US where the combined trends of momentum, passive investing and artificial intelligence led to a 23.3% gain for the S&P 500. In fact, US equities contributed 17 percentage points out of the 19.5% gain for the MSCI World Equity Index. Frankly, everything else represented a rounding error and so it is easy to see why US and international investors remained entrenched within the US equity wave.

Much of this wave was focused on the very largest companies, with Nvidia and Broadcom driving the biggest percentage gains, up 177% and 119% respectively. These two ‘AI’ titans contributed no less than 22% of total global equity returns. Add in the other mega caps - Apple, Alphabet, Amazon, Tesla, Meta and Microsoft - and together the (now) Magnificent 8 drove 50% of global equity returns.

The momentum wave

Momentum was the primary driver of returns in 2024. The chart below produced by Bloomberg shows that 2024 has been the best year for momentum this century.

Just ride the wave

Momentum has had its best year in at least two decades

Source: Liontrust; Bloomberg December 2024

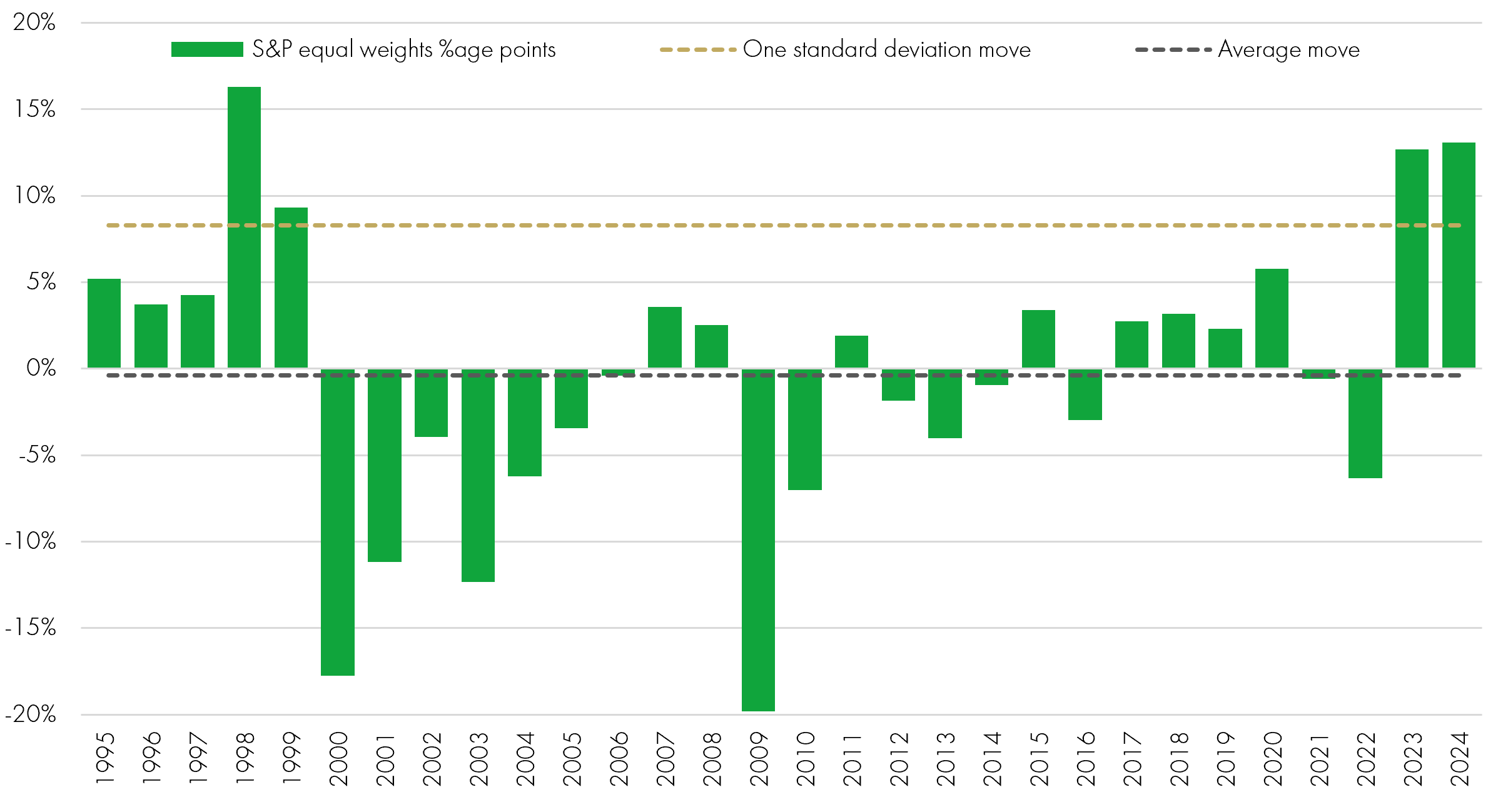

Looking deeper into this move and as we stated at the start of this article, the S&P 500 has had two successive years of outperforming the S&P Equal Weighted Index by a significant margin:

Source: Liontrust; Bloomberg December 2024

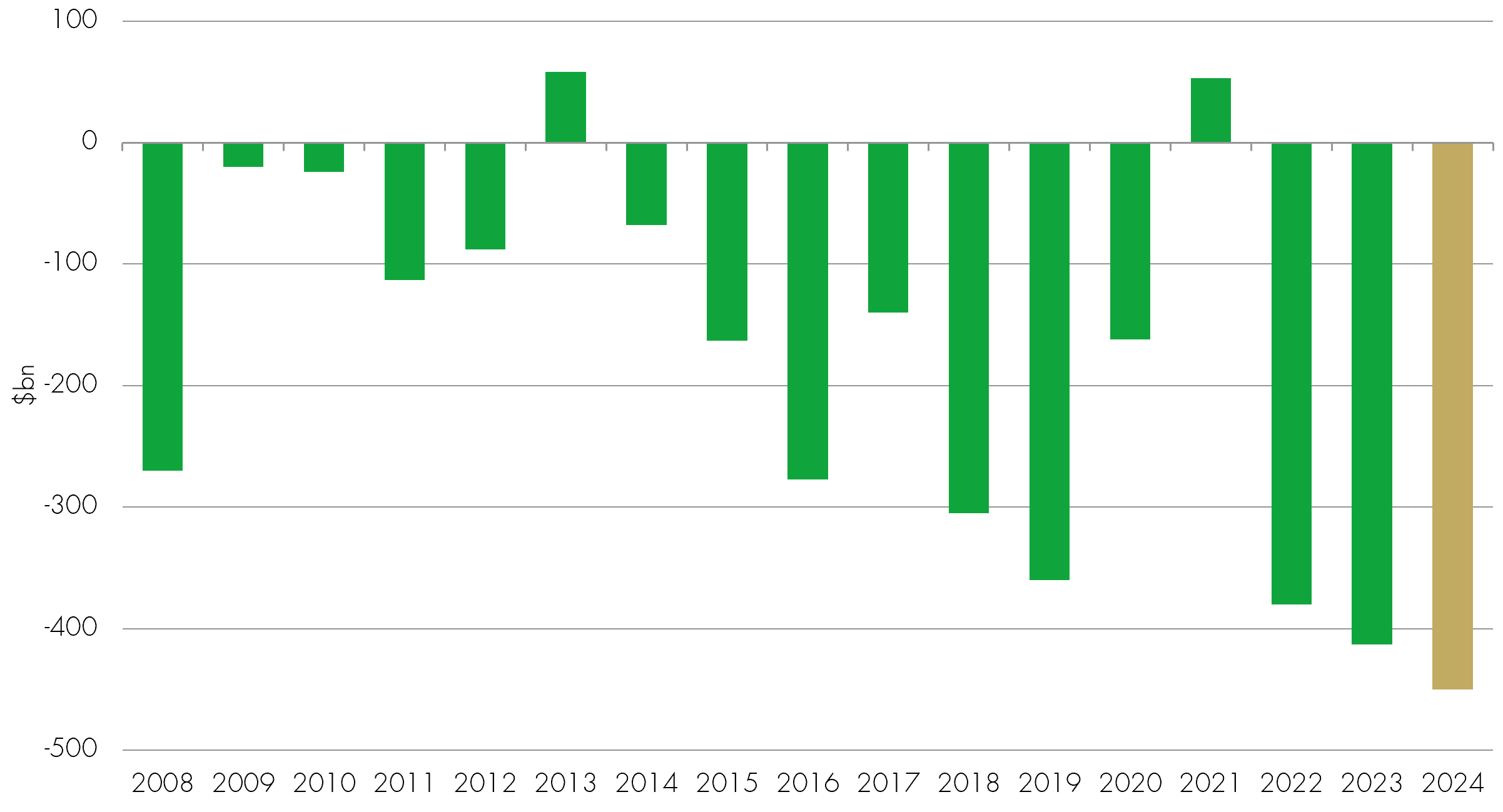

There have been two key factors driving this trend. The first is the ever-increasing move to passive investing. Since 2000, passive ETFs have gone from almost nowhere to over half of all mutual fund investing. The impact on daily trading volumes is even more acute, with ETFs accounting for as much as one-third of trading volumes. Of course, the counter side of this is accelerated redemptions from active strategies. The Financial Times recently published the 2024 numbers to cap off a strong run of years for active outflows shown in the following chart.

Active equities funds suffer record outflows in 2024

Source: EPFR December 2024

Second, is the cycle of disruption that has taken on a new velocity with the advancement of AI. Hugely cash-rich mega companies have led a charge to build the biggest and best natural language models, necessitating massive levels of investment in infrastructure. This in turn has led to a sales and earnings momentum cycle rarely seen for mega caps, which adds even more fuel to the momentum fire.

The two trends of passives and disruption have together created a potent force in markets, leading to the highest level of stock concentration since the early 1900s. We believe this is set to abate in 2025 as investment opportunities broaden beyond the few and spread to the many that will benefit from advancing technology trends.

Against this backdrop, we believe there are four key debates at a macro level that will decide where returns will be made in 2025:

- The evolution of active versus passive investing and the momentum wave

- The high-wire balancing act of global economic growth, inflation and interest rates

- The evolution of artificial intelligence beyond the infrastructure story

- Trump 2.0 and the impact of DOGE (the Department of Government Efficiency)

We make predictions about each of these four areas.

Prediction 1: The S&P Equal Weighted Index will outperform the S&P 500 in 2025.

This equates to a stock picker’s dream and a great opportunity for active managers.

So much has been written about the impact and relationship of economic growth, inflation and interest rates in the US. We believe economic growth will remain solid for 2025, driven by the benefits of private investment coming from factory fit out resulting from the CHIPS Act, artificial intelligence and rising business confidence. At the same time, the Trump-driven spending plans and tax cuts will add further support. Inflation is likely to remain stubborn, but there are plenty of signs that the wage component, which we see as a more structural concern, has peaked and will continue to fall during 2025. Against this backdrop, the interest rate outlook has been well discounted by the December Fed meeting and the new dot plot that signalled just two rate cuts for 2025.

Prediction 2: Growth remains solid, inflation and interest rates take longer to adjust, but there is no uptick in inflation or rates – which supports continued equity returns and favours diversification.

The market has become pre-occupied by the very sharp move higher in bond yields. During December alone, the US 10-year yield increased by over 10% at a time when the Fed cut rates in their last meeting of the year but also signalled via the dot plot that there was less scope for cutting aggressively in 2025. We believe market rates have moved to bake in the worst-case scenario, nullifying rates as a negative factor for 2025. Again, with solid growth and inflation grounded (albeit slightly higher than desired), the backdrop for equities remains good. This also implies that the strength in the US dollar has also potentially peaked, allowing for a better backdrop for commodities as well as emerging markets.

The Evolution of Artificial Intelligence

We believe the opportunities in AI are just beginning and there will be a myriad of companies that present compelling investments over the next three to five years. However, we also believe that - as in previous periods of excitement over new technologies - the extent of the AI capital expenditure cycle is fraught with both risk and reward.

‘This time it is different’ is perhaps one of the most costly mantras in investing, so we are careful to position the investment opportunity in AI. As a small reminder of the last major capex cycle, here is a chart from Bernstein that shows the fortunes of many of the capital expenditure winners of the 1999-2000 boom.

Peak Market Cap in Year 2000 and Date When Company Next Achieved that Market Cap (9 Largest Technology Stocks as of March 2000)

Source: Factset, CRSP, Bernstein analysis

Sun Microsystems was sold to Oracle in 2009 for $7 billion, having peaked at a market cap of $200 billion when server sales accelerated from 15% per annum to over 60% in the dotcom infrastructure buildout. The fibre build-out story was even more pronounced; $90 billion was spent often with debt financing to build fibre networks that were less than 3% utilised at the time. Even today, there are chunks of dark fibre still unused. Maybe this time it is different, but we vastly prefer companies that will use AI effectively – the balance of risk and reward is of paramount importance here in a balanced global equity context.

Prediction 3: AI will continue to be a major theme but the 2024 AI winners will not be the same in 2025. AI use cases will trump infrastructure build.

As AI inference starts to build revenue opportunity, we believe companies generating revenue or productivity benefits will outperform. This is highly asymmetric as, should these revenue beneficiaries fail to see material benefits, they will be quick to slow capex spending and thus the impact on the infrastructure names will be more impactful, supporting a diversified approach.

Trump 2.0 and DOGE

This factor is the most unknown for 2025. Trump’s own manifesto sought to focus on tax cuts, deregulation, spending, tariffs and immigration, a potentially volatile cocktail of measures that could have any number of unintended consequences. Therefore, we think the market will be highly sensitive to the details surrounding these plans as they emerge.

Trump has appointed Elon Musk and Vivek Ramaswamy, Silicon Valley icons, to manage the Department of Government efficiency (DOGE). Musk has thrown around huge trillion-dollar savings numbers that he thinks can be achieved. We are a lot less sure. There is no doubt that a dose of proven corporate management in government finances should be a good thing, but there are so many partisan factions to be conquered in Washington - things will likely prove hard to deliver.

It is a far cry from a founder of a super-voting status company where decision making is streamlined and effective to one where hundreds of congressmen and senators, each with their own agendas, have voting powers on many of the potentially planned measures. It will be messy, far from easy and is bound to lead to frustration and possibly a 2025 personality showdown between Musk and Trump. All this could create significant market volatility and is our black swan type factor to watch out for.

Prediction 4: Elon Musk and Vivek Ramaswamy deliver some sensible corporate governance into government, but the task of saving trillions is a distant goal, raising concerns over US debt/GDP levels. Tensions mount between the government and the DOGE, with this bubbling into tensions between Trump and Elon Musk.

This is yet another factor that, at the margin, may support some of our key investment themes below, including equity markets outside the US and gold. In addition, for emerging markets in particular, the level and breadth of new tariffs will be crucial and a potential source of upside should Trump's bark prove worse than his bite, with the threat of tariffs deployed more as a negotiating tactic.

Investment Implications for 2025

Taking the above key factors into account, we believe markets will remain robust this year but the opportunity set will differ from 2024. Two factors make the US slightly less straightforward than last year: increased volatility resulting from uncertainty over the exact path and timing of inflation and interest rates along with the early period of the new Trump regime as well as the concentration risk in the US market. Add in peak expectations on AI infrastructure, and we believe that 2025 will see a rotation into a broader range of US market opportunities as well as a better backdrop at the margin for equites in other geographies.

In the US, our key selection criteria revolve around finding companies that will utilise the newfound benefits of AI effectively as well as those companies set to benefit from Trump policies on tax cuts and spending priorities. We specifically reduce exposure to the AI infrastructure build cycle, as well as to mega cap names, and favour sectors like healthcare, industrials and fintech.

We remain positively disposed to stores of value in the form of crypto and gold, as well as commodities more generally. New regulation for crypto and the appointment of David Sachs as crypto tsar creates a world where sensible regulation essentially represents de-regulation and digitally based financial assets can flourish. Gold is a proven store of value and has benefited as many central banks seek to diversify their reserves away from the US dollar for a variety of reasons. Additional tailwinds could come from the emergence of any government policy uncertainty and if inflation proves more difficult to tame than expected.

Outside the US, Europe remains cheap by historical standards and also by reference to the US, but stock picking is still challenging when viewed through the lenses of disruption. We think, instead, Japan looks more interesting among developed markets. Japanese yen weakness eroded around half of returns in 2024 but if Fed cuts are more measured, the BOJ has a freer hand to hike. Banks are the clearest beneficiaries here, with additional market tailwinds from a positive IPO year in 2024 and a pick-up in M&A (both signs of general confidence in equities). The process of digitalisation is also significantly behind the rest of the western world so this provides exciting opportunities to benefit from the catch up.

Emerging markets are hotly debated. Our top pick remains India, which continues to enjoy strong economic growth, corporate earnings and stock market performance. India's economic outlook for 2025 is bolstered by macroeconomic stability, a reform-oriented government and rising consumption, positioning it to become the world's third-largest economy by 2027. Most importantly, India's destiny lies in its own control, with a domestically oriented economy that is relatively well-insulated from macro uncertainties, such as the path of US interest rates and the US dollar. Given uncertainties surrounding further trade frictions relating to Trump's threatened tariffs, India significantly represents a mere 2.5% of US imports.

India's corporate earnings are expected to grow by 15-20% annually for the foreseeable future, driven by domestic factors rather than global trade cycles. Overall, India is seen as a standout opportunity for structural growth with reduced correlation to global equities – a factor that adds further support to our positive stance. Any investment case that can diversify away the US rate, inflation and tariff risks should be represented in portfolios for 2025.

In Latin America, both Brazil and Mexico struggled in 2024, driven by delayed Fed cuts and then fiscal concerns in Brazil, the Presidential election and the Trump risk for Mexico. If the dollar starts to ease off highs then these markets could be interesting. For the wild card opportunity in 2025, however, we turn to China. This may take time to play out, but valuations are incredibly cheap and aggressive measures to stimulate the ailing economy are likely.

Overall for 2025, we retain a broadly index-based and positive view on the US but with broader exposure and best picks outside the US – Japan within developed markets and India as the prime emerging markets pick, with China as the wild card.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Equities team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term. Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.