Fresh from our journey, we have just returned from an extensive research trip across the United States, covering the key hubs of New York, Boston, and Silicon Valley. This trip has reinforced seven important points that we are keen to share with you:

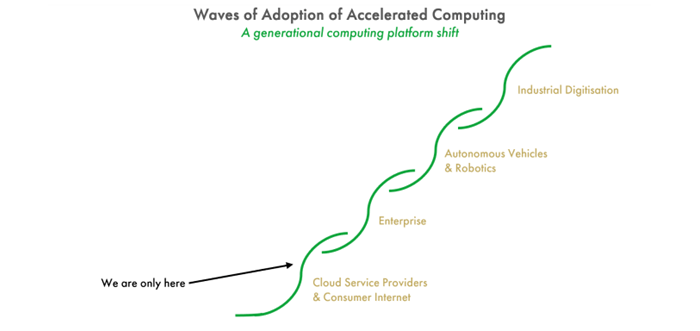

- We are at the beginning of a new technology cycle.

- The rate at which companies are adopting AI far exceeds the adoption speed of any previous General Purpose Technology (GPT).

- The new technology stack is built upon Nvidia’s compute platform.

- AI is set to drive a wave of productivity across all sectors, enabling companies to achieve ‘more with less’ and leading to more efficient resource allocation within organisations.

- In frontier organisations outside of technology companies, AI is already being adopted at unprecedented speed.

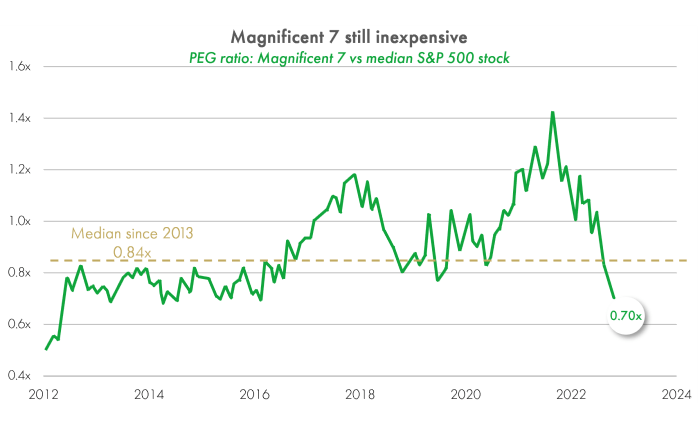

- The ‘Magnificent 7’ entered November with low valuations and continue to remain so. It’s important not to overlook the growth of the underlying businesses.

- There is a strong imperative to develop, train, and deploy your own domain-specific Large Language Model (LLM), and to operate these models on-premise.

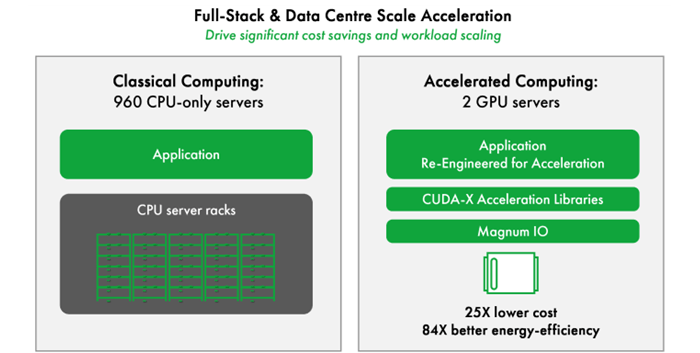

Heavy investment in accelerated computing is fueling a new technology cycle. This form of computing not only reduces the cost of computation but is also more energy efficient. The average return on investment for setting up a new Nvidia server is impressive, with a payback period of less than one year and a 500% return over four years. This is hardly surprising, considering Nvidia has reduced computing costs by over 90% - a classic example of a disruptive force that, due to a significant drop in cost, opens up new markets.

Chart source: Nvidia (2023)

Chat GPT reached 1 million users in just 5 days, whereas it took electricity nearly 46 years to reach 25% of the US population (source: OurWorldinData, Morgan Stanley Research & WSJ (2023)). The adoption rate of AI has greatly exceeded our initial expectations, largely due to the immediate productivity gains companies experience from the first day of deploying AI. For instance, a major US healthcare company collaborated with AMD to implement AI in its sales and market departments. This resulted in a 60% reduction in costs, including headcount, without any decline in output (Source: AMD 2023).

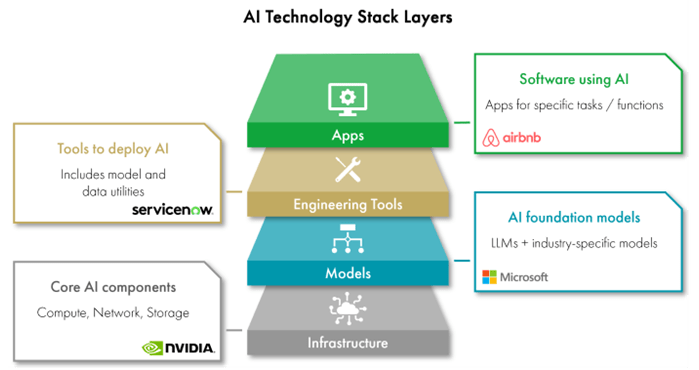

The new technology stack, which is spurring fresh investment across the tech sector, consists of a four- tiered structure with Nvidia’s chips and software forming the core of the infrastructure layer. Atop this infrastructure are the Large Language Models, with AI tools like Service Now layered over the LLMs. Finally, applications like Spotify and Uber reside at the top layer.

Chart source: Liontrust (2023)

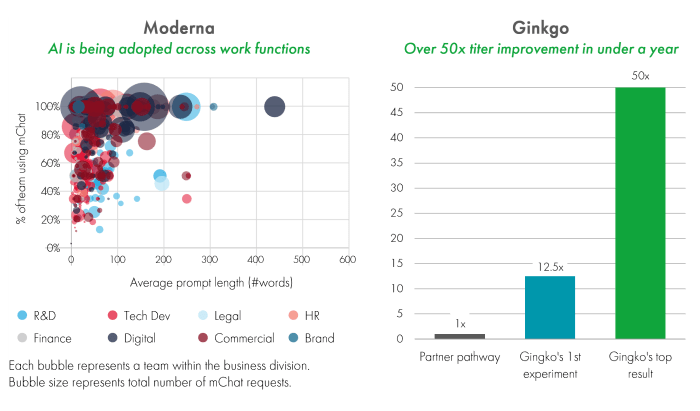

The pioneers in AI have gained a considerable head start, as these companies are riding a wave of increased productivity. The phrase ‘more for less’ will become more familiar as businesses integrate AI into various functions. This trend is reflected in recent reports, such as the ADP US employment report, which highlighted a weakening demand for labour alongside increased productivity. For instance, after discussions with Spotify last week, the company announced on Monday a further 17% reduction in their workforce, following enhanced productivity in key business divisions like software development and customer acquisition.

Our visit to ten life sciences and biotechnology companies in Boston confirmed this. Every company we met with is working with AI to enhance the efficiency of drug discovery, development and manufacturing, but are at varying stages. Again, digitally focused, data-centric frontier organisations are already adopting AI: Moderna was created as a digital platform using AI to develop MRNA medicines, and can now quickly scale up its capabilities as compute performance advances – the company has now added 1000 machine learning use cases and 1000 LLM use cases across every business unit. Meanwhile, the performance of the AI models of these early adopters is improving dramatically. Ginko Bioworks - the leading platform for synthetic biology and a new investment off the back of this trip - has been able to improve the output quality when producing biological products by a factor of 50x in under a year.

‘The Magnificent 7’ after facing challenges in 2022, are now at the forefront of this new technology cycle, it’s rare for leaders from a previous cycle to transition successfully into the next wave. Although its still early in this technological shift, at this stage, all seven appear well-positioned to capitalise on multiple growth drivers linked to AI. Just as the internet and web browsers significantly lowered the marginal cost of information sharing, AI looks set to reduce the costs associated with human thinking and reasoning, potentially leading to broad and transformative effects.

Chart source: Goldman Sachs (2023) PEG = PE to Growth

But, is there a need for every enterprise to have its own AI factory? The answer is yes, especially for those operating at scale. These enterprises will need to build, train, and deploy domain-specific Large Language Models (LLMs). Relaying on off-the-shelf solutions like Open AI’s Chat GPT can be prohibitively expensive and restrictive. For instance, Intuit explicitly mentioned that deploying Chat GPT LLM at scale for its 200 million+ customer base would be uneconomical. Companies with a vast repository of historical data and a large customer base have no choice but to develop, train, and deploy in-house LLMs. This necessity provides pioneers in this technology with a significant advantage over their competitors, as there is an ongoing arms race across industries to build in-house AI capabilities.

Sundar Pichai, CEO of Alphabet, yesterday encapsulated the current dynamics well:

Every technology shift is an opportunity to advance scientific discovery, accelerate human progress, and improve lives. I believe the transition we are seeing right now with AI will be the most profound in our lifetimes, far bigger than the shift to mobile or to the web before it. AI has the potential to create opportunities – from the everyday to the extraordinary – for people everywhere. It will bring new waves of innovation and economic progress and drive knowledge, learning, creativity and productivity on a scale we haven’t seen before (Sundar Pichai, CEO of Alphabet, 6/12/2023)

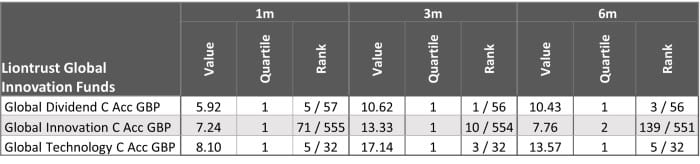

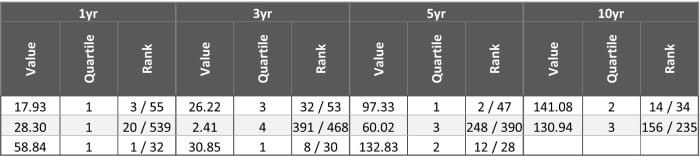

Even though we are at the beginning of a new technology shift, the performance of the funds over the longer term highlight the benefit of investing in innovative companies. Innovative companies compared to the market have better growth, higher quality business models, and have more resilient balance sheets so it is unsurprising that investing in these types of companies produce good outcomes for investors.

Source: FE Analytics as at 31st December 2023

Liontrust Global Dividend rankings against IA Global Equity Income Sector, Liontrust Global Innovation rankings against IA Global Sector and Liontrust Global Technology rankings against IA Technology & Telecommunications Sector

As we enter 2024, our innovators across the three funds are well-positioned to excel during new waves of innovation and economic progress across various industries. Not every innovation makes a great investment – to capture value for investors, it’s crucial to have strong barriers to competition and a management team capable of executing strategies during a rapid shift in technology, and we focus on investing in innovative companies with these key attributes.

To use a football analogy, we are only in the first five minutes of the game in this new technology cycle, the prospects for innovation have rarely ever been stronger and there are some exceptionally good investment opportunities.

Chart source: Nvidia Q3 2023

Discrete years' performance (%), to previous quarter-end

Source: FE Analytics as at 31.12.23

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice.