The Liontrust Income Fund returned -1.2%1 in August. The FTSE All-Share Index comparator benchmark returned -2.5% and the average return in the IA UK Equity Income sector, also a comparator benchmark, was -1.7%.

The Liontrust Income Fund seeks to offer attractive total returns to its investors while delivering dividend income to investors above the FTSE All Share Index.

August (-122bps) was a tougher month as markets generally drifted lower. Performance year-to-date (YTD) has been pleasing on an absolute basis, delivering a total return of 4.47%, and relative to our benchmark (+180bps). YTD, the Fund remains in the top quartile of the IA UK Equity Income comparator group.

The main trading activity in August was to initiate a position at c.3% of NAV in Convatec – the UK-listed medtech company. Its core businesses focus on Woundcare, Ostomy, and Infusion Devices – attractive, predictable underlying markets supported by demographic tailwinds. While this is a new position in the Liontrust Income Fund, we have invested in Convatec elsewhere within the Global Fundamental Team and met with management regularly for several years. We have been increasingly impressed with the improvement in both organic growth and margins brought about under the current management team. At the end of July, the YTD relative underperformance of Convatec vs. peer Smith & Nephew had reached c.17%, and c.13% vs the FTSE All-Share, despite what we considered strong operational performance. Given our knowledge of Convatec, its management, and its markets, we felt comfortable building a position swiftly, an example of how we like to have quality dividend paying stocks ‘on the bench’, waiting to be substituted into the portfolio.

The top contributor to performance in July was Admiral (+64bps) which defied very low expectations, shown by a short interest at c.35 days to cover, for its 1H23 results, closely followed by 4Imprint (+53bps) which opened the month with stellar results delivering material earnings upgrades. Our newest position Convatec (+17bps) also contributed positively, roughly matched by Bank of Georgia (+16bps) which rose strongly on continuing upgrades.

The biggest detractor from August’s performance was luxury watch retailer Watches of Switzerland (-56bps, WOSG). We wrote confidently about our conviction in WOSG in our last newsletter after the shares were our largest positive contributor in July – the irony of this is not lost on us and it’s a reminder that markets can swiftly humble. The shares fell materially in late August on news that Rolex, its largest supplier, would be acquiring Bucherer, arguably the co-leader in luxury watch retailing alongside WOSG. Our belief has been that a symbiotic, mutually beneficial relationship exists between WOSG and the luxury watch brands, who trust it to market their products responsibly. Until now Rolex has had no presence in retail itself. Rolex has stated the acquisition of Bucherer is to resolve succession issues at a long-standing, trusted Swiss partner; it will be run independently and at arm's length; and the acquisition will not impact relationships with its existing retail partners. We continue to monitor the situation, but observe ongoing commitments being made by Rolex to WOSG, such as partnering with it for its recently launched Certified Pre-Owned scheme. Time will tell but trading on c.11x FY24e price to earnings (P/E), we believe significant long-term impairment of the growth story at WOSG is already in the price and we have left our holding unchanged. Other notable detractors were Kitwave (-32bps) which drifted lower following a strong run, Anglo American (-30bps) which largely followed the fate of the other miners on China concerns, and MAN Group (-30bps), which had a second successive weaker month of performance on the important AHL funds.

Dividend paying companies with Competitive Power: Admiral

Year-to-date our holding in Admiral has delivered a total return of 19.2% and made a strong positive contribution to fund performance (+79bps). Admiral is a well-known brand in UK motor insurance and is the #1 by market share, but it also writes business in UK household, travel, and pet insurance. Admiral has small motor insurance businesses in Europe and the US under a variety of brands and a blossoming UK loans business which has synergies with the core UK motor business.

Our investment philosophy is that 'quality dividend investing works best' and we apply a systematic framework to understand and identify quality. Admiral demonstrates all the building blocks of quality we look for across our portfolio holdings.

- It has delivered high return on equity (ROE) through the cycle, capturing market share at above average margins, and doing so in a capital-lite manner due to favourable reinsurance agreements. It's UK motor ROE is somewhat cyclical but has averaged c.50% since 2013.

- As dividend focused investors, cashflow matters most. This can be a blurry metric in the world of insurance given the importance of releases from prior year reserves to the profit and loss account. Evidence of its attractive financial model though has been its ability to pay out >90% of adjusted EPS over many years while maintaining strong leverage and capital adequacy ratios.

- Admiral’s balance sheet is robust. Admiral is able to achieve high ROE due to its superior underwriting and reinsurance agreements (more on this below), rather than levering up its balance sheet. From an investment portfolio perspective, Admiral invests its float in lower risk/return assets than peers, preferring to focus on its core expertise of high-quality underwriting to drive shareholder returns.

- There are some favourable traits to Admiral’s market – demand for its key product is mandated by law. However, there are low barriers to entry and plenty of competition from established players and newcomers, leading to poor industry-level returns. What we like, however, is that the variance in returns is very high, and the reasons for the variance persist. As the high-quality player, Admiral can make a tough market work for it, consistently growing share at higher margins than its peers.

- Finally, we hold management in high regard. The founders created a unique culture of information sharing and operational excellence, underpinned by share ownership even down to the entry-level staff. While they are no longer executives, we see the present C-suite as upholding the values and rituals that helped make Admiral the quality business it is today, witnessing it firsthand on a recent visit to the Cardiff HQ.

Admiral has been the winner in a tough market for a long time and shareholders have been rewarded with a 5yr/10yr TSR CAGR of 9.9%/14.4%, well in excess of the competition and the UK market. However, the future is the only thing that matters in investing and, as with all our investments, we apply a Competitive Powers framework to assess whether Admiral’s superior financial performance can sustain over time. As a reminder, Powers are strategic traits that underpin potential for a company to generate persistently attractive returns. They have dual attributes – benefits to the company, manifest through pricing power or lower costs; and barriers to competitors, who would ordinarily attempt to arbitrage away supernormal financial returns (for further discussion see here). We believe Admiral has three of the seven Competitive Powers – Process, Scale Economics, and Cornered Resource – which, in combination, should underpin continued market share gains.

Process

The rarest power – intuitively this can be understood as the business having intangible traits which would prevent the competition from replicating its success, even if it had all the component parts available to them. This manifests in Admiral's consistent ability to deliver superior underwriting metrics. Its process is differentiated by a unique culture of connectivity, collaboration and unprompted sharing of best practice; underpinned by long employee tenure (often >20yrs) across business divisions and key functions. Share ownership and share-based bonuses at all levels help to maintain this culture.

Scale Economics

More data is valuable in the pricing of risk, helping to calibrate predictive models. Admiral has the most extensive claims book in the UK insurance market. But what is done with it (Process) elevates this power further at Admiral. Scale also brings down the average cost of claims resolution through bargaining power with garages and even insourcing otherwise expensive legal functions. This is shown by industry-leading loss and expense ratios over the very long term.

Concerned Resource

The high profitability and relative predictability of Admiral’s underwriting grants it unique access to very favourable reinsurance agreements with its long-standing partner Munich Re and other third parties. These allow Admiral to materially lower its risk and capital exposures, while retaining most of the profit upside, greatly enhancing returns. The competition cannot access these agreements on similar terms due to their weaker underwriting performance, which provides Admiral with a key and sustainable advantage.

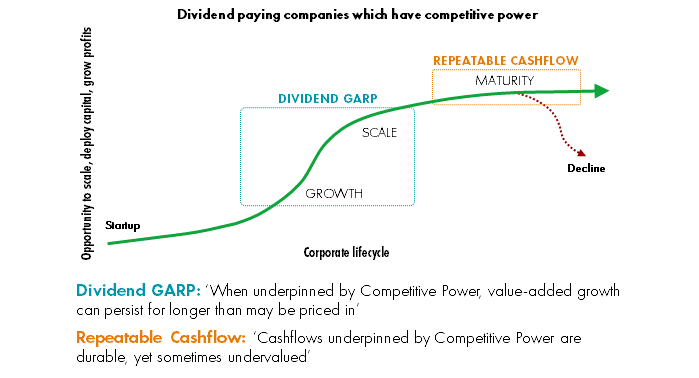

Admiral sits within the Repeatable Cashflow portion of portfolio. With this silo we focus on more mature companies, directing a greater proportion of their cashflows to dividends. Our investment hypothesis with this group of stocks is that 'cashflows underpinned by Competitive Power are durable, yet sometimes undervalued’. A high yield (or ‘cheap’ valuation) is an implicit expression by ‘the market’ of scepticism around the sustainability and/or growth potential of that cashflow stream. Often this scepticism is appropriate; sometimes it is not. Our job is to find companies, such as Admiral, trading on attractive dividend yields, with better prospects than are currently ‘priced-in'. Because of the very high returns on equity delivered by Admiral’s underwriting, it can afford to pay out c.90% of adjusted earnings, maintain balance sheet ratios and still deliver mid-high single digit earnings growth through the cycle.

Notwithstanding Admiral’s pleasing share price performance, we continue to see scope for attractive returns. Admiral offers a prospective dividend yield of c.5.3% (FY24e) at what we see as a cyclical trough in its motor profitability cycle. We take a longer-term view on valuation at what we think is the cycle-low with mounting evidence to support this view, most importantly from industry pricing that is now tracking well ahead of claims inflation. The stock trades at c.18x FY24 PE which is reasonable for a business with a targeted 20-40% ROE, a track record in excess of this, as well as room to grow earnings. We think the higher end of that ROE target could be met or beaten in a more favourable UK motor underwriting environment and should action be taken on the heavily return-diluting US business, which management seem to be looking to address.

Fund performance year-to-date has been pleasing. We are, though, focused on the more substantial opportunity that exists to grow our investors' wealth and dividend income over the long-term (and indeed our own, as substantial investors in the strategy). We remain confident that our process, identifying dividend paying companies with Competitive Powers, gives us a framework to capture superior risk adjusted returns. As ever, we thank you for your interest and continued support.

Discrete performance

|

To previous quarter 12 months ending (%) |

Jun-23 |

Jun-22 |

Jun-21 |

Jun-20 |

Jun-19 |

|

Liontrust Income C Acc |

9.5 |

0.7 |

19.0 |

-13.1 |

6.5 |

|

FTSE All Share |

7.9 |

1.6 |

21.5 |

-13.0 |

0.6 |

|

IA UK Equity Income |

4.3 |

-0.3 |

25.4 |

-13.6 |

-2.5 |

|

Quartile |

1 |

2 |

4 |

2 |

1 |

Source: FE Analytics, as at 30.06.23. Liontrust Income Fund, primary share class performance, C Accumulation GBP, total return (net of fees, interest/income reinvested) versus FTSE All-Share and IA UK Equity Income comparator benchmarks. Quartiles and rankings, as at 30.06.23, generated on 06.07.23

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments. The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. International banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. The level of income is not guaranteed.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.