The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income above the FTSE All Share Index. September (+28bps) was a subdued month as rising sovereign bond yields around the world saw choppy equity markets. Performance year-to-date (YTD) has been satisfactory on an absolute basis, delivering a total return of 4.54%, and relative to our benchmark (+22bps). YTD the fund is in the second quartile of the IA UK Equity Income comparator group.

The top contributor to performance in September was Computacenter (+37bps), the global provider of IT equipment and managed services, which reported strong results. Shell (+23bps) also performed strongly as oil prices climbed towards $100/bbl.

The biggest detractor from September’s performance was Kitwave (-38bps) which, absent any news flow, continued to drift lower following a strong run. Homewares retailer Dunelm (-37bps) saw some pressure after its results, although with no material changes to estimates and the company demonstrating ongoing market outperformance, we remain sanguine. Other notable detractors were Ashtead (-34bps) with the market rotating out of construction exposed stocks as interest rates rise and Pets at Home (-37bps), as discussed in more detail in our company profile below.

Dividend paying companies with Competitive Power: Pets at Home

Year-to-date Pets at Home (PETS) has delivered a total return of c.20.7%, although our holding has made a neutral contribution to fund performance (-2bps) given the poor timing of our purchases.

We are a truly nation of animal lovers. Various estimates suggest a population of c.10-12 million ogs plus a similar number of cats in the UK. That's c.20-25 million pets in the context of around 28 million households (although some families will own multiple pets). And pets truly rule their roosts – a recent survey into consumer spending intentions suggested people would prioritise spending on their pets over groceries, holidays, exercise, health and wellness, and even products for their babies and children! The 'humanisation' of pets is real…

PETS is the market leader in the £7.2 billion UK pet care industry. It is a business our animal-loving readers may be familiar with (hopefully as happy customers). For those less familiar, PETS operates a unique integrated pet care model with co-located retail (457 stores), vet practices and grooming salons, plus a well-established online offer. This creates a platform to meet all of a pet owner's needs and, we believe, a superior operating model which both single vertical specialists and generalist retailers dabbling in pet products would struggle to recreate. It enables cross-sell opportunities across the businesses, increasing PETS’ share of customer wallet and driving loyalty.

A remarkable c.7.7 million customers are signed up to its VIP loyalty scheme, which provides a rich pool of data with which to manage the business. Its offer is resonating with customers, with market share having increased from 18% in FY17a to 24% in FY23a. Better still c.35-40% of all new pets in the UK are being signed up to its Puppy & Kitten Club scheme.

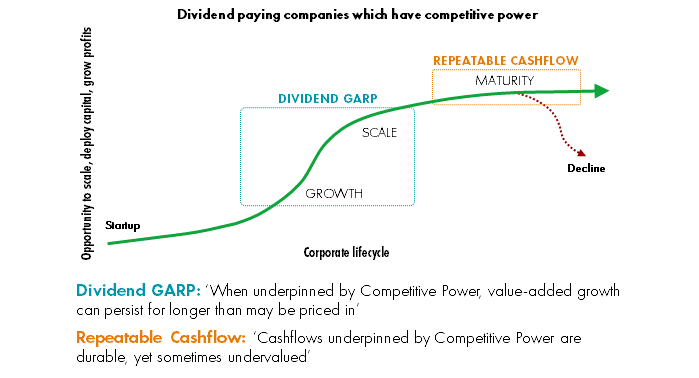

Our investment philosophy is that ‘quality dividend investing works best’ and we apply a systematic framework to understand and identify quality. In our view PETS is a competitively advantaged market share winner operating in an attractive, structurally growing market. It demonstrates the five building blocks we look for across our portfolio holdings.

- It generates strong returns on invested capital (ROIC), achieving c.23% in FY23a (post-tax, leases capitalised), a number which has pleasingly trended higher over recent years. These returns create distributable cashflows for reinvestment into organic growth opportunities - PETS has achieved a 5 and 10-year EPS compound annual growth rate (CAGR) of c.11% and c.13%, respectively, alongside shareholder returns.

- As dividend-focused investors we want clean, cash generative financial models. PETS reports very straightforward accounts with few adjustments to earnings. Free cash flow to net profit conversion has been c.90-95% over recent years.

- PETS operates with a prudent balance sheet, with a net cash position of c.£55 million at FY23a. Treating capitalised leases as debt (a can of worms for another time!) its IFRS 16 net debt / EBITDA ratio is a conservative c.1.5x. It has no pension deficit to service or material provisions booked.

- Pet care is a fundamentally attractive underlying market. Spend tends to be resilient, growing c.5% over the 2008-09 recession against a UK economy which shrank by c.-3.5%. The UK pet population has typically grown by c.1-2% per annum, but saw a >10% boost during the Covid pandemic as working habits changed. Cats and dogs have life expectancy of c.10-15 years and owners generally spend more as their pets get older, for instance on more complex veterinary procedures or advanced nutrition. For PETS this means once it has won a customer it tends to translate to predictable, annuity-like revenue streams.

- Pet care is a fundamentally attractive underlying market. Spend tends to be resilient, growing c.5% over the 2008-09 recession against a UK economy which shrank by c.-3.5%. The UK pet population has typically grown by c.1-2% per annum, but saw a >10% boost during the Covid pandemic as working habits changed. Cats and dogs have life expectancy of c.10-15 years and owners generally spend more as their pets get older, for instance on more complex veterinary procedures or advanced nutrition. For PETS this means once it has won a customer it tends to translate to predictable, annuity-like revenue streams.

The future is the only thing that matters in investing and, as with all our investments, we apply a Competitive Powers framework to ensure we are comfortable that Pets At Home's superior financial performance can sustain over time. As a reminder, Powers are strategic traits that underpin potential for a company to generate persistently attractive returns. They have dual attributes –benefits to the company, manifest through pricing power or lower costs; and barriers to competitors, who would ordinarily attempt to arbitrage away supernormal financial returns (for further discussion see here). We believe PETS has two of the seven Competitive Powers – Switching Costs and Scale Economies, which we think will underpin its continued profitable growth.

- Scale Economies: PETS retail business is c.10x bigger than its nearest specialist competitors. This gives it significant purchasing power with suppliers and has enabled it to launch own-brands, which account for c.30% of food and c.50% of accessory sales. These come with c.15% higher margins than branded goods while being c.25-30% cheaper for customers. This scale is shared with the consumer – a recent pricing study by Jefferies found PETS pricing to be on average c.3% cheaper vs. online competitors and >10% cheaper than brick-and-mortar-based peers. Other benefits of scale are its ability to amortise investment costs (e.g. in its new app) across the biggest pool of customers, or to run national (including TV) brand marketing campaigns. All this makes PETS a difficult business for smaller players or new entrants to compete against.

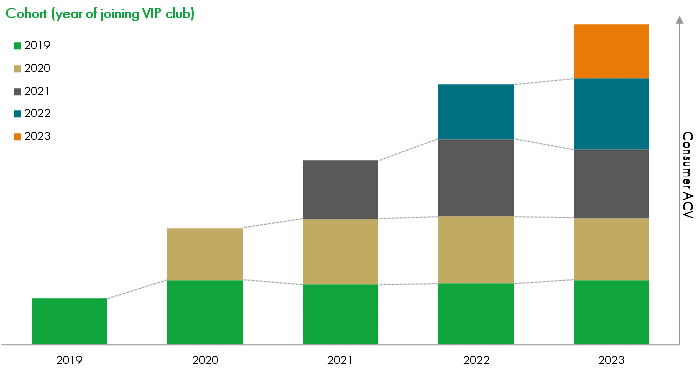

- Switching Costs: PETS unique pet care platform – a blend of products, services and advice, connected across both physical stores and digital channels – makes it attractive to customers and is allowing it to win more than its fair share of new pet owners. Once won, switching by veterinary customers is relatively unusual. Similar to a human switching their doctor, the loss of a personal, trusted relationship and friction involved in transferring medical records creates stickiness. On top of this, PETS has c.1.6 million customers signed up to recurring subscriptions, a number which is continuing to grow. All this translates to exceptional levels of customer loyalty. The cohort chart below, taken from a recent company presentation, illustrates this clearly with customers spending more in years three and beyond than in year one.

The stock sold-off during September on reports the UK Competition and Markets Authority (CMA) had initiated a market review into the UK veterinary sector. For context, PETS' Vet Group segment accounts for c.34% of total profit. The CMA has noted private equity owned vehicles have been consolidating the industry in recent years – independent practices accounted for 89% of the UK veterinary industry in 2013, which fell to approximately 45% by 2021. Its focus appears to be on pricing and price transparency; and the potential conflict of interest in vets referring customers to providers owned by the same group, for services such as diagnostics tests and specialist hospital treatments. It is expected to report its findings in early 2024. While remaining mindful, our sense is that PETS is not in the CMA's crosshairs. On pricing, we note a recent study by Liberum showing PETS pricing for vet services is amongst the cheapest in the industry, whereas the large private equity owned practices were at the upper end. And the issue of diagnostics seems less relevant to PETS given it primarily offers first opinion services, with diagnostics and more complex hospital treatments referred outside the group on an arm's length basis. For these reasons we have been prepared to disagree with the market in the face of a falling stock price, maintaining our holding at prior levels.

PETS offers a prospective dividend yield of 4.1% (FY1-2e) and we believe its Competitive Powers, aligned with attractive market structure, will allow it to continue delivering double-digit growth in earnings, cashflow and dividends over the medium term, consistent with management targets. The stock trades on a blended forward P/E of 14.7x (FY1-2e) vs. its own 5-yr average of c.19x and is on a prospective FCF yield of 6.3%. Should the stock hold its current multiple, which is undemanding given its defensive growth and returns profile, we see a prospective annualised shareholder return in the 'mid-high teens'. Any re-rating to historical levels could accelerate returns.

Fund performance year-to-date has been satisfactory. We are, though, focused on the more substantial opportunity that exists to grow our investors' wealth and dividend income over the long-term (and indeed our own, as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk adjusted returns. As ever, we thank you for your interest and continued support.

Discrete performance

|

To previous quarter 12 months ending (%) |

Sep-23 |

Sep-22 |

Sep-21 |

Sep-20 |

Sep-19 |

|

Liontrust Income C Acc GBP |

14.1 |

-2.9 |

20.7 |

-12.1 |

5.0 |

|

FTSE All Share |

13.8 |

-4.0 |

27.9 |

-16.6 |

2.7 |

|

IA UK Equity Income |

13.6 |

-8.5 |

32.7 |

-17.2 |

-0.2 |

|

Quartile |

2 |

1 |

4 |

1 |

1 |

Source: FE Analytics, as at 30.09.23. Liontrust Income Fund, primary share class performance, C Accumulation GBP, total return (net of fees, interest/income reinvested) versus FTSE All-Share and IA UK Equity Income comparator benchmarks. Quartiles and rankings, as at 30.09.23, generated on 09.10.23.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Fundamental Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term. Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Fundamental Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.