The reputation of water companies has taken a beating in recent years due to poor environmental performance and historic underinvestment in the aging infrastructure. Despite the urgent need for water companies to upgrade their Victoria-era resources, it’s perhaps no wonder that investors are reluctant to support through investment.

Since privatisation, substantial dividends have been paid out by water companies. The combination of these dividends as well as pressure from the industry regulator Ofwat to keep bills low over the past few decades has exacerbated the issue of underinvestment. It also means bill increases are now landing at a time when consumer budgets are challenged.

While a significant amount of spending is necessary given the state and age of the infrastructure in the UK, consumers are understandably sceptical about whether increased bills will deliver the promised improvements, especially in the context of the cost of living crisis.

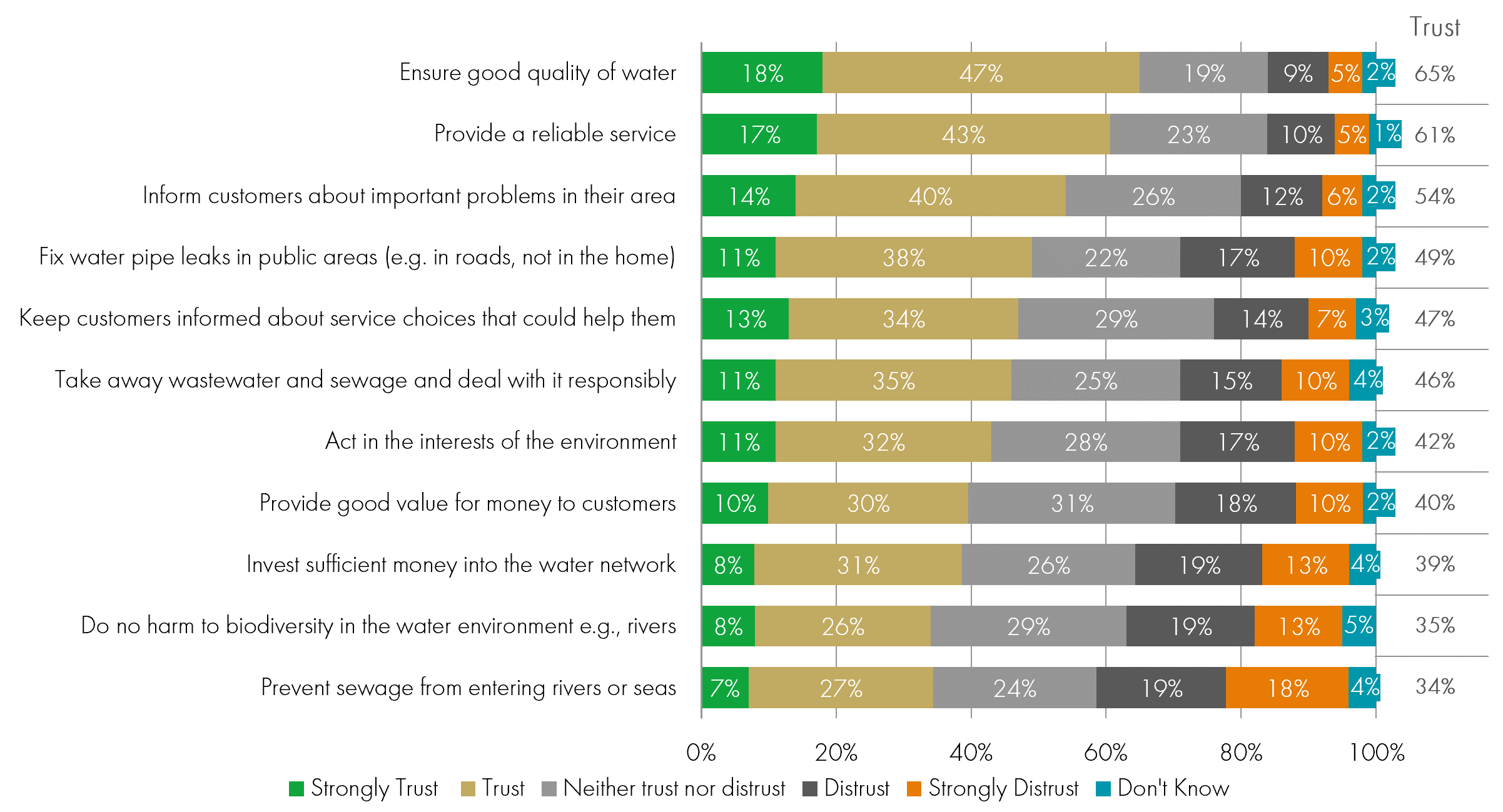

Attracting investment is also becoming difficult. Markets are crowded as utility companies look to raise money for the sustainable transition. Investors are looking at water companies elsewhere in Europe and America, where the allowed returns are higher and public perception is better. The table below also shows how trust in water companies is falling among the public.

Trust in water companies’ ability

Figure 1: Source: Ofwat, February 2023

The table above shows that while most consumers believe there is decent service and water quality, trust has fallen over sewer inflows and insufficient investment in the aging network.

The water utilities sector needs to focus on improving its environmental performance before expecting public perception to improve. We want to see deliverable plans for the next five years. Companies must ensure that supply chains are healthy and set up to deal with increased capital expenditure. Improvements must be affordable to the consumer, especially considering the tougher economic backdrop. Balancing long-term needs with immediate affordability is crucial. The most vulnerable customers need support as well, and we would support a national scheme that standardises measures across different companies and increases accessibility.

Engagement with water utility companies within the Sustainable Future range

With this in mind, we met with each of our UK water utility holdings across the Sustainable Future fixed income and managed funds, following our initial engagement exercise with them in 2022. This time around, we focused on assessing their plans for the next regulatory period and further out, and how credible hitting their targets would be.

Severn Trent remains one of the top performers from our perspective. It described to us its work worldwide with both water and non-water companies to determine best practice for its operations, and how it shares this with peers at home. The company has invested a lot into obtaining the correct expertise for each of the issues it faces. The company’s ambitions extend to emissions as well, developing the world’s first carbon neutral wastewater hub which is to be operational this year.

Anglian Water, with middle of the table environmental performance, mentioned it was in the process of revoking overflow permits for allowed combined sewer overflow (CSO) usage, which it will do as it creates additional capacity to render storm overflows permanently inactive. This is to show commitment to its zero spillages target, with the plan prioritising sensitive sites, like a Special Site of Scientific Interest or chalk stream. Efforts such as these, eliminating the legal ability to use overflows altogether, and beyond what the regulators are calling for, can be the first steps to restoring credibility in the sector.

Yorkshire Water informed us of its nature first initiative which means it looks at these solutions first before any other. These can be cheaper and more environmentally friendly, and the company is currently working on building them up to use on a larger scale.

Executive pay has been at the forefront of media attention. We challenge businesses we are invested in to make stronger links between environmental performance and pay throughout the organisation, as we believe this creates the right incentives for better operational performance. Incentives for executives need to be aligned with consumer needs, especially around an essential right like access to water, and we will continue to encourage and monitor this.

Are things getting better?

The sector will invest a record £96 billion in the next regulatory period, with goals on improving both pollution incidents and increasing water resilience. Improvements have already started, with monitoring of overflows in England and Wales now at a level that will capture nearly every discharge. Companies can now use vast amounts of data to better target the worst CSOs first. While we are encouraged by the step change in the plans to address these issues, there are still a huge amount of investment and operational improvements to be implemented before we see meaningful change.

Water utility assets have existed for 125 years and there has been chronic underinvestment during this time. While there have been failures in every stage of the ownership cycle, the responsibility lies with current owners and the regulators to define and action a clear pathway to improvements. As investors to these companies, we believe there is a route to better outcomes. We believe in the benefits the sector can provide as a job creator and driver of economic growth, alongside facilitating the sustainable transition while upgrading our water infrastructure for the benefit of all stakeholders.

Deepesh Marwaha, Investment Analyst, Sustainable Investment Fixed Income team

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Sustainable Future Team:

Are expected to conform to our social and environmental criteria. May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Future Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.