Bond market yields have risen significantly over the last year as investors have adjusted to rapidly rising interest rates. One obvious implication of higher yields is that companies will have to pay a much higher coupon to attract capital over the coming years. We think these higher costs will create more dispersion in corporate credit, leading to investment opportunities.

As you would expect, corporate borrowers took advantage of the prior several years’ exceptionally low interest rates to raise finance cheaply. They often issued long maturity debt in order to lock in these favourable rates for a longer period, meaning that there is no impending ‘maturity wall’ of bonds that will need refinancing at the same time.

There will, however, be a gradual refinancing of liabilities over the next few years as this old, low-coupon debt matures. This will mean issuers having to ‘re-coupon’ upwards to match the higher yields now on offer in a world of more historically normal interest rates.

Higher coupons may seem like good news for bond investors, but yields had already rebased higher over the last year, offering a much improved returns outlook for the asset class.

From an investor’s perspective, re-couponing to a higher rate would simply mean a greater portion of an investor’s future return comes in the form of coupon running yield rather than capital appreciation to par. An old, low-coupon bond and a new higher-coupon bond issued by the same company would trade on similar redemption yields – the combination of their coupon running yield and their pull-to-par as they approach maturity.

For the issuing company, however, the refinancing process will be the first time it has been exposed to more expensive borrowing rates. Although prices in the secondary market for existing debt dropped as yields rose last year, this hurt the investors who owned them at the time, not the issuer.

The biggest impact from the refinancing process could therefore be the additional strain it places on borrowers and, in turn, the increased importance that investors should place on credit selection.

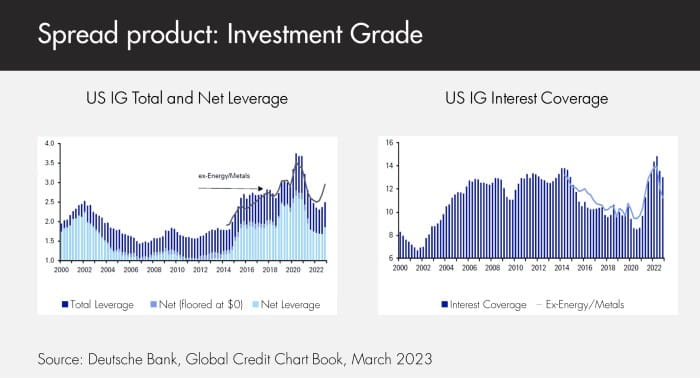

As it stands, corporate borrowers are largely in good shape, having trimmed down leverage levels to pre-pandemic levels, while most companies have been prudent in their cash deployment in the face of a challenging economic environment. Interest coverage – the extent to which debt interest payments are covered by profits – is currently pretty robust.

As higher debt servicing costs bite, free cash flow will be hit and interest coverage ratios will decline. When combined with the mild recessionary period we expect later this year, we should expect default rates to rise slightly too.

While this may sound like bad news for credit investors, it isn’t.

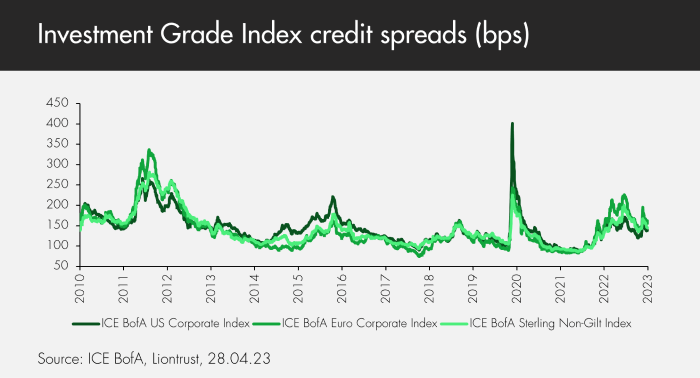

Valuations are much improved, meaning that expected returns are higher so long as defaults can be largely avoided. Credit spreads, the additional yield offered by corporate bonds above government bonds, have tightened since their zenith in October 2022, but because government bond yields remain much higher than a year ago, corporate bond ‘all-in’ yields are still at attractive long-term levels.

The process of bond refinancing will create greater dispersion in credit markets between those issuers whose business model and balance sheet can withstand a period of higher interest rates and those that will struggle. An environment of greater dispersion should naturally suit our highly selective style, which emphasises higher-quality companies operating in less cyclical sectors of the economy.

We have recently been participating in high quality BB-rated high yield new issues which are offering very attractive coupons and we expect some increased market volatility later this year which should present further investment opportunities.

For more of the Global Fixed Income team’s latest views, read their quarterly strategy update.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in Funds managed by the Global Fixed Income team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Funds may invest in emerging markets/soft currencies which may have the effect of increasing volatility. Some of the Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.