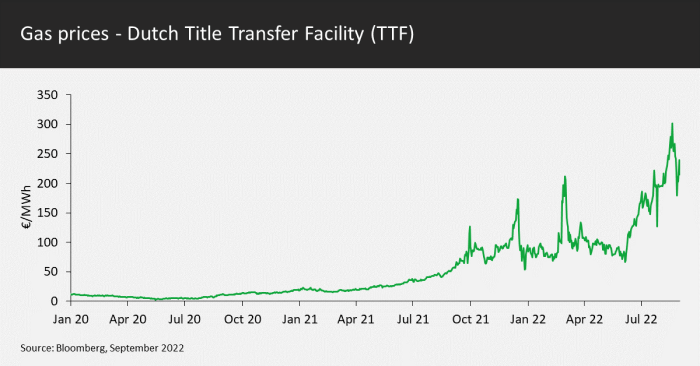

The price of natural gas in Europe has risen tenfold since the end of 2020. Supply has been curtailed by Russia just at a point when demand was rising as European economies bounced back from levels depressed through the Covid-19 pandemic.

This price shock has shown just how sensitive and dependent our economies are on energy. It demonstrates how prosperity and energy availability are well correlated. It has also shown how regressive energy price rises are. On average, poorer people spend a higher proportion on energy than wealthier people – there is little discretion about heating your home or using lights in the winter, so the absolute amounts spent are similar.

The current crisis has little to do with European climate policies. Yes, some argue that we may have kept more coal-fired power stations operating if we had not been trying to limit carbon emissions; but the dash to gas had more to do with higher efficiencies and better economics of gas powered CCGT (combined cycle gas turbine) than their low carbon attributes. Actually, the main reason for the crisis is to do with over-dependence on a single unreliable supplier. [There is a linked issue that resource rich countries tend to be run by authoritarian regimes, which also tend to be less reliable partners, but we won’t discuss that here]. Nevertheless, the negative effect of the price rise has raised the question of how aggressive countries should be in pursuing carbon-dioxide reduction strategies. Simply put, will decarbonising raise energy prices, depress economic growth and place an unfair burden on those least able to afford it?

In his 2020 book, False Alarm: How Climate Change Panic Costs Us Trillions, Hurts the Poor and Fails to Fix the Planet False Alarm, Bjorn Lomborg makes this argument strongly. He states that poverty alleviation is a far greater imperative than curtailing carbon dioxide emissions today. From this perspective, for instance, the terrible impact of the recent floods in Pakistan should be looked at principally as a consequence of poverty. The extreme poverty of the people in those areas made them very vulnerable to flooding. Whether climate change made the flood marginally worse than it would have been is not so important. Had the populations had better flood defences, better housing and insurance, then the human and economic impact would be less catastrophic. So, he continues, poorer countries should prioritise increasing wealth, using whatever energy sources do this most effectively. Develop first; reduce carbon dioxide emissions later. It is hard to argue against this, especially with Pakistan emitting 15 times less per capita than the US. Lomborg then extends this to developed countries to say we too should maximise economic development and effect carbon reduction later, when we are richer and more technologically advanced.

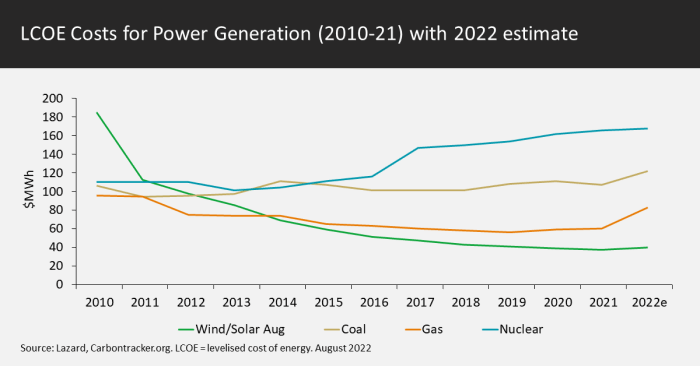

Is this correct? Only if two things are true: firstly, that the cost of low carbon energy is higher than higher-carbon alternatives; and secondly, that the economic impacts of climate change do not themselves curtail economic progress and hence societal development.

On the first, it is clear that in region after region, low carbon renewables are outcompeting coal and gas on cost when looked at over the life of a project.

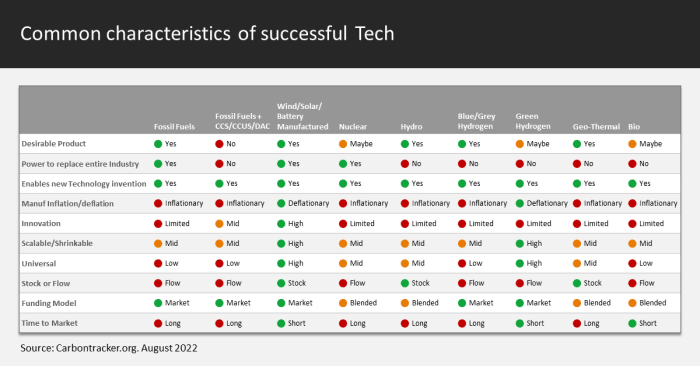

But that is not all. Recent events have shown how important security of supply and speed of deployment are. Indeed, looking across multiple criteria, solar and wind have attractive characteristics aside from simply being better on cost.

Click to enlarge

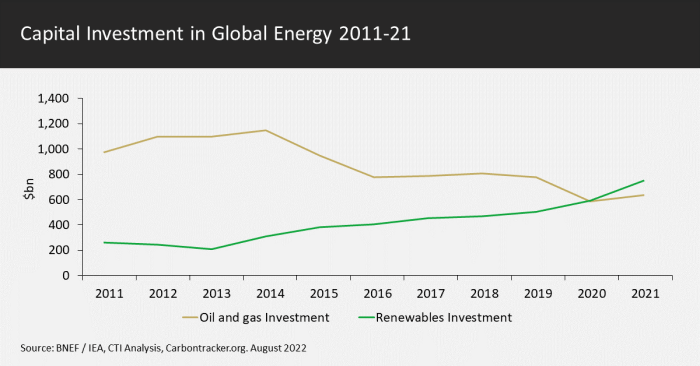

If we are looking for cheap, available, secure and quick-to-deploy energy, then renewables in many areas fit the bill. For this reason, we have recently seen a crossover in capital expenditure on energy, with renewables now exceeding oil and gas.

With this backdrop, it would be perverse not to continue investing in renewables even in the absence of climate change considerations.

On the second point regarding the likely costs of climate change, Lomborg takes the central scenario forecasts for the negative effects of climate change on economic growth, and observes that these are small relative to the compounded economic growth we are likely to see in the coming decades. What this misses though is the wide range of outcomes we could see as the planet rapidly warms. We are changing the chemistry of our atmosphere at an unprecedented rate. Yes, it could be manageable, but there are also scenarios with very grim outcomes for economies and societies. This suggests we should be precautionary in our approach, and favour solutions that at least start to mitigate further carbon dioxide emissions.

The evidence points to our being at a critical juncture in energy. We now have the means to deliver affordable, secure, low carbon electricity. The current energy crisis will only accelerate investment in solar and wind and therefore we are very confident that our themes related to renewable energy and energy efficiency are intact and that the companies we are invested in have bright futures.

However, it is also important to recognise that climate change is not the only issue we need to solve. Poverty, poor health and insecurity also need to solved in parallel. Business and investment have a big part to play in these areas too. For this reason, the Sustainable Future process has always focused on multiple themes and identifying those companies that will be successful while making our world cleaner, healthier and safer.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.