About the MA MPS Blended Growth Portfolios

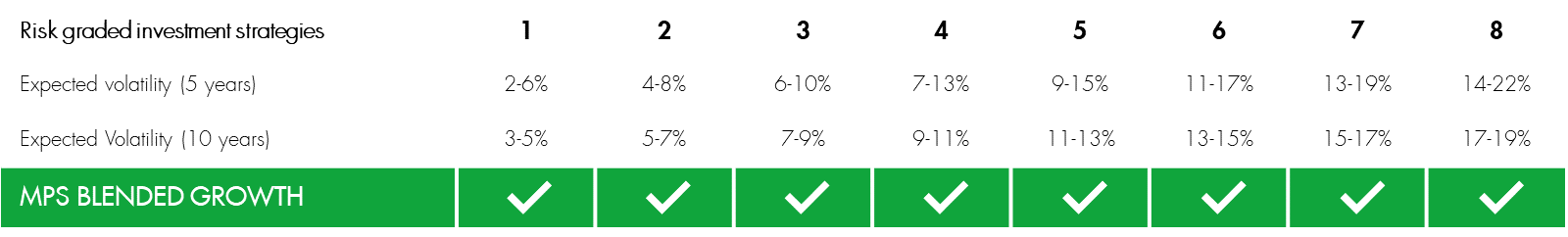

The Liontrust Multi-Asset MPS Blended Growth portfolio range is designed to target the outcome expected by investors in terms of their level of risk, as measured by volatility, and maximise the return for each portfolio within the appropriate risk band.

These portfolios are for investors seeking a cost-effective investment solution that combines passive with good quality active investment managers who we expect to outperform the relevant indices over the medium to long term.

The portfolios use passive funds where it is appropriate to do so and they are available and use actively managed funds where they believe the opportunity to deliver higher returns is greatest or where passive funds are not an option.

The higher the risk of the portfolio within the range, the greater the potential for volatility, positive returns on the upside and losses in down markets.

Each of the Multi-Asset portfolios within the range provide diversification across a range of different underlying funds, fund managers, geographical regions and asset classes.

Clients can stay invested in the service through the accumulation and decumulation phases of their lives as their risk profile changes.

Reasons to invest

- Experience: One of the most experienced and highly regarded multi-asset multi-manager investment teams in the UK market, headed by John Husselbee

- Diversification: Each portfolio provides diversification across a range of different funds, fund managers, geographical regions and asset classes

- Long-term flexibility: Investors can switch between the range of portfolios as their risk profile and objectives change during the accumulation and decumulation phases of their lives

- Rigorous process: The investment process is designed to deliver the outcome expected by investors and aims to generate maximum returns for each target risk portfolio within the pre-determined volatility ranges

- Added value: We seek to add value through each of strategic and quarterly asset allocation, fund selection and portfolio construction

- Costs: We aim to keep costs to a minimum and are often able to invest in underlying funds on better terms than those commonly available

Our Investment Process

A range of portfolios for different risk profiles

Fund insights

Multi-Asset team

Headed by John Husselbee, who has nearly 40 years of industry experience, the seven-strong Multi-Asset team comprises multi-manager, equity and fixed income specialists. James Klempster (who joined Liontrust in 2021 from Momentum Global Investment Management) is Deputy Head and Head of Equities, Phil Milburn (2018 from Kames Capital) is Head of Rates and Donald Phillips (2018 from Baillie Gifford) is Head of Credit. Anthony Chemla, who joined in April 2023 from atomos where he was lead Portfolio Manager for DFM portfolios and co-Portfolio Manager of the MPS, and Sharmin Rahman, who joined in August 2022 having previously been a Senior Portfolio Manager and Analyst at AXA Investment Managers, are both Investment Managers. Fund Analyst David Salisbury joined in 2022 from 4 Shires Asset Management.

"A key objective in terms of performance is to strive to 'win over the long term by not losing.' We aim to achieve this by seeking to manage risk and limit losses in falling markets to enhance long-term returns in each risk target."

Key Risks

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested. The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds and Model Portfolios managed by the Multi-Asset Team have exposure to foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The majority of the Funds and Model Portfolios invest in Fixed Income securities indirectly through collective investment schemes. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. Some Funds may have exposure to property via collective investment schemes. Property funds may be more difficult to value objectively so may be incorrectly priced, and may at times be harder to sell. This could lead to reduced liquidity in the Fund. Some Funds and Model Portfolios also invest in non-mainstream (alternative) assets indirectly through collective investment schemes. During periods of stressed market conditions non-mainstream (alternative) assets may be difficult to sell at a fair price, which may cause prices to fluctuate more sharply.

Disclaimer

The issue of units/shares in the Liontrust Multi-Asset Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term. For the Multi-Asset Model Portfolios, any performance shown represents model portfolios which are periodically restructured and/or rebalanced. Actual returns may vary from the model returns. There is no certainty the investment objectives of the portfolio will actually be achieved, and no warranty or representation is given to this effect, whether express or implied. The portfolios therefore should be considered as long-term investments.