The famous WWE (World Wrestling Entertainment) wrestler from the 1990s, the Undertaker, was known for dramatically rising back up off the canvas after having been knocked flat out by his opponent.

Two years ago, Netflix also looked down and out, with its once strong member growth grinding to a halt, fears of too much competition, and its share price down over 70% from its peak.

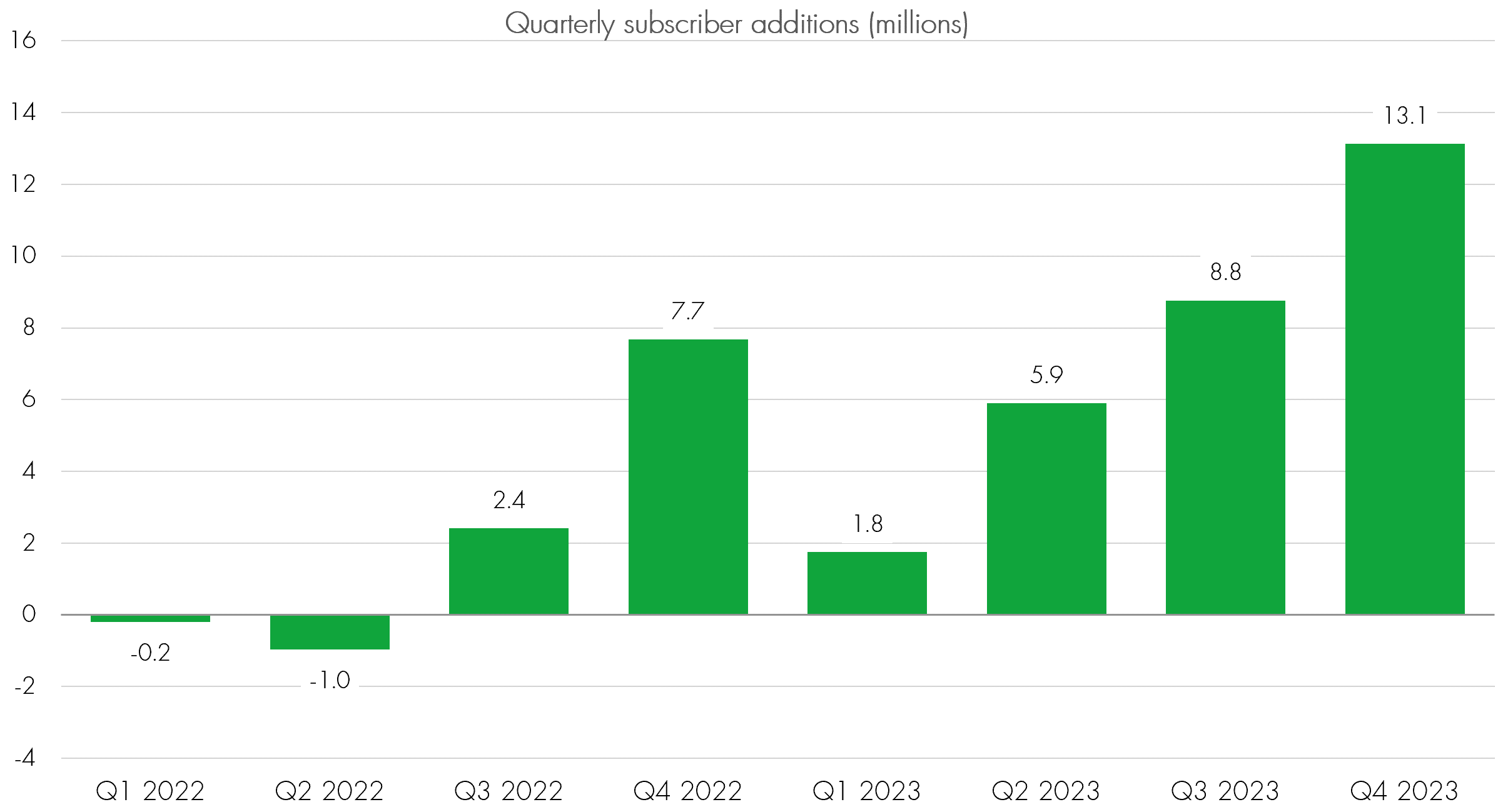

But its results last night were another impressive step in its dramatic comeback, with member growth of 13 million in Q4 − the strongest quarter ever outside of the anomalous March 2020 Covid quarter − taking Netflix to over 260 million members.

Membership growth accelerating – biggest quarter ever ex-Covid

Source: Netflix company reports, Bloomberg, January 2024.

Behind this is a set of strong growth drivers the company has engineered since its downturn, to which earlier in the day it added a deal with WWE − moving Netflix into live streaming for the first time.

The most structurally important of these drivers is management’s decision in 2022 to abandon its long-held principle of no advertising. The company introduced an ad-supported low price membership option, opening up a whole new swathe of the demand curve for lower income households in both developed and emerging markets.

When companies drive down prices like this, particularly as they increase the quality of their offering at the same time, they expand the market and we expect Netflix to add hundreds of millions more members over time. The ad-supported tier is now contributing to member growth on a global basis, with all regions seeing year-on-year acceleration in Q4.

While it is early days for the advertising business, it is an exciting proposition given that advertising spend is increasingly going where the best engagement is and Netflix has exceptional engagement. Overall advertising spend is a huge $180 billion (excluding China and Russia) with $25 billion in connected TV alone, and it is a big opportunity for Netflix, partnering with Microsoft and building internal capabilities in targeting, measurement and relevance optimisation.

It is early days too for Netflix’s gaming business, but a $160 billion market (ex-China and Russia) provides Netflix with strong potential to increase overall engagement and cross-fertilise with TV shows and movies. December’s release on Netflix of Grand Theft Auto, one of the most successful and infamous game franchises, may represent a statement of intent here, adding to a library of over 80 games from which the company is collecting data and developing its gaming strategy.

The business has executed well on replacing password sharing with paid sharing and seems to have minimised customer upset – evident in lower-than-expected churn. This move could potentially expands Netflix’s ultimate TAM (total addressable market) by around 20%.

While the growth contribution of this move will fade in 2024, Netflix has gone easy on price increases during the process, which it will be able to pick up again in 2024, adding strongly to comfortably double-digit revenue growth.

Content is king, and we like management’s focus on content quality as the biggest driver of the success of the business. In 2023, Netflix originals were the top viewed shows in 48 of the 52 weeks of the year, and yesterday its original movies received 18 Oscar nominations across 10 different films, including Spain’s Society of the Snow, once again demonstrating Netflix’s ability to make excellent content around the world and deliver to a global audience.

Given the “sports entertainment” nature of WWE and its story-based content, the WWE deal fits the company’s storytelling approach to sports, such as its successful franchises Drive to Survive (Formula One) and Full Swing (golf). Dipping its toe into live streaming will clearly enable it to experiment and collect data on a potentially important new direction.

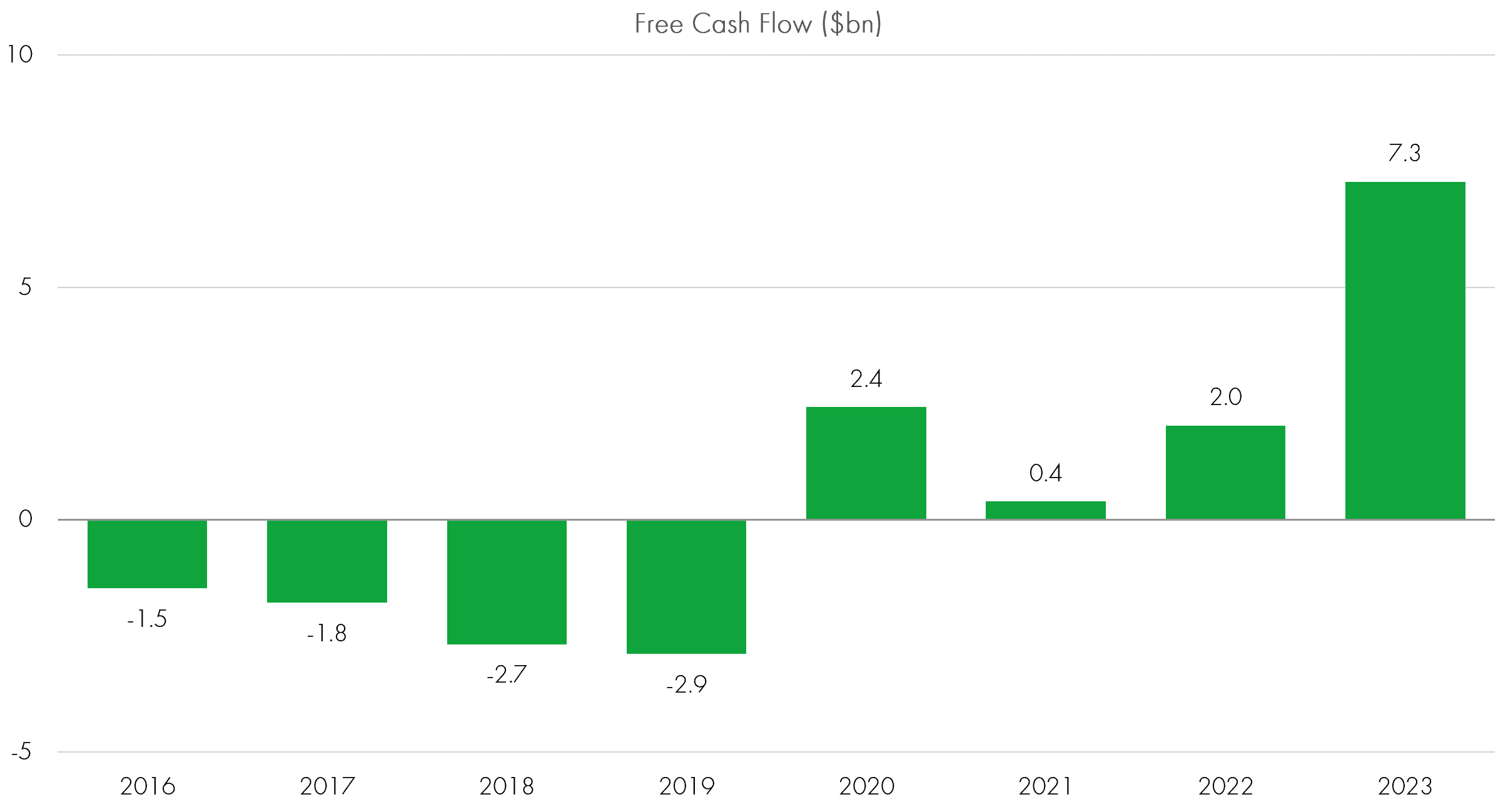

Finally, helped by the inherent economies of scale for leaders in streaming, management continues to fine-tune the financial machine for translating this value creation for customers into free cash flow growth. The company increased its operating margin to 17%, a huge 10% year-on-year increase and 300 basis points (bps) above consensus expectations (we wrote about here) and guided for 24% for 2024 vs. prior consensus expectations of 22%.

Cash flows inflecting

Source: Netflix company reports, Bloomberg, January 2024.

With free cash flow (FCF) of $6 billion guided in 2024 and strong FCF growth likely over the coming years, Netflix is becoming a cash king for shareholders, just as it is going to get tougher for competitors to keep up.

Oh, and Squid Game is back in 2024.

James Dowey, Co-Head of Global Innovation Team

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

The Funds managed by the Global Innovation Team:

May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund. May have a concentrated portfolio, i.e. hold a limited number of investments. If one of these investments falls in value this can have a greater impact on a Fund's value than if it held a larger number of investments. May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings. Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash. May be exposed to Counterparty Risk: any derivative contract, including FX hedging, may be at risk if the counterparty fails. Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Global Innovation Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice.