Increased use of digital content, faster connectivity rates, the Internet of Things and now demand from AI are all driving demand for data centres. Data centres are where most of our digital information ultimately is stored and where, increasingly, much of the computational power takes place to carry out computing tasks. They represent a key component of the infrastructure we inadvertently rely on when using our phones and computers. We have researched how we can invest behind businesses which can make these data centres more efficient in terms of energy use and associated emissions many times in the past two decades. The easiest way for businesses to improve the energy efficiency and reduce the carbon intensity of their computing needs is by moving their servers off premises into a larger, more efficiently run data centre and optimising server utilisation through the use of virtual servers which ensure the system is more efficient.

Reducing the energy needed for cooling

Data centres require good connectivity to the physical internet infrastructure as well as solid connections to the electricity grid. The biggest costs in running a data centre are energy related. The biggest use of energy historically within the data centre is for cooling and getting power to the servers. Energy efficiency gains often involve reducing the proportion of energy used for cooling versus computational tasks. We look for companies that run their data centres efficiently and are proactively sourcing low-carbon electricity to reduce the energy use and associated emissions. We have exposure to this trend through our holdings in Microsoft, Alphabet, and Equinix which operate some of the most energy efficient data centres globally. Sustainable Investment team analyst Linnea Bengtsson recently wrote about an interesting potential area to improve energy efficiency by using liquid cooling in datacentres.

Improving efficiency of hardware and semiconductor chips

As the computational demands from AI increase energy consumption, the largest source of energy demand in a data centre is expected to come from the computing chips. Traditionally these chips were central processing units (CPUs), a type of general-purpose computing chip capable of performing a wide range of tasks. More recently, graphic processing units (GPUs) have been adapted to perform calculations required for artificial intelligence much more efficiently, lowering the cost to train models. This has led to increased demand for power, and a potential source of greenhouse gas (GHG) emissions, despite commitments from technology companies and countries to take action in limiting climate change.

We believe this dichotomy represents two primary opportunities for companies selling semiconductors into data centres. Firstly, we believe that application specific integrated circuits, or ASICs, will take a larger share of the computing units in data centres over time. These chips are designed for AI use cases like GPUs are today, but further optimised for specific AI workloads to be more power efficient. We believe the likes of Broadcom, a Sustainable Future holding, is set to benefit from co-designing these chips with customers that desire greater energy efficiency when using AI.

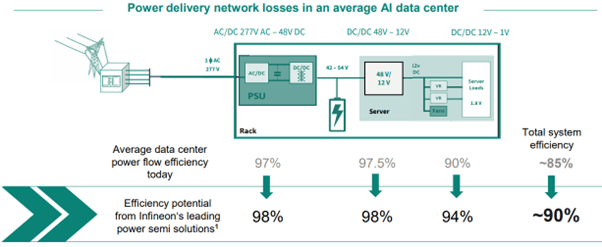

In order to deliver energy efficiently to the computing chips within a data centre, there is also a need for high-end power semiconductors. This type of chip enables energy to be delivered from its source into the data centre and its component electrical parts, requiring multiple conversions of current and voltage along the way.

Source: Infineon Q1 2025 Quarterly Update Presentation.

Monolithic Power, a holding in our SF range, was the sole supplier to Nvidia on its Hopper platform throughout much of 2023 and 2024 due to its close customer cooperation and high efficiency. While share has more recently been taken by the likes of Infineon, another Sustainable Future holding, we believe this market will continue to grow significantly as more computing moves to the cloud. Increasing power requirements from more advanced computing chips will also necessitate new designs to increase efficiency, such as moving from lateral to vertical power delivery. This should drive price increases, which we believe Monolithic Power and Infineon have the expertise to benefit from.

Using low carbon sources of electricity to power data centres

The GHG emissions from data centres is dependent on the efficiency of the data centre as well as the carbon intensity of the electricity used to power the centre. The use of renewables (wind and solar) is our preferred source as this is very low carbon and can be purchased using long-term agreements to reduce power price volatility. These renewables are intermittent, and back-up and storage systems will play an increasingly important role in ensuring reliable power to data centres. There has been renewed interest in nuclear power to power data centres especially small nuclear reactors (SMRs). We remain sceptical due to the high sunk costs for new nuclear, which do not appear to improve at smaller scale, and are not cost competitive or suitably flexible on electricity grids, which we believe will become increasingly dominated by intermittent cheap renewables.

Key Risks

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments

The Funds managed by the Sustainable Future Team:

- Are expected to conform to our social and environmental criteria.

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Future Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Disclaimer

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.