- The UK equity market had a tumultuous start to 2022. Russia’s invasion of Ukraine added to an already challenging macro-economic backdrop.

- Our flexible, stock-driven, style-agnostic approach struggled in a macro-driven, risk-off environment.

- Idiosyncratic opportunities in some areas of the market remain highly compelling.

The UK equity market had a tumultuous start to 2022. Russia’s invasion of Ukraine, which has come at an appalling humanitarian cost, added complexity to an already complex macro-economic backdrop. The prices of energy and commodities spiked, while pressures on supply chains intensified. In the worst squeeze on consumers’ wallets in 30 years, the UK’s CPI reached 6.2% yoy in March, driven by rising prices in energy, food and durable goods. The Bank of England increased the base rate in two steps to 0.75% during the quarter. The Federal Reserve, meanwhile, lifted the fed funds rate by 0.25% in March. Against a backdrop of high inflation and tight labour conditions, Chair Powell was decidedly more hawkish, stating there is an “obvious need to move expeditiously [our italics] to return the stance of monetary policy to a more neutral level”.* This level is estimated to be roughly 2.4% – some way above the current target fed funds rate of 0.25-0.50%. Bond markets sold off sharply at the short end on expectation that next month could see an increase in the order of 50 basis points. A flatter yield curve reflected growing concerns about stagflation.

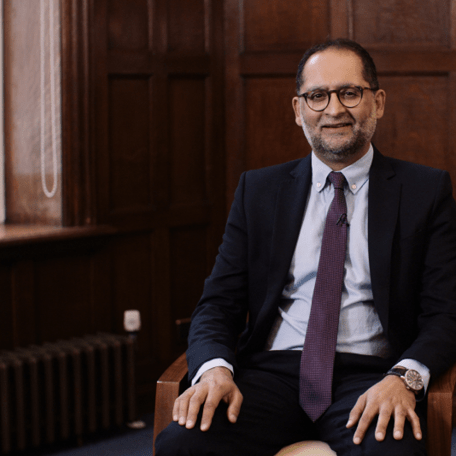

Stock-level fundamentals were of little consequence in this environment and the market polarised into two camps: 1) areas of perceived safety and beneficiaries of commodity inflation, and 2) everything else. Mid-caps were shunned, while large-caps held their ground: the FTSE 250 Index returned -9.5% against a return of +2.9% for the FTSE 100 Index. Meanwhile, among FTSE All-Share industries, Energy (+25.4%), Basic Materials (+19.6%) and Telecoms (+7.4%) significantly outperformed Technology (-16.1%), Industrials (-12.9%) and Consumer Discretionary (-11.5%). Intra-day volatility also spiked [Figure 1], reflecting a widening of possible outcomes and the market’s sensitivity to short-term news flow.

Figure 1: Intra-day activity follows the news

Source: Goldman Sachs, 01.03.22

Portfolio update

This was a difficult quarter for performance: our flexible, stock-driven, style-agnostic approach struggled in a macro-driven, risk-off environment. Moreover, relative performance was driven as much by stocks not held in the Fund as those we do hold. Not holding British American Tobacco, BP and Glencore impeded performance, for example, while names such as Experian, Ferguson, CRH and Flutter, also not held, were among the top relative contributors as a function of their share price falls. Among the Fund’s holdings, Fever-Tree was derated (harshly, in our view), after it moderated its guidance due to significant cost pressures, particularly freight, whilst maintaining growth investment; the market appears to be underestimating its excellent long-term growth prospects in Europe, Asia and the US. In contrast, holdings in the gold mining group Newmont Corporation added value, while QinetiQ, which provides technology and services to the defence sector, rallied on the prospect of increased defence spending across the world.

We have made a number of changes to the portfolio in the weeks since the start of the war in Ukraine, continuing a process of rebalancing we began late last year. These include new or increased positions in Shell, gold miners Newmont Goldcorp and Barrick Gold, as well as pharmaceutical businesses Roche and AstraZeneca. We like Shell’s strategy of recycling some of its strong cashflow into selected renewables and helping its customers decarbonise their energy needs. We have also bought back into Rentokil, which has defensive earnings and good long-term growth opportunities. We have trimmed positions in RELX, London Stock Exchange and Autotrader, and have top sliced some market sensitive stocks that have held up, such as 3i and St James’s Place.

We reduced the holding in HSBC. It should be a beneficiary of the change in the rate environment – for the first time in years HSBC and other banks will earn money on customer deposits. However, China and Hong Kong’s zero Covid policy is stifling its growth opportunity and, more importantly, the cost of risk for operating in Hong Kong and China has to have risen with the enduring redrawing of the geopolitical map over Ukraine. We also reduced Legal and General. Again, we like the company’s strategy, but in the past it has proven to be sensitive to perturbations in credit markets: with Quantitative Tightening comes that risk again.

Outlook

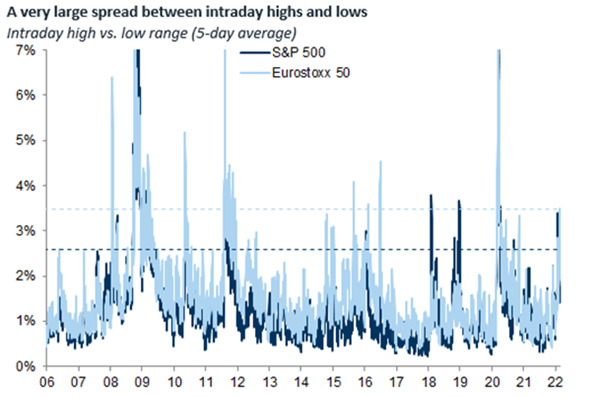

The geopolitical landscape has dramatically shifted, with energy security becoming a top priority for governments. The history of past conflicts is instructive [Figure 2] and serves as a reminder that markets are forward looking and have looked through previous military crises relatively quickly, with the obvious caveat that no two conflicts are alike and this conflict has come at a time of pre-existing macro challenges related to inflation, supply chains and energy security. Even if there is an agreement or resolution, it is likely the market, economic and political regime has changed irreversibly due to the conflict: this means higher inflation, higher spending on defence, a greater focus on the security of supply, and ongoing isolation of Russia and potentially cooler relations with China.

Figure 2: Market responses to past conflicts

Source: JP Morgan, Global Equity Strategy, 28.02.22

Meanwhile, central banks are increasing interest rates and remain keen to unwind quantitative easing. Against a background of strong inflationary pressures feeding through into rising wages, stagflation becomes a risk. It is therefore important at a stock level to invest in companies that have market leadership, pricing power and high gross margins to offer protection against cost pressures. We believe the Fund is well positioned for this scenario.

In terms of our recent activity, it is important to note that recent changes to the portfolio, while tactical in nature, have emerged from our ongoing commitment to deep fundamental analysis. The market has been rattled by the conflict in Ukraine and has inevitably adjusted for a wider array of potential outcomes (as have we). However, some of these moves have been severe, in our view, and several oversold holdings should not only revert in time but could make quite meaningful gains as the market reappraises their potential. Examples include pessimistically priced consumer-facing names we mentioned above.

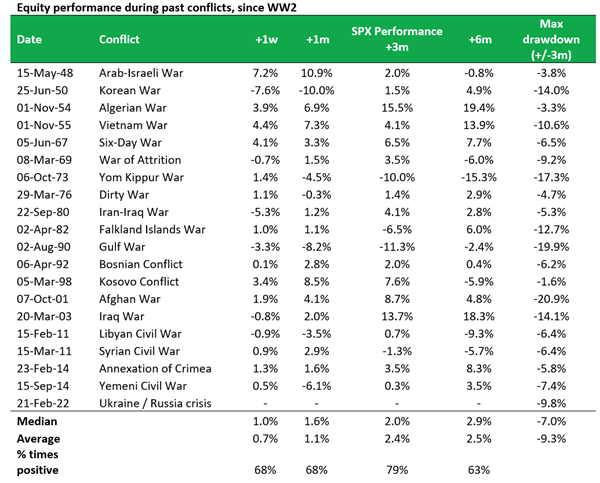

For investors, uncertainty creates opportunity, and as harrowing as the current crisis is on humanitarian grounds, we believe the current market environment offers a rare opportunity for investors in the UK. Since September last year, the FTSE 250 Index has experienced its largest drawdowns against the FTSE 100 Index since the financial crisis, underperforming by some 19% [Figure 3]. While the drawdown has several causes – e.g. a wider flight to safely, in part on growing concern about inflation and hawkish central bank policy – historically these drawdowns have been relatively short lived. We are certainly not making a case for buying the FSTE 250 Index, but believe this dynamic supports the case for continuing to identify companies in that area of the market we believe are well placed to grow and deliver decent returns in the years ahead. These include businesses with a good degree of operational resilience, backed by structural growth drivers and low levels of debt – businesses that are firmly on our radar as part of our flexible pursuit of opportunities for the Fund.

Lastly, the UK equity market remains a fertile hunting ground for private equity (PE) which has seen huge growth in assets over the last decade and has “dry powder” that needs to be invested to earn its full fees. We believe there will be more Morrisons – snapped up by PE last year – as the gap between the earnings yield and the cost of borrowing remains wide. Shareholder activism is also on the rise and is accelerating potentially positive change among UK businesses. Activists are currently on the register of three of the UK’s largest companies – Shell, Unilever and GSK – for example. Mega cap is no longer too large for such action. Notwithstanding the uncertain macro backdrop, there are multiple reasons why we believe the UK equity market could be at the foothills of a multi-year rehabilitation with the potential to provide enduring returns for investors.

Figure 3: FTSE 250 Index relative drawdown

Source: Bloomberg, 20.04.22

*https://www.federalreserve.gov/newsevents/speech/powell20220321a.htm