- The second half of 2024 was challenging for the Fund due to several headwinds: low large-cap value exposure, overweight to AIM and stock-specific setbacks.

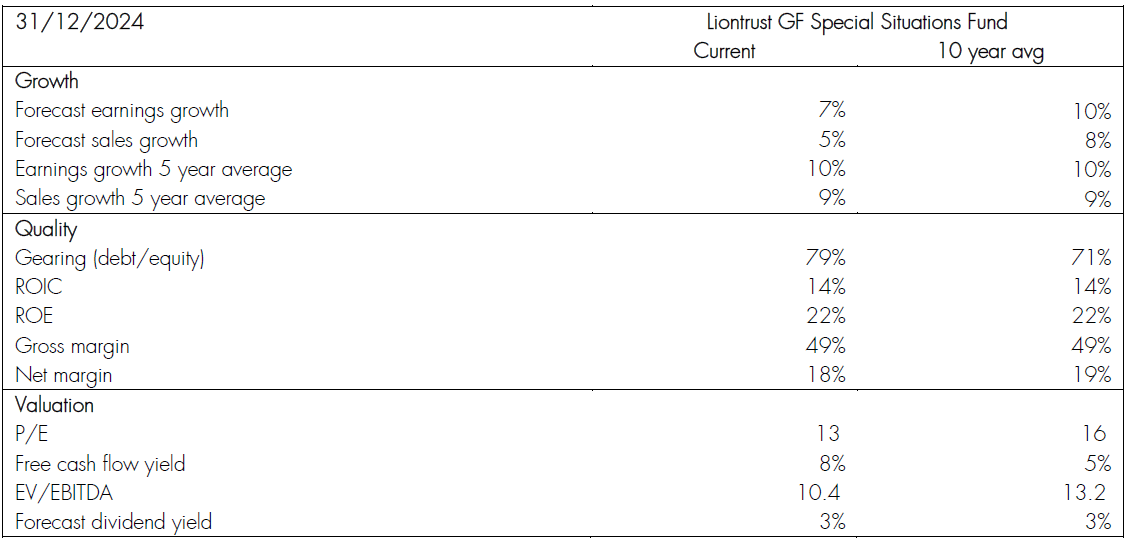

- The outlook is positive, with the Fund’s quality metrics at normal levels but valuations at a discount of around 20% to their long-term average.

- The portfolio is expected to deliver around 7% earnings growth next year, with a healthy dividend yield of 3%.

The Liontrust GF Special Situations Fund returned 2.5%* in 2024. The Fund’s comparator benchmark, the FTSE All-Share, returned 9.5%.

It was a challenging period of performance with the Fund underperforming the FTSE All Share by 6.3%. The Fund was tracking the market relatively closely until late May with the divergence largely playing out after the announcement of the general election.

2024 – fund performance versus the index

Source: FE Analytics, as at 31.12.24, net of fees, income reinvested, total return. Past performance does not predict future returns

We attribute the underperformance to 3 main factors:

- Lack of exposure to large cap value

- Overweight position in small cap growth, AIM in particular

- Stock specific

Taking each in turn:

Lack of exposure to large value

Large cap value was the strongest performing part of the UK market during 2024 (MSCI UK Large Cap Value delivered a 15.0% total return). This performance was driven, predominantly, by two sectors – Banks and Tobacco, which collectively represent ~14% of the FTSE All Share.

The macro backdrop in terms of broader economic uncertainty and rising bond yields, in part due to concerns that inflation will remain higher than expected, has been particularly supportive for these sectors. Combined they added ~5% to the headline FTSE All Share Index return, or approximately 50% of the 9.5% gain posted during the year.

The Fund has zero exposure to these two sectors and therefore the cost to relative performance was the full ~5%.

Overweight position in small cap growth, AIM in particular

The longstanding overweight position in small caps, specifically AIM (22% of NAV at 31 December 2024) relative to the Index was costly to performance during the year. The FTSE AIM All Share total return of -4.0% compared to the FTSE All Share total return of 9.5%, an underperformance of 13.4%. As a reminder, the investment process naturally tilts the investable universe towards the quality growth style factors and away from the value factor. Furthermore, the requirement of management ownership as part of the process within the Fund’s smaller companies exposure determines that the investable universe is more weighted towards AIM stocks than FTSE Small Cap.

The underperformance of AIM can be attributed to a number of factors:

- Style – it is a more “growth” orientated index than the FTSE All Share

- Political – particularly speculation of tax relief applied to AIM shares

- Stocks – a number of the larger AIM stocks (some which we owned – see below) downgraded expectations

Stock specific

There were five notable detractors during the year (each with a performance cost >70bps), each downgrading expectations and the performance impact compounded by de-rating. Two were very cyclical in nature: Spirax (-70bps) and Spectris (-75bps). Three were a combination of cyclical and company specific issues: YouGov (-107bps); Next 15 (-74bps) and Impax (-74bps). The average de-rating across these five companies was particularly harsh at 38%. We retain all five of these positions and consider the recovery potential to be significant when the cyclical headwinds subside.

Looking beyond the detractors noted above, the portfolio as a whole performed relatively resiliently during the year with the majority of holdings delivering earnings either ahead or in line with expectations. There were notable strong positive contributions to Fund performance from portfolio holdings such as Hargreaves Lansdown, TP ICAP, Gamma Communications, Keywords Studios and Compass Group, which collectively added ~5%.

Outlook

We are cautiously optimistic about the outlook despite a relatively uncertain macro-economic backdrop. The portfolio is, at the aggregate level, delivering healthy levels of growth, an attractive dividend yield and supported by quality fundamentals.

As at the end of December, based on market consensus, the portfolio is expected to deliver ~7% earnings growth for the year ahead. Whilst this is modestly below the long run average for the fund, in the context of an uncertain macro backdrop, we feel it is attractive and represents further recovery potential as cyclical headwinds subside.

The Fund’s quality metrics are in line with long run averages across most measures.

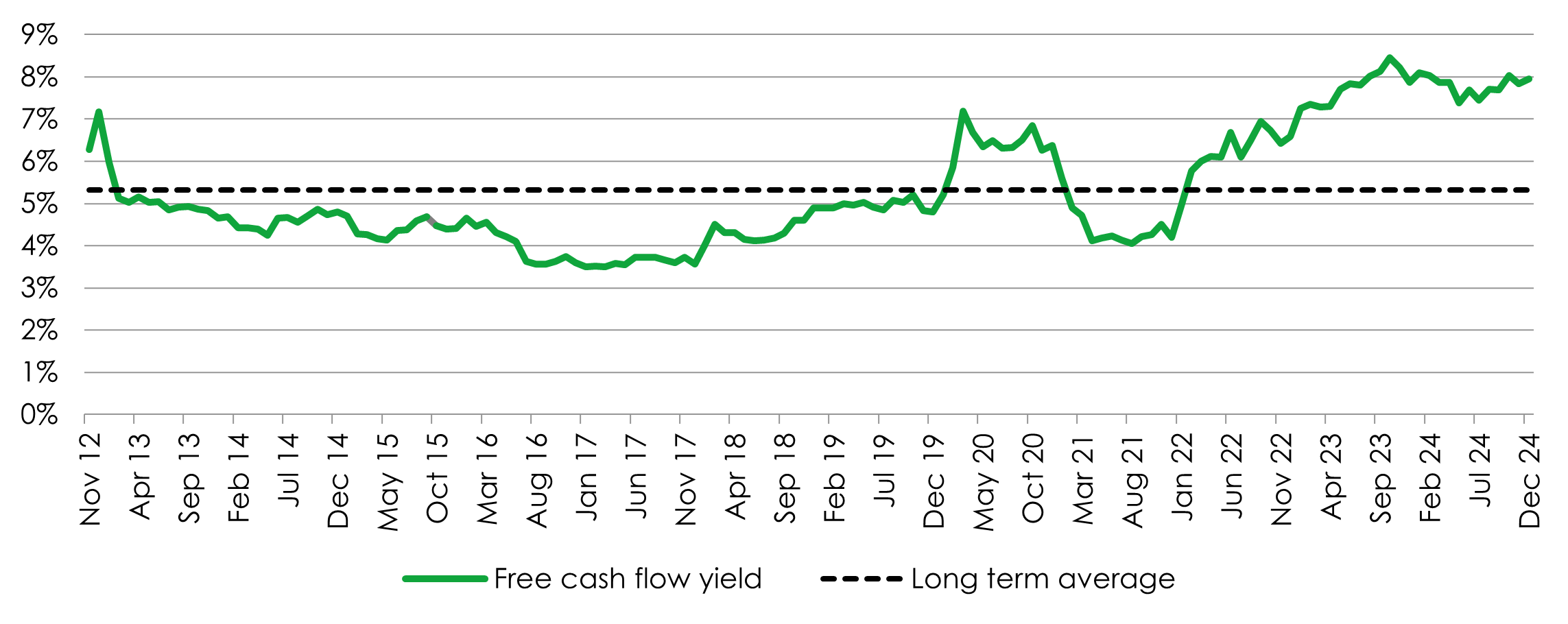

Valuations are attractive with the aggregate forward price/earnings ratio of 13x representing a discount of nearly 20% to the long run average P/E of 16x for the Fund. A free cash flow yield of 8% is particularly compelling and is at levels not seen for a very long time in the Fund’s history (>1.5 standard deviations above the long run average free cash flow yield of 5.3%).

Portfolio free cash flow yield

Source: Style Analytics, monthly data points to 31 December 2024. Past performance does not predict future returns

In addition to the 7% earnings growth, investment returns for the year ahead are also expected to be supported by a healthy dividend yield of 3%.

Portfolio valuations versus 10-year averages

Source: Style Analytics, monthly data points to 31 December 2024.

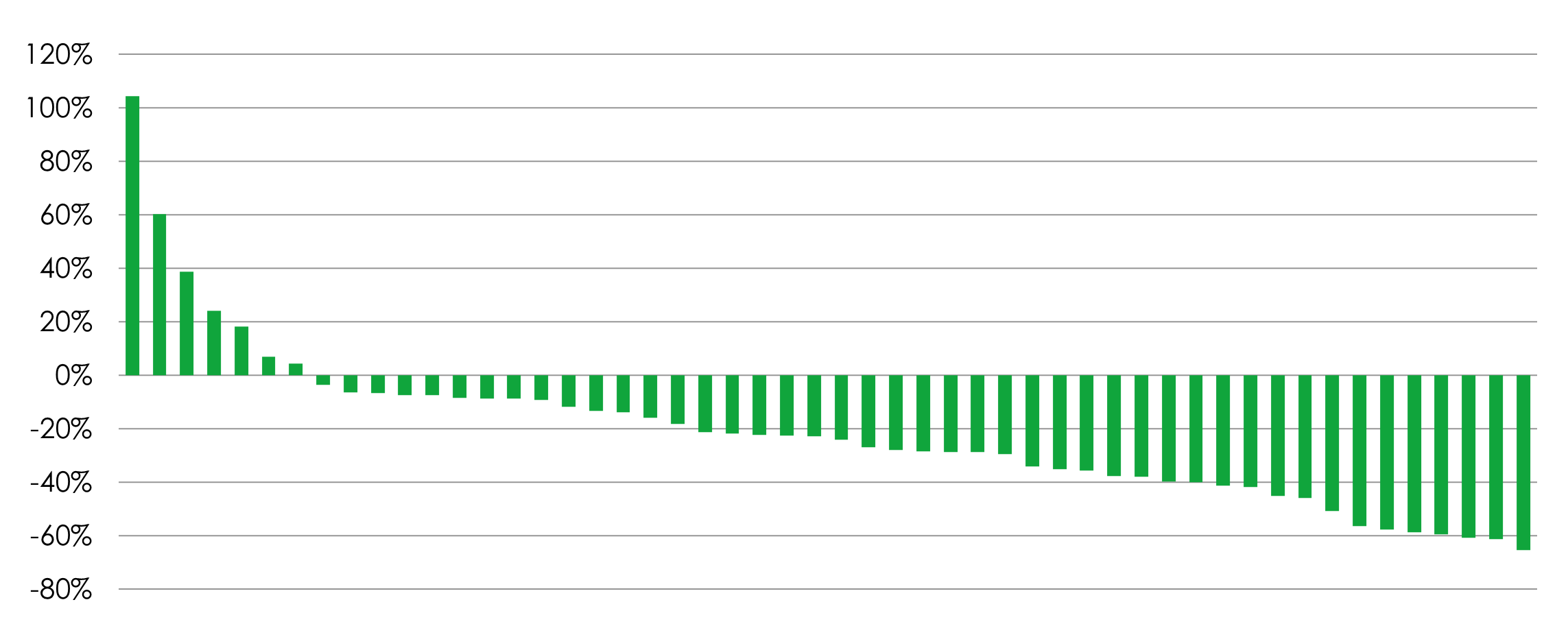

Looking at valuations at the stock level, nearly 90% of the portfolio is trading at a discount to long run averages. The average stock is at a 25% discount – this represents significant reversion potential if sentiment towards UK equities supports a re-rating back to long run averages, which we are increasingly hopefully that policy changes will help to catalyse.

Portfolio forward price/earnings ratio versus 10-year averages

Source: Bloomberg, 13.01.25. Data excludes loss making companies and companies where 12m forward EPS forecast data is unavailable. Long term average = 10 year average for each of the underlying stocks in the fund. % premium/discount is calculated by dividing the current blended 12m forward P/E ratio by the 10 year average for each stock. Past performance does not predict future returns

Discrete years' performance** (%) to previous quarter-end:

Past performance does not predict future returns

|

|

Dec-24 |

Dec-23 |

Dec-22 |

Dec-21 |

Dec-20 |

|

Liontrust GF Special Situations C3 Inst Acc GBP |

2.5% |

5.7% |

-12.3% |

19.3% |

-1.4% |

|

FTSE All Share |

9.5% |

7.9% |

0.3% |

18.3% |

-9.8% |

|

|

Dec-19 |

Dec-18 |

Dec-17 |

Dec-16 |

Dec-15 |

|

Liontrust GF Special Situations C3 Inst Acc GBP |

21.7% |

-2.4% |

15.4% |

16.6% |

12.5% |

|

FTSE All Share |

19.2% |

-9.5% |

13.1% |

16.8% |

1.0% |

*Source: Financial Express, as at 31.01.25, total return (net of fees and income reinvested), sterling terms, C3 institutional class. Non fund-related return data sourced from Bloomberg. **Source: Financial Express, as at 31.12.24, total return (net of fees and income reinvested), primary class. Investment decisions should not be based on short-term performance.

Key Features of the Liontrust GF Special Situations Fund

The investment objective of the Fund is to provide long-term capital growth by investing in mainly UK equities using the Economic Advantage investment process. The Fund invests at least 80% in companies traded on the UK and Irish stock exchanges. The Fund is not restricted in choice of investment in terms of company size or sector. The Fund has both Hedged and Unhedged share classes available. The Hedged share classes use forward foreign exchange contracts to protect returns in the base currency of the Fund.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- This Fund may have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on the Fund's value than if it held a larger number of investments.

- The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- The Fund may invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing.

- The Fund will invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.