The Liontrust GF Sustainable Future US Growth Fund returned -0.6% in US dollar terms in Q4, compared with the 2.7% return from the MSCI USA Index (its comparator benchmark) and the 1.3% return from the IA North America reference sector.

This topped off a disappointing year for the portfolio, which although posted a positive return of 10.7%, lagged the MSCI USA Index by 13.9%. Since launch in July 2023, the portfolio has risen 24.0% compared to the MSCI USA Index of 36.4%, with the underperformance primarily stemming from 2024. In this note, we aim to provide some context for that.

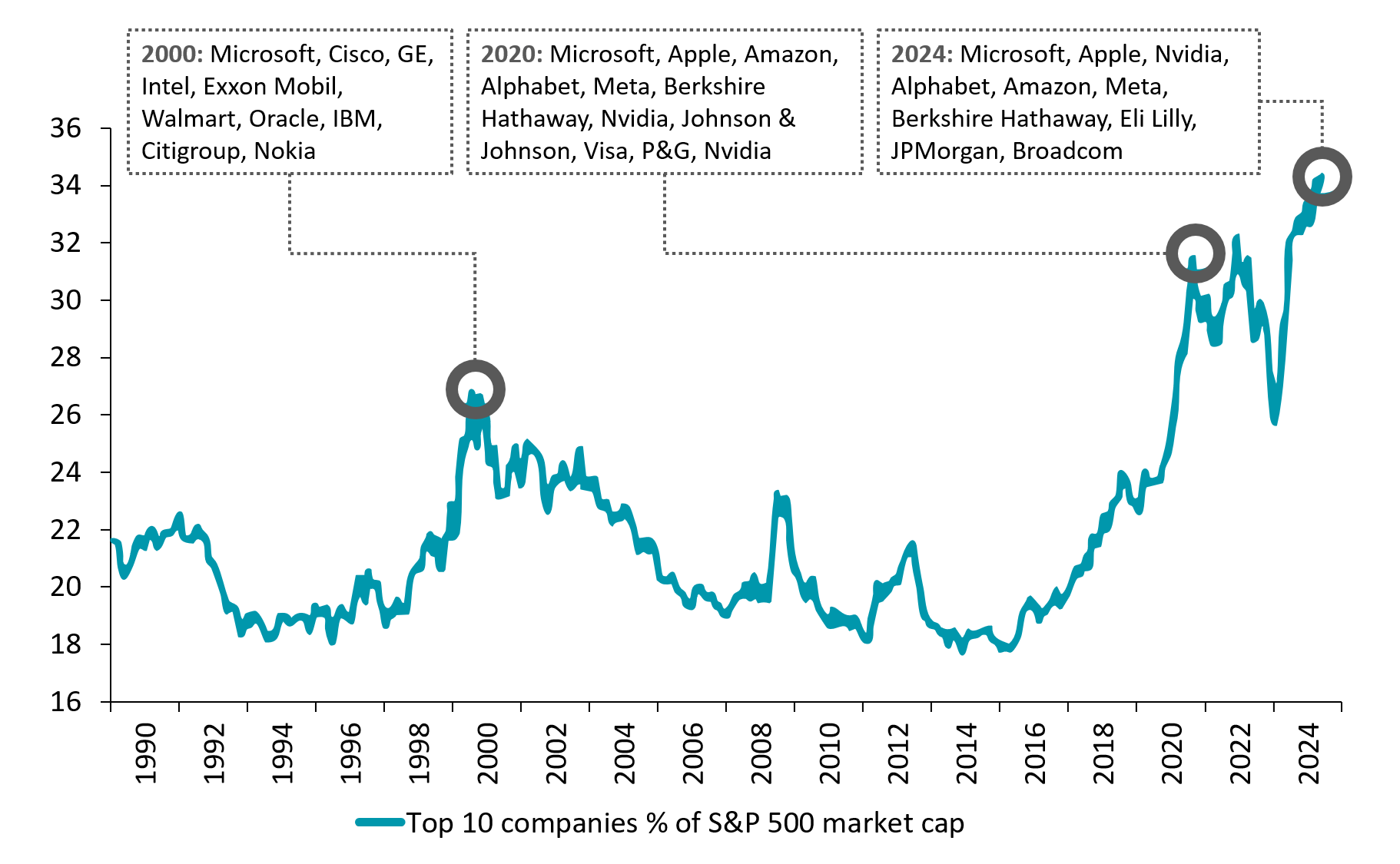

Benchmark returns in 2024 remained heavily concentrated in a few mega-cap names, resulting in one of the most concentrated periods in market history. The US market, which now represents c. 74% of the MSCI World1 (despite accounting for only c. 26% of global GDP2), saw significantly reduced breadth. Typically, about half of U.S. stocks outperform the S&P 500 in a given year, but this figure was less than one-third in both 2024 and 2023. Such limited market breadth has only occurred twice in the past 70 years: in 1998 and 1999, during the late-1990s tech bubble.

Record-low percentage of stocks outperforming the S&P 500 index

Source: The Kobessi Letter on X, 18.12.24; 2024 YTD data as at 12.10.24

More than half of the S&P 500’s approximate 25% return in 2024 was driven by just seven stocks − the "Magnificent 7" − of which we hold two: Microsoft and Alphabet. Remarkably, Nvidia alone contributed around 20% of the index’s total returns for the year and not owning this name was a major drag on relative performance. This has left the benchmark in a concentrated state – with the top ten holdings representing 37% of the entire index. One might suggest that the benchmark is now starting to resemble the concentration of an actively managed fund.

Top 10 stocks = record 37% of S&P 500

Source: BofA Global Investment Strategy, Bloomberg – The Kobessi Letter on X, 05.11.24

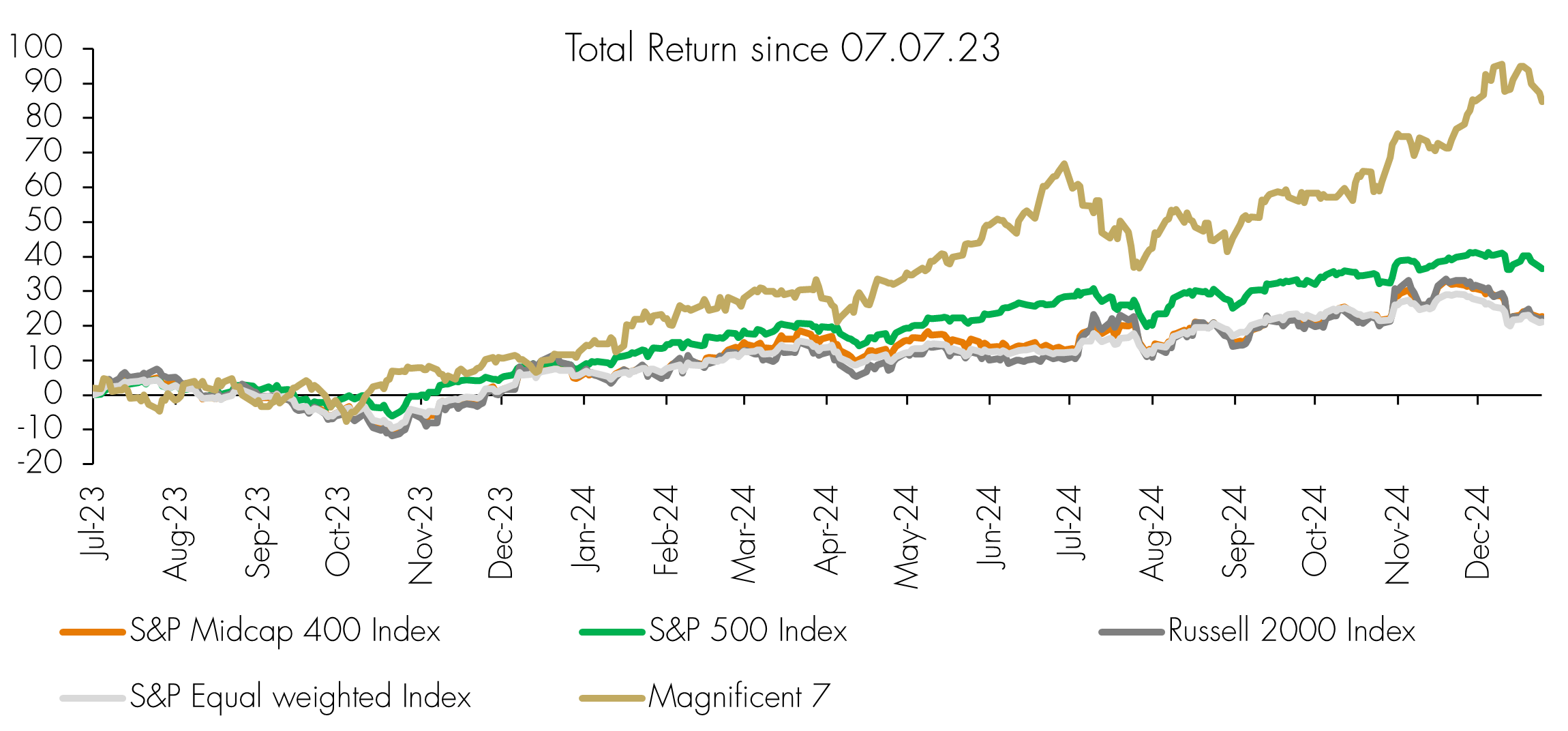

Our focus on sustainability and identifying companies exposed to structural growth trends, such as the global push for cleaner, healthier and safer solutions, naturally steers us away from mega-caps and towards a strong small- and mid-cap bias. This bias has clearly hurt the relative performance of the strategy of late, as the chart below shows.

Market dynamics since launch

Source: Liontrust, Bloomberg as at 31.12.24

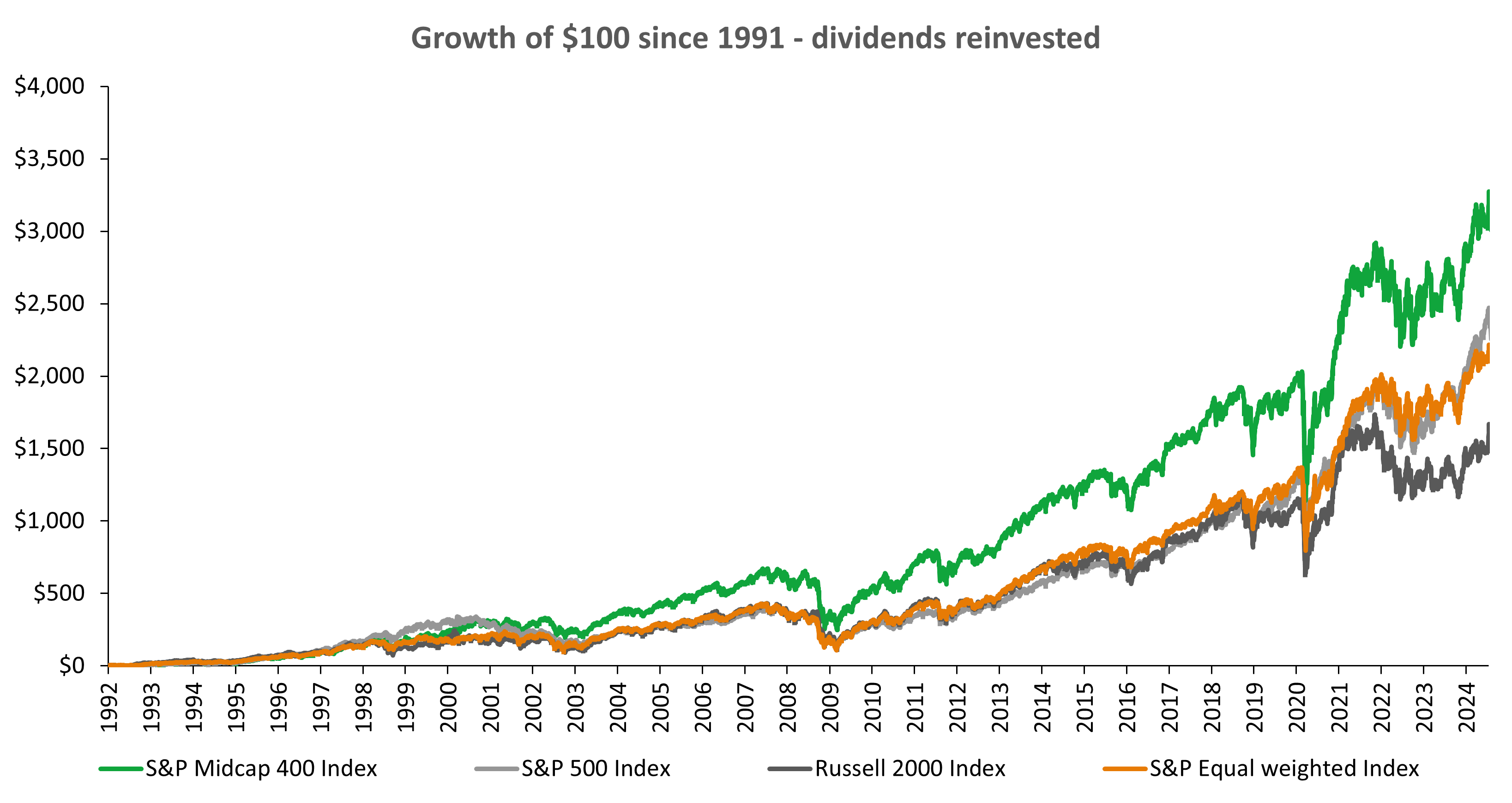

Over the long run, despite the stellar returns of the mega-caps, it is actually mid-caps that have compounded at the highest rate. While the success of the mega-caps has therefore been painful in recent years, we believe the portfolio is well positioned from here.

Over the long run, mid-caps have generated superior investment returns in the US

Source: Liontrust, Bloomberg as at 31.12.24

During the quarter, the top contributors included Alphabet (+14%), Visa (+15%) and Paylocity (+21%). All three reported strong earnings in the quarter and investors gained confidence in their ongoing structural growth opportunities.

The main detractors were TransMedics (-60%), American Tower Corporation (-20%) and Thermo Fisher Scientific (-16%).

We believe American Tower shares were negatively impacted by rising yields, which disproportionately affect the company partly due to its somewhat levered balance sheet. Regarding Thermo Fisher, the life-science industry continues to be in recovery mode following the post-pandemic issues with inventory, as well as ongoing weakness from China. Finally, TransMedics reported a disappointed quarter; growth appears to have stalled and investors are trying to ascertain whether this is a temporary or structural headwind. There was also a short-seller report released in January this year, with some strong accusations levelled at the company, which we are also working through.

For the full year, the main contributors to performance were Alphabet (+36%), Trane Technologies (+52%) and Trupanion (+58%). Alphabet continued to release promising updates to its suite of AI-related products and post impressive earnings results, dispelling the narrative of the company being an AI loser as the year progressed. Trane Technologies went from strength to strength, consistently surprising the market with the strength in demand for its energy efficient air-conditioners. Pet insurance company Trupanion had a tough start to the year, but discipline on pricing resulted in the company’s margins expanding impressively with a minimal impact on customer retention.

The largest detractors for the year were American Tower (-13%), TopBuild (-17%) and Verisign (+1%). Insulation installer TopBuild is sensitive to construction activity in the US and rising rates weighed on the shares. Verisign, which manages .com domains, struggled to return to volume growth after several strong years during the pandemic. There were also doubts about the contract renewal for .com but these proved to be unfounded.

Looking back on 2024, the main area of weakness for the portfolio was the semiconductor industry – we did not have sufficient exposure. During the year we worked hard to address this by adding three names: KLA Corporation, Broadcom and Monolothic Power Systems.

KLA Corporation we covered in our Q3 update and in Q4 we acquired positions in Broadcom and Monolothic Power Systems. Both companies are exposed to the theme of Improving the efficiency of energy use. Monolithic Power designs high efficiency power semiconductors that help to reduce electrical losses that occur when changing voltages from the energy source to the device. Broadcom is a leader in designing products to make the computing system more energy efficient through specialised AI accelerator chips, energy efficient networking equipment and virtualisation software.

Many end markets are at a cyclical low, such as chips that go into computers, mobile phone or automobiles. Companies linked to the boom in AI capex, however, have experienced an explosion in demand. All three businesses fit our themes well by improving the energy efficiency of the industry or by reducing waste. While each has some exposure to AI, they are also set to benefit from a broader recovery in the more cyclical end-markets, whenever that occurs.

|

|

Dec-24 |

|

Liontrust GF Sustainable Future US Growth B5 Acc USD |

10.7% |

|

MSCI USA |

24.6% |

*Source: FE Analytics, as at 31.12.24, primary share class (A5), in euros, total return, net of fees and income & interest reinvested. 10 years of discrete data is not available due to the launch date of the fund.

Notes:

1MSCI

2World Bank Group

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments

- All investments will be expected to conform to our social and environmental criteria.

- Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

- This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments.

- The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.