Bond investors have a lot to reflect on so far in 2023. Following on from the significant repricing seen in 2022 as interest rate expectations rose, uncertainty around inflation and central bank policy have remained a feature of markets. Bond market volatility is now significantly higher than in the decade from 2010 – 2020, a good thing as it creates more opportunity to target portfolio alpha through new investment positions.

As we look forward to the remainder of the year, we have no shortage of investment ideas. Here, we give a sample of five of our favoured trade ideas across the strategic, high yield and absolute return strategies:

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy.

Government bonds trade #1 – US yield curve steepener

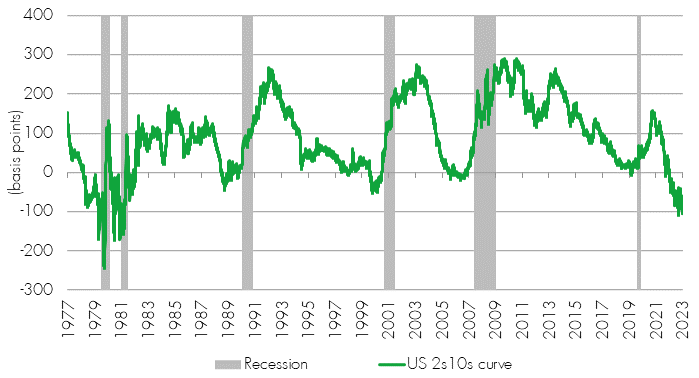

The US yield curve is not only a great predictor of impending recessions, it also provides plenty of opportunities to target investment returns through predicting changes in its shape or position. This year, the curve has become very inverted, meaning 2-year US government bond yields are much higher than 10-year yields – about 100 basis points higher.

However, we think that as the Federal Reserve approaches its rates peak in this cycle, the curve should start to normalise back towards a steeper shape again.

We have taken a duration-neutral position which is long of the 2-year bond future relative to the US 10-year, betting that the gap between the two will narrow or reverse. A return to an average yield curve shape would generate over 50bps of performance. In the meantime, because the 2-year bond (of which we are long) yields more than the 10-year bond (which we are short), the position generates a good yield differential for our funds. This protects against capital downside in case we are wrong; the curve would have to invert much more deeply, to around -200bps from -100bps currently – an extreme seen in the late 1970s/early 1980s – before capital losses outweighed the income we expect from the position in the second half of 2023.

Government bonds trade #2 – Buy New Zealand government bonds at 4.5%

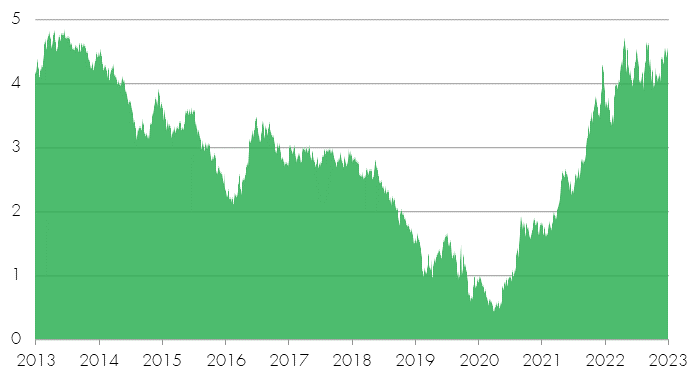

The Reserve Bank of New Zealand (RBNZ) was one of the first developed market central banks to recognise the inflation problem – it raised interest rates sooner and faster than most others. Due to restrictive monetary policy, economic momentum is fading in New Zealand and inflation will follow. The RBNZ has reached peak rates at 5.50% and will probably look to start cutting in the first half of 2024.

With a central bank that has shown its commitment to tackle inflation and an attractive yield of over 4.50%, we believe that 10-year New Zealand bonds are a great opportunity. The yield on its own is compelling, plus there should be capital upside as the monetary cycle turns.

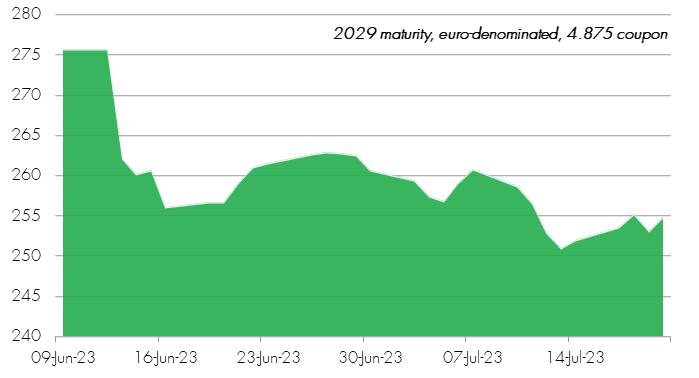

Investment grade stock pick – 3i

As measured by yield, it often seems to us that the corporate bond market just doesn’t ‘get’ non-bank, non-insurance financial companies. The latest example is the recent new issue from private equity company, 3i. This is a BBB+ rated private equity and infrastructure company, based in the UK but with investments across developed markets. It tends to be a majority investor in companies and the bulk of its investments are on-balance sheet, i.e. the investments are generally not part of external funds which need to be liquidated within five years, as is typical of the private equity industry.

3i issued its recent bond in early June, with a total yield of over 5% (in euros, or over 7% in sterling), offering a credit spread – the additional yield above government bonds – of around 280 basis points (bps). We felt this was fantastic value for an excellent, listed company with a market capitalisation close to £20bn but with net debt of less than £1bn. In fact, we felt the value was so good it also made it into our high yield portfolios. Although it is an investment grade issue, it offers a credit spread which is more typical of the higher yielding but lower-rated BB category (the first credit rating level of high yield debt).

Crossover stock pick – Intesa Sanpaolo

Intesa is a solid, well-diversified, leading Italian bank that has improved its costs, credit quality and capital over recent years, leaving it with better asset quality and a more robust capital position than the majority of its Italian peers.

We believe that the drama around Credit Suisse’s Additional Tier 1 (AT1) bonds created valuation opportunities in safer parts of the capital structure in quality banks.

We like Intesa’s Tier 2 bonds. They are higher level in the capital structure of banks and in other respects the sterling denominated bonds are very conventional, with a set maturity in nine years’ time.

While Intesa is investment grade rated, its tier 2 bonds are BB+ rated, the highest rung in the high yield rating category, sitting in the ‘crossover’ area on the cusp of investment grade, where its often possible to find good value relative to credit risk. With a credit spread of over 450bps and all-in yield of almost 9%, it certainly offers good value.

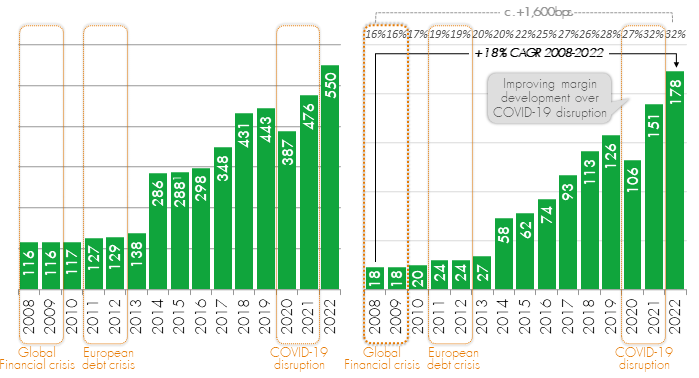

High yield stock pick – InfoPro Digital

InfoPro (IPD) is a leading European business-to-business information provider focusing on industry-specific information platforms. Its business is split into Technology Solutions, which is an area that involves pairing data and technology for software and workflow solutions, and Information and Connection, which involves creating data platforms and includes trade shows. IPD has a subscriptions-based model for around 60% of sales, which provides good visibility on earnings. The business is benefiting from the structural tailwind from continuous digitalisation across industries, is geographically diversified, has high margins of around 27%, a good level of liquidity and is cash generative.

We believe these positive business fundamentals along with its proven resilience through economic cycles – as shown in the chart – leaves its bonds looking very attractive on a 550bps yield spread over government bonds for a B-rated bond.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies which may have the effect of increasing volatility. Some of the Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.