Pieran Maru, Investment Manager in the Liontrust Global Equities team

It was 31 October 2008 when an individual or group using the pseudonym ‘Satoshi Nakamoto’ published a white paper, proposing a new peer-to-peer network electronic cash system with no trusted party. This has grown in popularity and become a mainstream name – Bitcoin. Although never fully taking off as an alternative electronic cash system to fiat currencies, it has been likened to digital gold due to its store of value and scarcity.

What is Bitcoin?

Bitcoin is a decentralised cryptocurrency where transactions are verified on a peer-to-peer network. These transactions are recorded on a block, which are linked together to form a ledger known as a blockchain. Bitcoin specifically uses the Proof of Work (PoW) consensus mechanism for nodes to agree on the state and validate transactions. PoW is a computationally and power intensive process, with an algorithm rewarding participants’ Bitcoin for solving cryptographic puzzles to validate transactions and create new blocks, a process conducted by miners and known as mining.

Halving

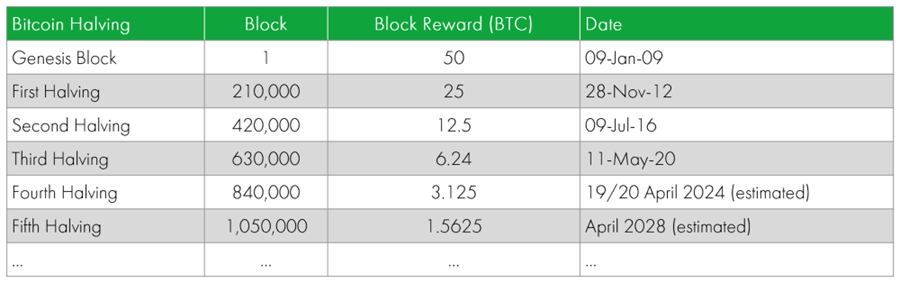

One of the unique aspects of Bitcoin is the halving mechanism, which is designed to regulate the supply. Originally, each block reward for miners were 50 bitcoins. However, every 210,000 blocks (approximately every four years), a halving event occurs whereby miners’ issuance rewards are halved. Block 840,000, expected to be on 19 or 20 April 2024 will see the fourth halving event in the history of Bitcoin. Miners who successfully verify and add a block will see their rewards decrease from 6.25 bitcoins to 3.125, reducing new BTC issuance from roughly 900 to 450 per day. This potentially could lead to an increase in the price of Bitcoin, if the demand remains constant or increases, while the rate of supply slows.

With approximately 32 halving events, block rewards are expected to end in the year 2140, when all 21 million bitcoins would have been mined. From that point forward, miners will earn solely through transaction fees. It’s important to note that although Bitcoin has a cap of 21 million, the actual number is less, with current estimates indicating that over 10% of the supply is already inaccessible due to lost or forgotten keys.

What direct impact will the halving have on miners? Miners could potentially see their revenue halve while their operational costs remain the same. To counter this, mining companies have been pushing efficiencies to stay ahead and reducing their debt, aided by historically high revenues. Furthermore, increased activity on the blockchain has added a revenue stream that accounts for around 10% of total miner revenues. Some miners are also expanding to diversify into other areas, such as allocating a portion of their computing power for AI.

What’s next?

From being a niche digital currency to a defined asset class, with approximately one in five Americans owning crypto, the future appears bright. Bitcoin has experienced a surge in retail and institutional activity following the announcement by the US Securities and Exchange Commission (SEC) in January approving the long-awaited Bitcoin ETFs (exchange traded funds). To date, the total fund assets in these ETFs has reached $56.2B, representing about 4.4% of Bitcoin supply.

Although the crypto scene can sometimes resemble the wild west, particularly with high-profile scandals, progress is being made in establishing a regulatory framework for crypto. A prime example is the recent Markets in Crypto-Assets Regulation (MiCA) in the EU, which came into force in June 2023 and is expected to be fully applied by the end of 2024.

Overall, while still in its early stages, it is clear crypto is becoming an increasingly significant part of our world. Bitcoin, as the pioneer, has inspired the creation of new blockchains that are more scalable and have added utility, such as decentralised apps and smart contracts. Despite this, Bitcoin's dominance continues to hold as the original truly decentralised blockchain.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend any fund is held long term (minimum period of 5 years). We recommend that you hold funds as part of a diversified portfolio of investments.

All Liontrust Funds carry some degree of risk which may have an adverse effect on the future value of your investment. Therefore, before making an investment decision, you should familiarise yourself with the different types of specific risks associated with the investment portfolio of each of our Funds. There is no certainty the investment objectives of the portfolios or strategies mentioned in this document will actually be achieved and no warranty or representation is given, whether express or implied, to this effect.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This document is issued by Liontrust Fund Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518165) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of any Funds or services mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy.

The document contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.