The two ranges of target risk funds (Blended and Dynamic Passive) that are designed to target the outcome expected by investors in terms of their level of risk, as measured by volatility, and maximise the return for each fund within the appropriate risk band while MA Explorer aims to maximise capital growth and/or income over the long term.

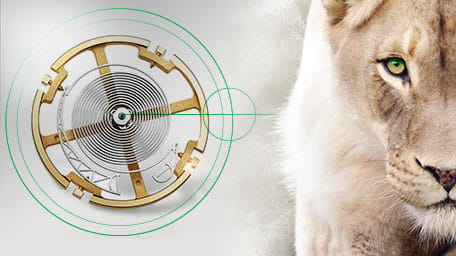

Actively different

Liontrust works in partnership with advisers for the benefit of their clients.

Our Multi-Asset investment proposition and service is designed to enable advisers to provide the highest quality advice and service to their clients. We seek to help advisers achieve their clients’ investment objectives and meet their suitability requirements over the long term. We also help advisers to fulfil their responsibilities under Consumer Duty.

Liontrust achieves these aims through the following distinct partnership and service offering, which we call Actively Different.

Adviser resources

Liontrust produces a range of reporting and literature to help advisers and their clients. This includes MA Performance Review and Outlook, A Guide to Managing Volatility and Liontrust Views. Literature can be white labelled or co-branded for advisers.

Meet the team

Global Fixed Income

Funds & portfolios managed by the team

Multi-Asset Funds

Multi-Asset Funds

Global Fixed Income funds

The fund managers believe fixed income markets are inefficient and there are myriad ways of adding value to investors’ portfolios. The inefficiencies are caused by many market protagonists who are not price sensitive, ranging from the macroeconomic distortions caused by central banks to the idiosyncratic scenarios when companies need to raise debt finance and price accordingly.

Global Fixed Income funds

MPS Portfolios

A broad range of 22 target risk model portfolios designed to meet most investors' risk and return objectives. They are designed for clients of financial advisers and are available on most major platforms.