- The stock market has been selling off as the strong US economic recovery post-Covid looks like it may be running out of steam. The market is forcing the Fed to get on with it and cut rates

- The market is punishing recent winners as investors de-risk, including innovative companies

- The good news starts with the fact there is no reason to expect a deep recession as opposed to a slowdown or relatively mild recession

- And our innovative companies are fighting-fit given the major recession they faced in their part of the market in 2022 and have increased profitability and improved their businesses significantly

- They are in the early stages of very strong structural growth driven by AI and other major innovations – and are executing exceptionally well as demonstrated in the second quarter earnings season

- The market will soon shift its focus on initial de-risking to investing in companies that will absorb a slowdown/recession and rate cuts well and those with strong structural growth

- Our high-quality innovative companies are among the best positioned on these counts and an opportune moment to invest in them is arising

The stock market has been selling off recently because it looks like the US economy may have finally run out of steam following its strong recovery post-Covid. The extraordinary government support given to the economy during Covid and the immediate recovery is now fading and cumulative interest rate increases are also finally taking their toll.

The good news is there is no reason to expect a deep recession as opposed to a slowdown or relatively mild recession. There do not appear to be significant imbalances in the economy, which are the causes of deep recessions, and the Fed has a full arsenal with which to respond with the Fed funds rate sitting at 5.25-5.50%.

Indeed, you can think of the stock market right now as forcing the Fed to get on with it and cut rates, which it will likely do in abundance. High inflation is finally no longer a reason to maintain high rates. This week, the New York Fed released its latest estimate of underlying inflation, which was 2.06% compared with the Fed’s target of 2.0% (see chart 1).

Figure 1: New York Fed underlying inflation estimate and Fed target rate of inflation

Source: New York Federal Reserve and Bloomberg, 7.8.24. NY Fed underlying inflation estimate is Multivariate Core Trend of PCE Inflation.

Companies fit and battle hardened

We continue to focus on the fundamentals of our innovative companies, which are exceptionally strong. Many of our companies experienced a large recession in their part of the market in 2022 when interest rates sharply rose, got stuck into cutting costs and improving profitability then and are now in excellent shape and ready to win even if the overall economy gets tougher.

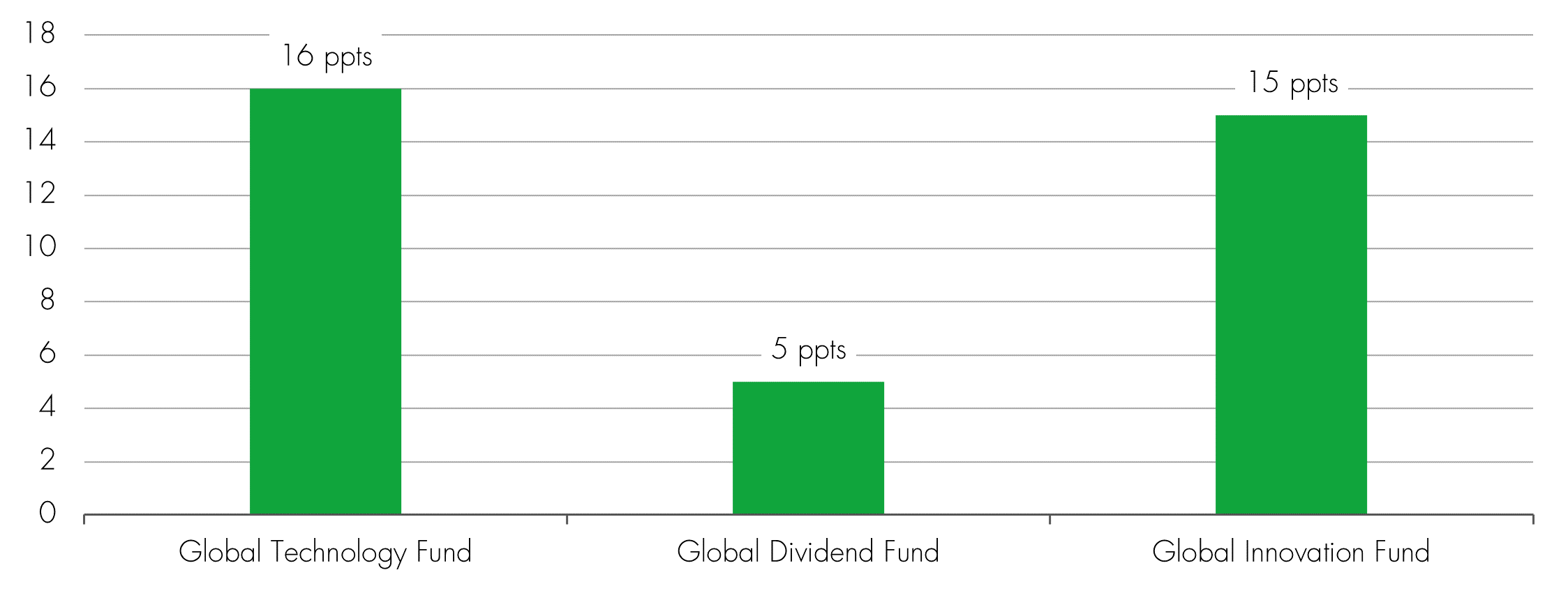

This can be seen in the stunning rise in operating margins of our companies. The average next 12 months expected operating margins for the companies we currently hold have increased relative to their respective averages for the past three years by 16 percentage points in the Global Technology Fund, five percentage points in the Global Dividend Fund and 15 percentage points in the Global Innovation Fund.

Figure 2: Increase in next 12 months operating margins relative to average of past 3 years (percentage points)

Source: Bloomberg, 7.8.24

For example, Palantir’s operating margin has increased from an average of -10% over the past three years to an expected 34% for the next 12 months as the company has achieved critical scale, expanding beyond its government business to build its commercial customer base from 14 customers four years ago to 300 today, and has taken the opportunity to pivot strongly to profitability.

This is exactly how to respond to a recession. If the overall economy does indeed get quite a bit tougher in the quarters ahead, our companies will be able to focus on winning market share and coming out even stronger.

Executing in the new innovation cycle

Moreover, our companies are in the early stages of a major new innovation cycle driven by AI – alongside other major innovations in healthcare such as GLP1s, industrial electrification and efficient power generation. This will drive structural growth in the years ahead. Let us be clear about AI in the next few paragraphs as there is much hype and much scepticism from different investors.

We firmly believe AI is what economists call a general purpose technology – which means a major innovation where the opportunities are everywhere. We believe it is the most significant general purpose technology since the roll-out of electricity over 100 years ago and just like electricity will be very profitable for the winners while very disruptive for the losers.

Appraising the second quarter earnings season so far, our companies continue to execute very well and allocate capital to position themselves as the winners of the next decade with respect to AI.

TSMC is the world’s AI foundry and essentially the only company in the world that can manufacture advanced AI chips at scale. Given demand is well in excess of supply, it is sold out until at least 2026. Constant innovation means that TSMC is maintaining its dominance and its two nanometre node technology that goes into production next year – which improves energy efficiency by 30% – will maintain its immense competitive advantage. It reported year-on-year sales growth of 40% for the second quarter, extremely impressive given it expected growth of 20% for 2024 only three months ago, and significantly raised guidance for 2024.

Constellation Energy has the largest nuclear energy fleet in the US and we are now seeing electricity demand break out after two decades of zero growth, driven by AI data center energy consumption, electric vehicles, reshoring of industry and the broader energy transition. As such, it is plugged into very strong secular growth ahead with more nuclear capacity than all other competitive generators combined. Owing to these drivers, it increased guidance for the year, now set to grow earnings by 27% this year.

Meta is already reaping the benefits of AI deployment at huge scale. Its AI investments for content recommendations on its social media platforms like Instagram and AI ad tools are driving direct AI revenues today. Second quarter revenues were up 23% with 10% growth in ad impressions and 10% growth in ad pricing. Over 50% of the content we see on Instagram is now recommended by AI, and advertisers using Meta’s AI advantage+ tools are seeing a 22% higher return on ad spend. We believe its investments in leading large language models in the form of Llama will create significant opportunities.

We are seeing powerful growth drivers for our companies during the current earnings season, and believe that winning in the hand-to-hand combat to which it will give rise will be a major determinant of the winners and losers in the stock market across most sectors in the years ahead.

Market is punishing recent winners

The market is currently punishing recent winners, including innovative companies. This is due to investors de-risking at the sight of a possible recession and selling what has gone up over the past year.

Alongside a much broader fall in the market, driven particularly by the weakening US consumer, the SOX semiconductor index, which is clearly overall positively exposed to innovation and AI, has fallen by 23% in US dollars since its peak on 10 July, having risen 62% in the prior 12 months and 136% since the start of 2023. The mega cap technology companies – generally well exposed to AI, although we believe stronger returns can likely ultimately be made in the current cycle investing more broadly in other companies – have fallen significantly since their peaks in early July as well, having performed well beforehand.

For example, Microsoft has fallen 15% from its early July peak having risen 38% over the prior 12 months, Amazon has fallen 20% from its early July peak having risen 54% in the prior 12 months and Alphabet (Google) has fallen 17% from its early July peak having risen 60% in the prior 12 months.

But note this prior stock performance has been underpinned by strong fundamental performance both in absolute terms and relative to the overall market. Over the past year, from mid-2023 to mid-2024, consensus expectations for 2024 earnings per share for five of the largest technology companies (Microsoft, Amazon, Alphabet, Nvidia and Meta) have risen by 38%, compared with 0% for the S&P500 overall and a 5% decline for the other 495 S&P500 companies.

These five companies, along with others who are generating growth in the new innovation cycle, are winning in the market because they are wining on the fundamentals. Their valuations are no longer at trough levels, but nor are they worryingly high either, far off previous peak multiples and underpinned by strong structural growth.

Quality footprint is key in a recession

Before long, this process of de-risking by selling deserved winners will come to an end and be replaced by investing in the companies that will:

- Absorb a potential recession and rate cuts well; and

- Win structurally in the years ahead

We have no doubt that our innovative companies have strong structural growth prospects over the years ahead in what we believe will be one of the most innovative eras in history. The key to winning during a recession, should one transpire, is simple – high quality.

This can be rigorously demonstrated using data from Cliff Asness, Andrea Frazzini and Lasse Pedersen’s (of AQR Asset Management and New York University) excellent study “Quality minus Junk”, published in the Review of Accounting Studies in 2019 (data available at Quality Minus Junk: Factors, Daily (aqr.com)).

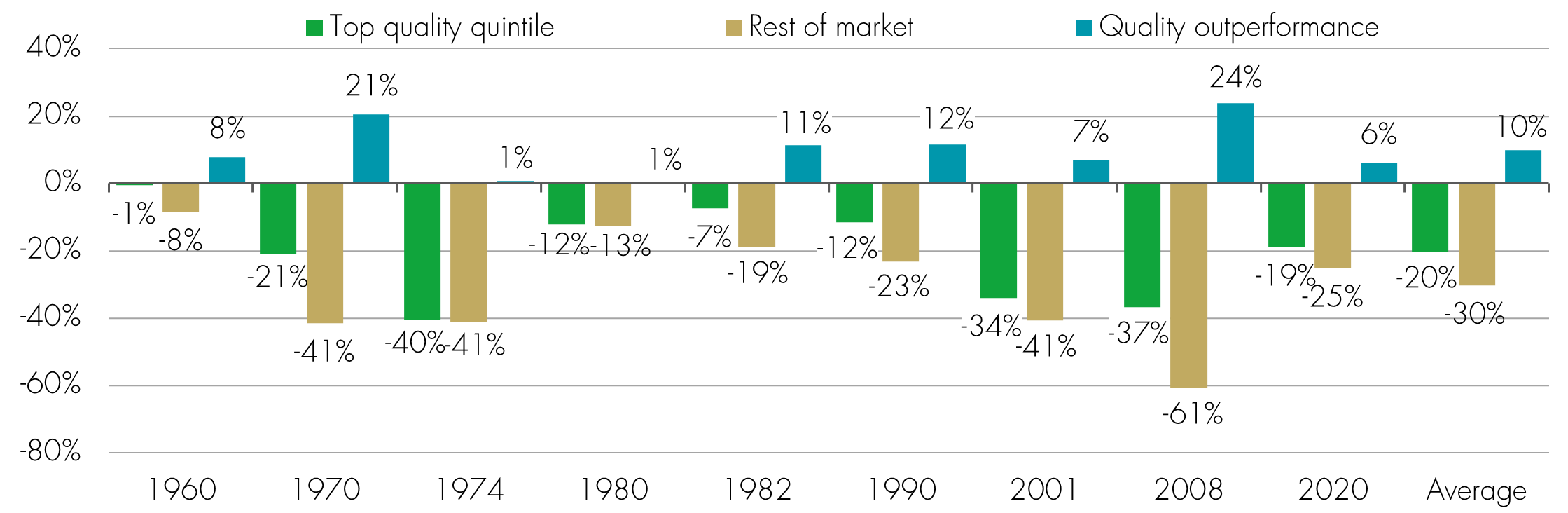

For the US in chart 3 below, we have taken the top quintile of the stock market by quality – in which quality is defined by Asness et al. using characteristics covering profitability, growth and financial strength – and compared its return against the rest of the market during each market drawdown associated with all US recessions since the 1960s.

Figure 3: % returns during US stock market drawdowns associated with US recessions since 1960

Source: AQR Asset Management (Quality Minus Junk: Factors, Daily (aqr.com)) and Liontrust calculations, 7.8.24

High-quality companies ultimately outperformed the rest of the market for eight of the 10 occasions and performed in-line during the other two, outperforming by 10% on average. While the initial phase of such a drawdown may consist of investors simply de-risking recent winners that may include high-quality companies, quality ultimately asserts itself.

The quality characteristics of our companies are very strong because innovation drives profitability, growth and financial strength.

The Liontrust Global Dividend Fund has a return on invested capital of 21% compared with its MSCI World Index benchmark of 11% and IA Global Equity Income sector average of 11%; three-year average sales growth of 17% compared with 16% for the benchmark and 15% for the sector; and net debt to EBITDA of 1.2x compared 2.0x for the benchmark and 2.2x for the sector.

The Liontrust Global Technology Fund has a return on invested capital of 18% compared with its MSCI World IT Index benchmark of 17% and IA Technology and Technology Innovation sector average of 12%; three-year average sales growth of 30% compared with 17% for the benchmark and 19% for the sector; and net debt to EBITDA of -2.1x (i.e. 2.1 times net cash) compared -0.2x for the benchmark and-0.4x for the sector.

The Liontrust Global Innovation Fund has a return on invested capital of 14% compared with its MSCI World ACWI Index benchmark of 11% and IA Technology and Technology Innovation sector average of 11%; three-year average sales growth of 32% compared with 18% for the benchmark and 16% for the sector; and net debt to EBITDA of -2.0x (i.e. 2.1 times net cash) compared 1.8x for the benchmark and 1.5x for the sector.

Conclusion

As the economy slows, high-quality innovative companies will have the added advantage that they are best equipped to deal with a tougher environment and can continue to achieve strong growth when there is less growth around. From a stock perspective, interest rate cuts will likely help too given innovative companies’ typically longer duration earnings than the overall market, just as unpriced interest rate hikes hurt on the way up.

While investors are currently punishing winners by de-risking and simply selling what has done well in recent months, high-quality innovation will be key as they invest in the best companies and those likely to be the structural winners over the years ahead.

As such, we expect our companies to lead the market recovery and we see an opportune moment arising to invest in them.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.