The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income above the FTSE All Share Index. November (+287bps) recovered most of the losses of October as markets rebounded, especially in areas most significantly impacted the prior month. Performance year-to-date (YTD) improved, taking total return to 3.48%, and maintaining modest outperformance vs the benchmark (+22bps). YTD the fund is in the second quartile of the IA UK Equity Income comparator group.

The top contributor to performance in November was luxury watch and jewellery retailer Watches of Switzerland Group (+38bps), after management delivered an ambitious and reassuring long range plan for the business at a time when the stock valuation implied significant risks of a breakdown in its relationship with key supplier Rolex (discussed in more detail in our 2024 outlook below). Having been the worst performer last month, Pets at Home (+38bps) rebounded after a first-half update where bad news was seemingly priced in and with the backdrop of a general recovery in consumer discretionary stocks. Finally, after being a highlight in our last newsletter, Admiral (+37bps) continued its strong performance in November as motor insurance policy pricing trends continued to outstrip cost inflation.

The biggest detractor from November’s performance was 4Imprint (-59bps). The shares fell over 10% on the day of its third quarter trading update despite delivering upgrades to consensus expectations, as management flagged increased macro uncertainty, a sell signal for this historically cyclical business. We believe the business has developed such a large pricing and service quality gap to its competition, while having fundamentally shifted its cost structure (more variable digital marketing versus historically fixed cost print), that its earnings should be less cyclical going forward. So while understanding concerns of other investors in the near term, we do see this as an overreaction.

Last month we flagged Rentokil as a negative detractor and while we are still unconvinced the soft third-quarter update which prompted the sell-off represents a thesis breaker, we see greater upside in other opportunities and have since exited what was a relatively small position (<1% of NAV).

Some thoughts as we turn the page on 2023…

It's that time of year again when the investment industry starts making predictions for the year ahead! You won't find too many of those in our outlook commentary – predicting the future is too hard for us. But we've attempted to answer some of the most common questions we get asked by clients about the prospects for markets and our portfolio. We hope you find it helpful.

Why should we invest in the UK market and what gets the market going?

In a year where the FTSE All-Share has so far underperformed the MSCI World by c.15ppts, one question we are often (and understandably) asked is what might be the catalyst to get the UK market going? We invariably (and unhelpfully) respond with 'we don’t know'. Whether it is next year's general election, pension reforms, footballing success at Euro 2024, inflation moving back into the pack versus other countries or (as is most likely) some other unforeseen macro event, we do believe that when a catalyst does emerge the UK market could have a lot of running room.

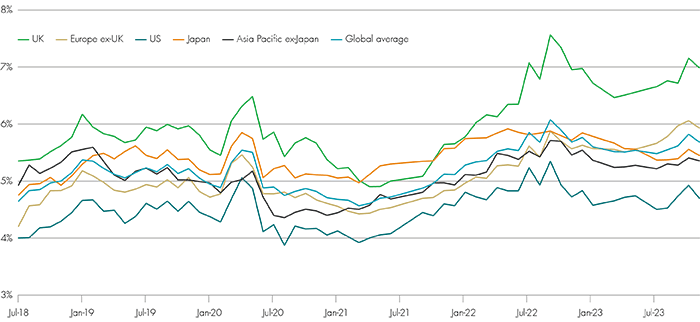

To illustrate this, we present below data from CG Quest® which looks at the implied cost of capital of various global equity indices. Calculated via a bottom-up, company specific, discounted cash flow model methodology, we consider this a more insightful measure of value, than say a simple price to earnings (P/E) multiple, as it considers both 'quality' and 'growth' of the underlying companies. The data shows the UK trading at a historically wide c.22% cost of capital premium compared to the global average.

We don’t know when this valuation discount ends and the trend reverses, but we do believe that investing in stocks at a discount, many of which are businesses with globally-sourced earnings, shifts the odds of attractive total future returns further in our favour. From lower starting valuations, two attractive pathways for future returns are possible. We will control what we can by reinvesting dividends to compound the portfolio NAV at attractive rates of return. Meanwhile, of course, the possibility of accelerated returns remains intact, should the UK market at some stage in the future mean revert to more fundamentally justified levels.

Share price implied cost of capital

Why is an income strategy interesting when I can earn 5% on cash at the bank?

For the first time in over a decade we have a situation where dividend strategies face greater competition from cash and bonds, often considered lower risk assets. Competition for capital has indeed increased, with interest rates and bond yields rising to levels above the current c.4.2% dividend yield offered by the FTSE All-Share. Although the dividend yield is lower, we would emphasise that investors in equities also have the benefit of potential dividend growth for their total return. As at the end of November our portfolio offered a prospective 3-year forward dividend compound annual growth rate (CAGR) of c.7%, for instance.

We won’t try to predict the landscape going forward; whether we will have a soft landing or inflation might keep rates higher for longer. However, we would observe that the shape of the bond yield curve suggests the largest gains in bond yields have already occurred and that rates for cash and bonds are likely to fall from current levels. So, it's quite possible that investors will start seeing declining returns from cash. Moreover, data from JP Morgan shows that historically dividend strategies have had a directionally positive correlation (0.34) to falling bond yields.

Simply put, we see limited potential for growth in cash yields going forward compared to solid potential for dividend growth from our portfolio; and we see the expected fall in bond yields, implied by the market, as likely to support dividend strategies.

What is your macro outlook for the year ahead?

Making calls on macro-economic trends is not our specialism. We prefer to appraise our investments across a range of potential upside and downside scenarios and to assess the risk-reward based on this. Some investors might ask how, without strong opinions on the macro, we get comfortable investing in companies that operate within a broader economy and whose earnings are likely to be at least somewhat tethered to such trends?

Psychologically, we think it pays to have a bias towards cautious optimism. Despite what 'in the moment' often feels like chaos and uncertainty, history shows that things usually work themselves out and equity markets reward long investors with strong returns. That's not to say, however, we are blasé. Hope for the best but be prepared for the worst. This is where the Competitive Powers framework we apply to all our investments really helps.

Powers are strategic traits (there are seven types) that underpin the potential for a company to generate persistently attractive returns. They have dual attributes – benefits to the company, manifest through pricing power or lower costs; and, barriers to competitors, who would ordinarily attempt to arbitrage away supernormal financial returns (for further discussion see here). The outcome is that a company with power(s) can make money in a competitive or macro environment in which its peers without power make no money at all. This is key. Our portfolio is comprised of high quality, resilient companies who have no reason to fear a tough economic outlook, for they should emerge from chaos competitively stronger. This is reflected in the choices you will see in our portfolio.

For instance, rather than having big positions in housebuilders, which we see as essentially leveraged calls on the direction of mortgage rates, we choose to play the cycle through a company such as Howden, the UK's leading kitchen manufacturer. It benefits from competitive powers of Scale (twice the size of its closest peer) and Switching Costs (builders recommend Howden due to quality, ease of installation and price confidentiality) and it wins market share, protecting volumes, on a consistent basis.

Rather than making a call on the UK consumer confidence by owning an optically cheaper electricals retailer, for instance, we have deployed our capital in higher quality, higher margin retailers such as Dunelm (powers: Scale, Process Power) or Pets at Home (powers: Scale, Switching Costs) which have more resilient demand drivers and financial models.

We feel 'ok' owning commodity producers such as Rio Tinto or AkerBP, despite having limited conviction on the direction of iron ore or oil prices, because these companies have high-quality, low-cost assets that sit in the bottom quartile of the cost curve (power: Cornered Resource) and so will generate cashflow in even low-price environments while supply readjusts.

Which stocks are you most excited about for the year ahead?

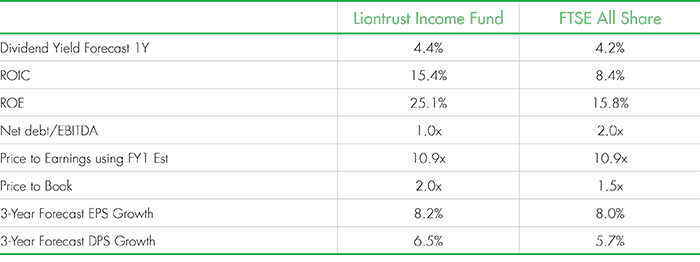

We feel good about the portfolio, which trades on the same P/E multiple as the FTSE ASX (c.10.9x) while offering a slight dividend yield premium (c.4.5% vs. c.4.2%), superior dividend growth (3-yr forward CAGR c.6.5% vs. c.5.7%) and notably higher ROIC (c.15.3% vs. c.8.4%).

Source: Factset; Bloomberg. Data as at 30th November 2023

That said… over a 12-month horizon we know that price multiples, or movements in valuation, tend to be the primary driver of share price returns. Over the longer term, earnings growth becomes the most important thing. With this in mind, we highlight a few stocks from the portfolio that trade on what we consider to be fundamentally low valuations relative to the quality of the business, and so could 're-rate', but which also have potential to deliver meaningful earnings growth over the longer term.

Kitwave is a UK-focused delivered food wholesaler with specialisms in: i) servicing small accounts (via its hub and spoke network); ii) frozen and chilled (from its refrigerated fleet). These niches mean it isn't competing against the big beasts in the industry, limiting competition, and gives it pricing power over customers who rely on its service. It trades on a P/E multiple of c.8.8x and dividend yield of c.4.5% which seems at odds with the 56% 5-yr EPS CAGR it has delivered (2018-23e) at an incremental ROIC of 56%.

IG Group is another stock trading on a single digit P/E multiple (FY24e: c.7.0x). It operates equity, foreign exchange and commodity derivative trading platforms across multiple regions. The shares find themselves out of favour as trading volumes and commissions have been impacted by generally soft global markets, absence of volatility and a squeeze on consumer discretionary budgets. That said, the company remains highly profitable, expected to still print net profit margins of 35% this year, and has delivered a 5 and 10-yr EPS CAGR of c.33% and c.12% respectively. Management targets c.10% growth over the mid-term, which should be achievable as market volumes improve.

Watches of Switzerland Group (WOSG) has de-rated materially over the past year to a P/E multiple of c.11.7x (FY24e), despite its stellar growth track record. Investors grew concerned after its key supplier Rolex acquired one of WOSG's luxury watch retail competitors Bucherer. Rolex has stated Bucherer will be run at arms' length, with the acquisition driven by founder succession issues at a historically symbolic Swiss company, rather than a strategic pivot towards a direct-to-consumer model. Our view is that Rolex is increasingly consolidating its route to market among a smaller number of key retail partners, of which WOSG remains its largest. WOSG recently outlined a 5-year strategic plan to double its revenues and profits over the next five years. Significantly, the plan has been shared with Rolex who said WOSG should 'assume their support'. Moreover, Rolex's actions are speaking louder than words – WOSG has just received its biggest ever allocation of watches from Rolex and been made a key global partner as part of its new Certified Pre-Owned program. The relationship appears to us to be becoming more, not less, embedded and symbiotic.

Thank you and all the best for 2024!

Fund performance year-to-date has been satisfactory in a challenging market. We are, though, focused on the more substantial opportunity that exists to grow our investors' wealth and dividend income over the long-term (and indeed our own, as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk adjusted returns. As ever, we thank you for your interest and continued support. Here's to a healthy and prosperous year ahead.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. The level of income is not guaranteed.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice.