The Liontrust Strategic Bond Fund returned -0.5%* in sterling terms in October. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was-0.4%.

Market backdrop

Was it the spike in energy prices, the ongoing problems with supply chain constraints or simply demand being greater than supply? No matter which explanation one attaches to the cause of developed market central bankers awaking from their slumber, the impact on bond yields in October was plain to see. For the record, I believe it is a combination of all three factors that is making inflation stickier than central bankers are comfortable with.

Crucially, higher prices are feeding through into enhanced consumer expectations of future inflation and increases in wages. It is the fear of the feedback loop between higher wages and sustained elevated inflation that has prompted monetary policy setters to want to tighten conditions. Recent examples include the Bank of England shifting to a hawkish rhetoric, actual rate increases from the Reserve Bank of New Zealand and Norges Bank with plenty more rate rises clearly in the pipeline, the Bank of Canada halting quantitative easing and signalling a rate increase in summer 2022, and the Reserve Bank of Australia backing away from its policy of yield curve control.

With actual actions being taken by so many central banks, it has emboldened bond markets to question the resolve of both the US Federal Reserve and European Central Bank. Despite both being notable for how late they are to the monetary tightening party (by over a decade in our opinion, but that’s another subject), their attendance is looking both inevitable and, in the Fed’s case, imminent. The ECB at its October meeting and accompanying press conference had the chance to push back against the repricing of rate expectations but Lagarde chose not to. We think if the yield spread between Italy and Germany on benchmark 10-year bonds reached 150bps then the ECB would become more proactive.

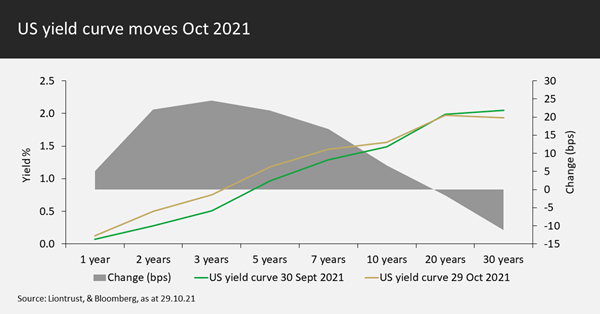

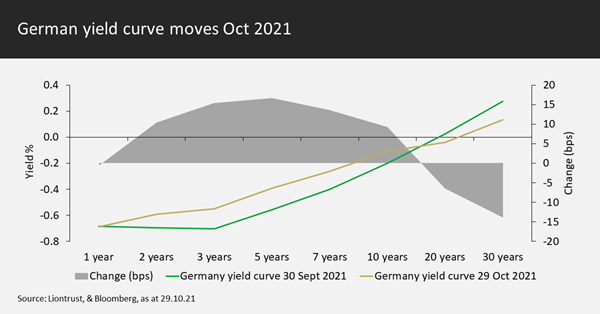

Let’s examine the yield moves in the US and German bond markets during October:

The green lines represent the yield curve at the end of September with the gold ones being the end of October. The change in yield over the month is shown by the shaded areas plotted on the right-hand axis. What is clear is that October’s shift in rate expectations impacted yields at the short end of the curve. Longer dated maturities actually saw bond yields fall; this phenomenon is known as a “twist” in the yield curve.

So why did yield curves twist during October? Simplistically, the bond market’s thesis is that earlier rate rises will lead to a lower peak in rates. The narrative is that any tightening in monetary policy will choke off economic growth. Clearly, tighter monetary policy does reduce growth assuming one has not long since passed the point of the “reversal rate,” the level at which lower rates become counterproductive. Even though I think loose monetary policy is a large contributing factor in the fall in productivity growth over the last 10-20 years, let’s just temporarily ignore this to prevent this commentary from becoming too long.

So yes, at some stage, higher interest rates do reduce growth; monetary policy does still work. But I fear that too many investors are looking at the experience of the last decade and – not having experienced meaningful inflation before – ignoring the longer-term horizon. Examining inflation breakevens or the ECB’s preferred measure (the 5-year, 5-year forward inflation swap) show a rise in inflationary expectations during October, thus the lower long-dated yields are suggestive of a fall in real economic growth.

With a lower predicted terminal rate, the level at which rates will peak in this cycle, this raises the question of whether we will see a positive real interest rate in this cycle. Using the US as an example, by 2023-24 inflation should be fading back down towards 2-2.5% having been stuck nearer 3% in the meantime. US Fed fund rates could conceivably get above 2% so you might get a positive real yield.

However, if the long-term neutral real interest rate is only zero that really is a sorry state of affairs. I am a big believer that the huge amount of debt outstanding is an impediment to growth, but surely with all the technological advancements in the world, we can cope with a small positive real interest rate.

My stance goes back to the flawed extrapolation of the last 10 years. The conditions are now in place for a sustained boom in real growth. Not ‘80s or ‘90s levels, but with excess savings boosting consumption, an accompanying tailwind in wages and rapidly falling unemployment, a real growth rate in developed market economies nearer 2% than 1% looks eminently achievable. Couple this with continued sticky inflation and we are of the firm belief that rate rises are necessary. Whilst many commentators see rate rises as being a potential policy mistake, our view is that they are needed and will not destroy economic momentum.

Rates

We were very active during the volatility in rates markets as various pricing discrepancies opened up as market reactions were exacerbated by investor positioning. Firstly, on headline duration, October saw a quarter year increase to 3.25 years† when US 10-year yields hit 1.65% (still significantly below our 4.5-years neutral level and way below the Index’s 7.5 years of exposure). We tactically added to the over 15-year maturity bucket but would oppose the flattening move if the US 5s30s curve got towards a 50bps differential. Strategically, we are looking for an opportunity to implement a steepener when the ultra-low terminal rates narrative gets challenged but this is unlikely to occur before mid-2022.

The cross-market position of being short Canada relative to the US was a big beneficiary of the month’s moves and on the first day of November we moved the position back to being a box trade (long Canadian 5-year versus the US and the opposite in the 10-year).

Within the broad dollar bloc economies, there was a huge amount of volatility in Antipodean markets; we took the opportunity to double up on long New Zealand bonds versus Australian government bond futures. The latter had a big jump in yields as the markets tested the resolve of the Reserve Bank of Australia; we took some profits but remain 0.25 years short.

In Europe, we banked the gains on our strategic long Sweden versus Germany trade. The spread between the two compressed from just below 60bps to just above 40bps; as we had predicted, more of the economic recovery was already priced into the Swedish bond market. We have opened up a position in Switzerland versus Germany again, this time at the 5-year tenor being long Swiss bonds and short the 5-year German BOBL future. Any tightening of monetary policy by the Swiss National Bank is likely to be via reduced currency intervention rather than adjusting base rates, thus, testing the SNB’s resolve should actually be bad for Bund yields (the SNB buys Bunds with the euros raised from selling Swiss francs) rather than the domestic market. That kind of pricing anomaly helps us generate alpha for unitholders and is why we love volatility.

Allocation

There was minimal change to the net investment grade weighting during October. The Fund holds approximately 40% net in investment grade credit, split between 45% in physical holdings and a 5% risk-reducing overlay; we deem 50% to be a neutral weighting. In the market volatility, we took the opportunity to pick up a couple of cheap high yield bonds to take the exposure up to 25% (23% physical bonds and a 2% overlay), above the neutral positioning of 20%, reflective of it currently being our preferred part of the credit markets. Do note though that we are still avoiding the worst segments of the market by sector and rating; the Fund has zero exposure to CCC (and below) rated credit.

Selection

Within investment grade, we purchased dollar-denominated bonds for the Fund in dialysis company Fresenius Medical Care, a classic case of an issuer having cheaper (wider) credit spreads away from its home market where it is most well-known. We switched the maturity of our Amgen (a pharmaceutical major) bonds longer to capture greater capital upside as credit improvements should lead to tighter spreads. Also at the long end, we bought bonds in HCA, the US hospital operator. On the other side of the ledger, positions in banking groups Credit Agricole and Santander UK were trimmed, as was the holding in Sempra Energy (a US utility and energy distribution company).

In the high yield universe, the Fund purchased bonds in Swedish property company Heimstaden Bostad, which had been unjustly tainted simply by operating in the same industry as Adler (a German real estate company with ongoing governance challenges). Also in the secondary markets, a position was established in AdaptHealth, a US home medical equipment company. The Fund also participated in two new issues: Iliad, a telecommunications challenger company, and Aggreko, a power rental company. I originally started following the latter company when it was demerged from its parent (Christian Salvesen plc) in 1997 – good to see it finally issuing a bond!

Discrete 12 month performance to last quarter end (%)**:

|

Sep-21 |

Sep-20 |

Sep-19 |

|

|

Liontrust Strategic Bond B Acc |

3.0% |

4.0% |

5.9% |

|

IA Sterling Strategic Bond |

4.6% |

3.6% |

7.1% |

|

Quartile |

3 |

2 |

3 |

*Source: Financial Express, as at 30.09.2021, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 31.10.2021, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12 month periods due to the launch date of the portfolio.

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies' bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

KEY RISKS

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. The majority of the Liontrust Sustainable Future Funds have holdings which are denominated in currencies other than Sterling and may be affected by movements in exchange rates.

Investment in the Strategic Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

The information and opinions provided should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.