Reasons to be cheerful

The news in 2023 was dominated by reports of wars, lack of progress at COP 28 climate talks, biodiversity loss, democracy under threat – all topics that could lead one to have a dismal view of future prospects. On the SF team though, we think it is important to look behind the headlines and counter this bleak view of the future. While it is not all rosy, we highlight some areas where, perhaps surprisingly, things have been getting significantly better.

Air pollution – Remember the 2008 Olympics in Beijing? Athletes complained of choking air pollution. We wrote about it under the headline ‘Airpocalypse Now’. Sulphur dioxide and particulate pollution reached multiples of the safe limits set by the World Health Organisation. 14 years later and there has been a 55% reduction in air pollution between 2013, when it was at its worst, and 2020. This has improved life expectancy in the city by an estimated 4.6 years[1].This progress has also been seen globally, with death rates from air pollution estimated to have halved since 1990.

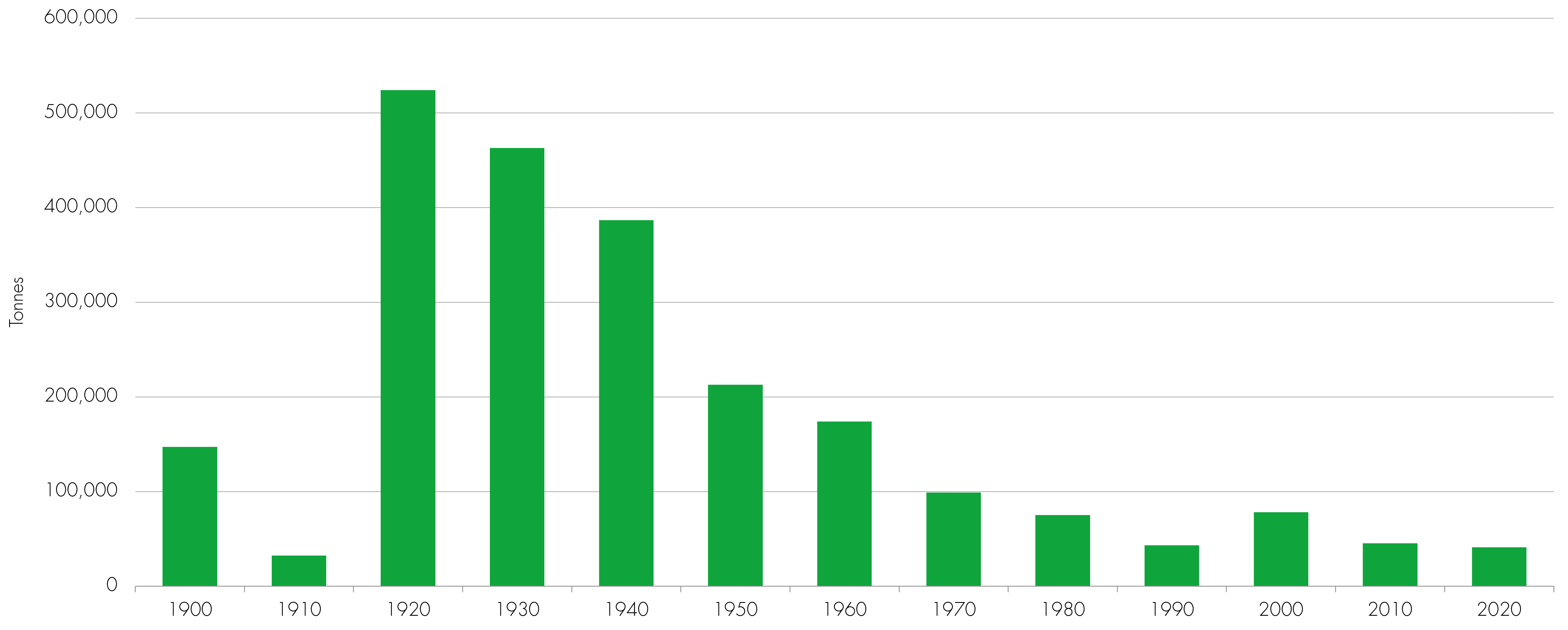

Natural disasters – Earthquakes, tsunamis, storms and floods make for dramatic news. But again perhaps surprisingly, the number of global deaths from natural disasters has halved in absolute terms over the last hundred years. This is in spite of the global population quadrupling in that time. We have become much more resilient to these natural events.

Decadal average: Annual number of deaths from disasters

Source: EM-DAT, CRED, 2023. Decadal figures are measured as the annual average over the subsequent ten-year period. This means figures for ‘1900’ represent the average from 1900 to 1909; ‘1910’ is the average from 1910 to 1919 etc. Data includes disasters recorded up to September 2023.

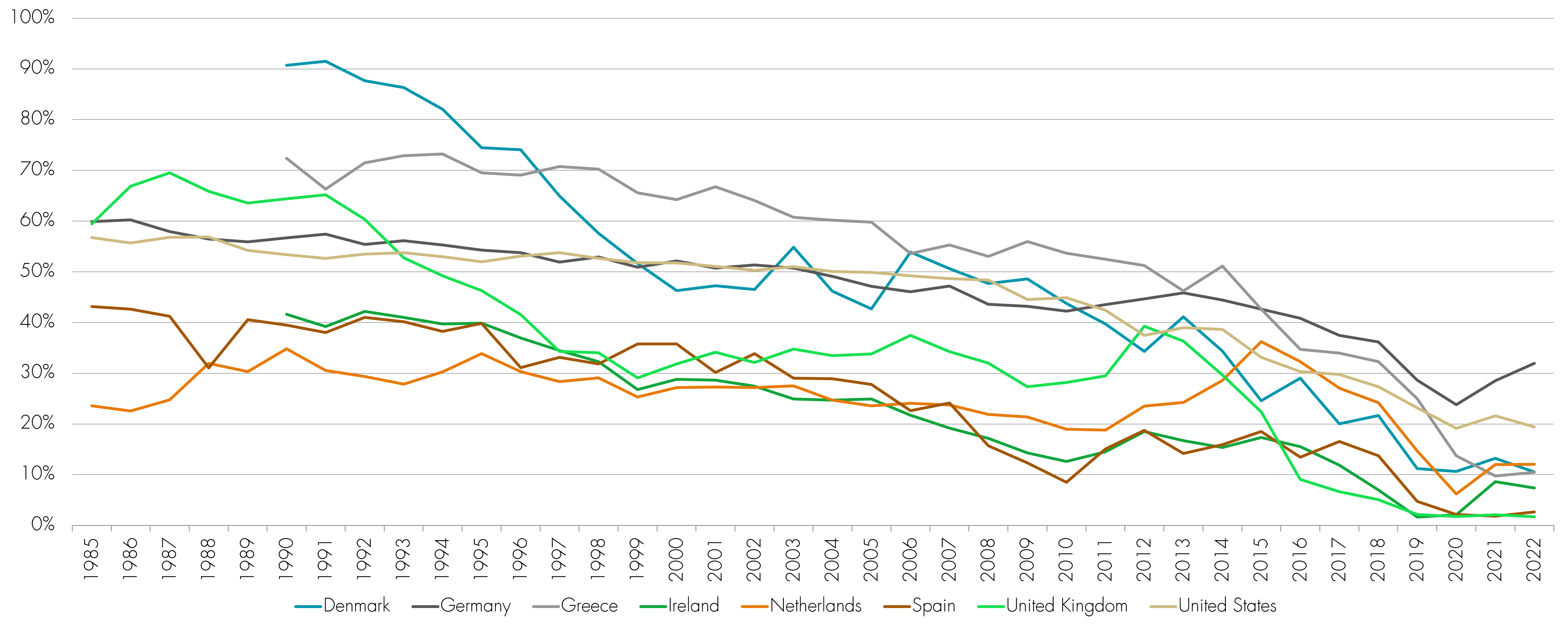

Coal is a dying fuel – Coal is plentiful, but dirty, dangerous[2] and becoming expensive relative to alternatives. In the UK it has fallen from 66% of the electricity generating mix to just 2% over the last thirty years. In the US, usage has dropped from 55% to 20%. It is being replaced by cheaper, easier to deploy, clean wind and solar. To quote the president of the International Energy Agency, ‘humanity has never had a cheaper energy source than solar PV’. Solar is now consistently cheaper than new coal- or gas-fired plants in most countries, and solar projects now offer some of the lowest cost electricity ever seen. The era of burning things for energy is coming to an end.

Share of electricity production from coal (measured as a percentage of total electricity

Source: Ember Climate Yearly Electricity Data (2023); Ember – European Electricity Review (2022); Energy Institute – Statistical Review of World Energy (2023)

Malaria vaccine – Malaria finally gets its vaccine – in fact two. GSK and the Jenner Institute have launched vaccines that will help to control a disease that in 2020 infected 249 million people and killed 608,000 (80% of these deaths were in children under the age of five). Boosting immunity in children will dramatically reduce the impact of this dreadful disease.

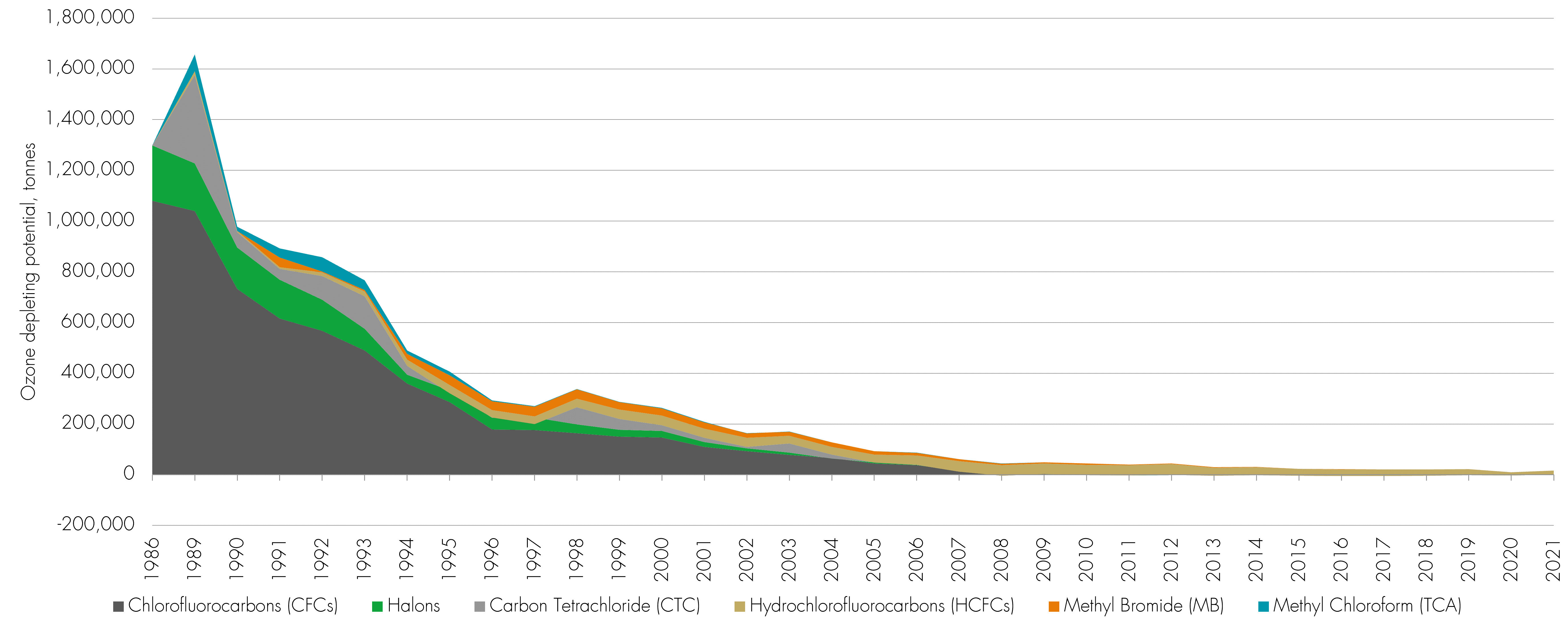

Ozone – The hole in the ozone layer is under repair. According to the UN environment programme, the ozone layer is now on track to fully recover within the next four decades – which means the hole will close and the layer will return to 1980 values, i.e before the appearance of the ozone hole. While this is dependent on the world continuing to comply with the Montreal Protocol of 1989, which outlawed the use of ozone-depleting circumstances including chlorofluorocarbons (CFCs), it is still hugely positive.

Emissions of ozone-depleting substances, World

Source: UN Environment Programme (UNEP) 203 and NASA Ozone Watch. Annual consumption of ozone-depleting substances. Emissions of each gas are given in ODP tonnes. In some years, gases can have negative consumption values. This occurs when countries destroy or export gases that were produced in previous years (i.e. stockpiles).

Innovation in healthcare

Our team identified a major shift in the way that medical treatments are formulated: moving away from small simple molecules (used in a pill) towards larger more complex molecules, which are called biologics.

This shift is expected to deliver much more effective ways of treating disease (many of which can’t be treated by using a simple pill.

We believe companies involved in selling life science equipment and consumables, as well as companies that have specialised in the manufacture of these more complicated biologics treatments are set to benefit from the increased demand for their specialised services.

We are invested in companies expected to benefit from this broad trend through our Innovation in healthcare sustainable investment theme. These companies include:

- Lonza,a company specialised in making biologics molecules – many pharmaceutical companies get Lonza to make these treatments for them.

- Sartorius is a global company headquartered in Germany that specialises in making the containers used to create and transport these biologics.

- Thermo Fischer is a US-based company that sells a broad range of specialist consumables and equipment used in life sciences. It is one of our biggest holdings and has been for many years.

Digital security

Digital security is a theme that keeps gathering momentum, as anyone wanting to access the British Library services will know. Unless you have secure systems, your organisation risks being shut down and having data and money stolen. Ransomware attacks are estimated to have risen 37% in frequency over the last year and 28% in cost per attack.

As more of our lives move online it becomes ever more critical that information and networks are secure. Home working, cloud computing and AI have only accelerated the pace of this race.

For this reason, we believe those companies helping to protect us in the digital world will see strong growth. Among these we would highlight Palo Alto Networks, which is the leading platform for firewalls and endpoint security; Softcat, which sells security to UK SMEs; and Verisign, which oversees the security of internet domain names.

[1] Much of this data comes from the excellent ‘Not the End of the World’ by Hannah Ritchie, lead researcher of Our World in Data,

[2] Coal is estimated to kill 24.6 people per TWh of electricity, wind, solar and nuclear less than 0.04 people a 50x difference.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Sustainable Future Team:

Are expected to conform to our social and environmental criteria. May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing. May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative contracts may help us to control Fund volatility in both up and down markets by hedging against the general market. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Future Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.