The dream of fleets of autonomous vehicles (AVs) offering ride-hailing services, aka “robotaxis”, has been a topic of both technological fascination and business speculation for many years. At scale, this technology promises to be an innovation in the most classic Clayton Christensen mould: driving down the cost of personal transportation while also improving the quality of the travel experience. While early timelines for this technology have proven overly ambitious – Elon Musk infamously declared that Tesla would have one million robotaxis on the roads by 2020 – recent technological breakthroughs have shifted the conversation from “if” to “when”.

Many of us have already experienced partial automation and assisted driving features in modern vehicles, representing levels 1-2 on the 0 to 5 autonomy scale. Levels 3 and 4 offer automated driving without constant human supervision, while level 5 represents the grand prize of full automation. To achieve this, AVs employ sophisticated sensor technologies and AI 'brains' for decision-making, requiring extensive real-world and simulated training. As such, AVs represent a major application and opportunity for the significant advances we have seen in the AI space.

This technology promises substantial benefits, including enhanced travel experiences by allowing passengers to reclaim commuting time – as Elon Musk put it, "you could fall asleep and wake up at your destination". AVs can also improve road safety, operating without human limitations such as fatigue, impairment, or distractions from mobile phones. Moreover, collective AI learning means that when one vehicle encounters a new situation an entire fleet can benefit, continuously improving safety and performance.

Robotaxis, meanwhile, are set to revolutionise ride-hailing services, potentially reducing the need for personal vehicle ownership altogether. Without the limits of human drivers, they promise to improve area coverage, cut wait times, and importantly reduce transportation costs for consumers. Tesla’s robotaxis will reportedly charge as little as 30-40 cents per mile – much lower than the cost of an Uber ride, which averages $2 per mile in the US. A win for consumers, lower fares will also help grow the market, driving mileage and facilitating expansion beyond the initial concentration in urban areas.

Waymo – driving ahead

Robotaxis have already started rolling out on to streets around the world, with notable early-stage and pilot programs operating in the US, China, Singapore, and South Korea. Waymo, a subsidiary of Alphabet, leads the charge in the US, operating a fleet of several hundred sophisticated vehicles equipped with over 30 sensors – including cameras, radar, and lidar (light detection and ranging). The company offers a ride-hailing app but has also recently expanded a partnership with Uber to offer its services via the transport giant’s platform in select cities in 2025.

Waymo first offered fully autonomous rides in San Francisco in 2022 and has seen impressive growth as it has scaled. Weekly ride counts have doubled in the last few months alone to surpass 100,000, helped by fleet growth (from 250 at launch to around 800 today), operational expansion (now in four cities across the US), and making its previously limited app widely available. Other players such as General Motors' Cruise are also vying for market share, though Cruise faced a major setback in 2023 when an accident led to a temporary suspension of its services. Internationally, companies such as Baidu's Apollo Go in China are making significant strides, with a fleet of over 500 vehicles offering more than 75,000 rides per week in cities like Wuhan, highlighting the global nature of the robotaxi race.

Tesla – a different approach

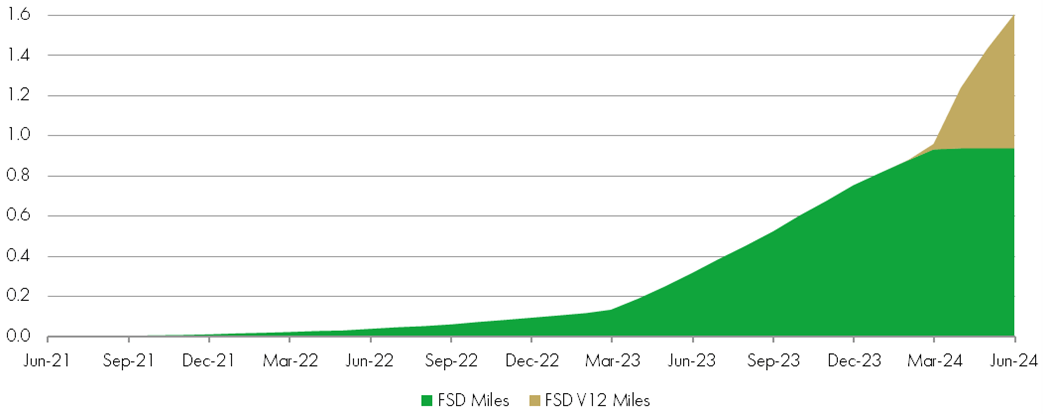

Tesla is taking a distinctly different approach. While competitors are typically geofenced to certain areas and rely on a combination of cameras, radar, and lidar for navigation, CEO Elon Musk has criticised this approach as both expensive and restrictive. Instead, Tesla focuses on purely camera-based vision systems powered by AI and massive computational resources, aiming to mimic human vision. This approach gives the company a huge competitive advantage thanks to its vast fleet of existing vehicles, kitted out with cameras facilitating extensive real-world data collection. Tesla has logged data from over 1.6 billion miles of travel using varying levels of autonomy across its userbase, far outpacing competitors like Waymo's 22 million rider miles as of September 2024. This data is processed by Tesla's Dojo super-computer, one of the most powerful in the world with the equivalent of 8000 Nvidia H100 GPUs, and is used to drive advancements in the company’s FSD software which is improving at an exponential rate.

Cumulative miles driven with FSD (Supervised, billions)

Source: Tesla 2Q24 earnings

Furthermore, Tesla’s high volume, low-cost production capacity – efficiently producing over two million vehicles per year – and ability to retrofit existing vehicles with the latest Full Self-Driving (FSD) technology paint a fundamentally different picture for the economics of robotaxi operation at scale. While Waymo vehicles cost around $175,000 per unit, largely due to expensive lidar systems, Tesla's vehicles will cost less than $30,000 each. Operating costs, currently about $3 per mile for existing AV operators, are also set to be undercut by Tesla, whose robotaxis are expected to cost as little as $0.20 per mile to run. This substantial reduction in both capital and operating costs bodes well for Tesla's competitive positioning and profitable growth in this burgeoning market, offsetting any downward pressure on fares likely to result from increased competition over time.

We got our first glimpse of Tesla’s entry into the robotaxi space at its "We Robot" event last week. The company showcasing its "CyberCab" alongside a larger 20-seater "RoboVan" and its Optimus humanoid robots. While the event was characteristically flashy, it left several questions unanswered, including what the long-term business model for its robotaxis might look like. However, we did get a timeline, with Musk suggesting CyberCabs would be rolling out some time in 2026. Tesla also plans to release its fully autonomous FSD software to existing Model 3 and Y owners in California and Texas as early as next year – a boon for Tesla owners, and an important step for the company in demonstrating its autonomous driving prowess at scale.

While Tesla's robotaxi business model remains unclear, it could potentially follow the path of other AV developers who are partnering with traditional rideshare platforms to scale their services. Uber's expanding collaboration with Waymo highlights the potential for AV developers to leverage the operational expertise and customer base of established rideshare companies. For Uber, these partnerships mitigate the risk of AVs becoming direct competitors, instead allowing AV fleets to complement existing services. For the likes of Waymo, partnering with established ride-hailing platforms can enhance vehicle utilisation rates and improve unit economics by offloading tasks such as vehicle maintenance, cleaning, and storage. For consumers, this should help improve ride availability while ensuring attractive pricing.

While partnerships between AV developers and ride-hailing platforms offer a promising path forward, the robotaxi space still faces several hurdles before achieving widespread adoption. Safety remains the most prominent challenge for AVs in general, with early studies showing promise but limited by small sample sizes and early-stage data. Convincing regulators, consumers, and insurers remains crucial. However, as technology improves and pilot programmes continue to roll out globally, these hurdles should diminish. Progress from both Waymo and Tesla bodes well for the industry, positioning robotaxis as one of the most exciting and potentially transformative innovations on the horizon.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.