You should answer a number of key questions before you make an investment. These include what are your investment objectives, what is your time horizon and what is your risk profile?

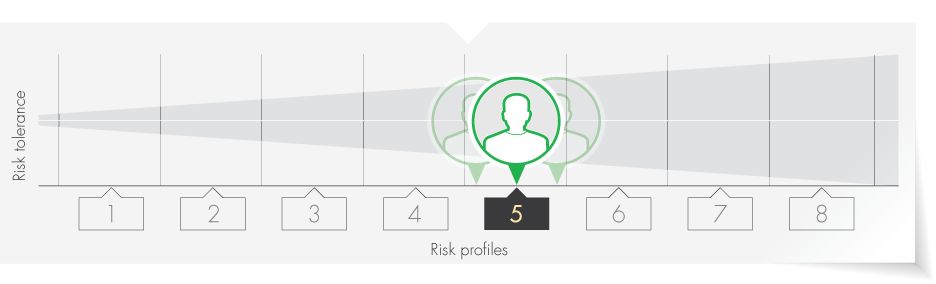

The first two questions tend to be easier to answer than the last one largely because risk is hard to quantify as it is a subjective measure. The risk profile comprises your risk tolerance, risk capacity and the risk required to meet your objectives.

Various methods and tools have been developed to help determine an individual’s risk tolerance, including questionnaires and personality tests. Ultimately, the level of risk you are prepared to take will often come down to how much money you are prepared to lose before you start worrying.

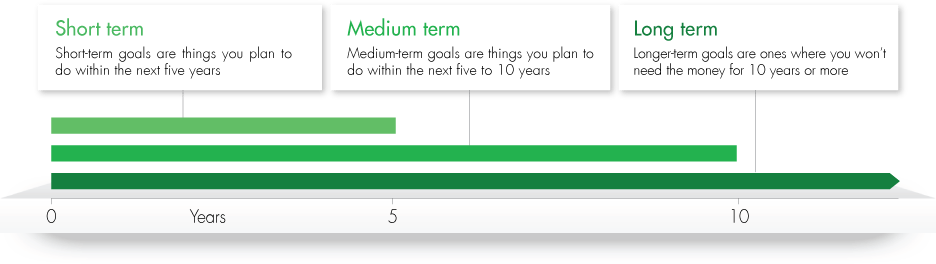

Your capacity for loss can be expressed in terms of how much capital you are prepared to lose during any 12-month period and how much capital you are willing to lose over the length of time you will be invested. The longer your time horizon for investment, the greater the level of risk you can potentially take.

It is equally important, however, to consider the amount of risk you need to take to achieve your investment objectives within your time frame. Take too little risk and you may not reach your financial goals.

Choosing a risk profile, therefore, involves targeting sufficient risk to achieve your investment goals, but also ensuring that this level does not exceed your risk tolerance and capacity.