Executive summary

With supply chain issues improving, commodity prices falling and signs of job market tightness abating (albeit slowly), we believe it likely US inflation has peaked and will gradually fall. Meanwhile, the global picture on inflation remains suggestive of highly stubborn inflation, but there are also signs we are at a peak.

The pace and degree to which inflation drops remains uncertain. We have added duration throughout the year and are positioned with around 5.25 years presently. We still believe it too soon for markets to be celebrating ‘dovish pivots’ from central banks – they are a long way through their tightening cycle but still have further to go. We may have seen a peak in yields, but with ten year yields having rallied from 4.5% to 3.5%, there is plenty of scope to see higher yields from here. The corollary is we believe recessionary risks have increased since the summer. Chief amongst our thinking on this is in consumption, where dwindling savings, increased cost of credit and falling house prices may make it very hard to avoid a recession. Towards the end of 2023, central banks will be witnessing weak enough economic data to enable them to start cutting rates. Whether they will be willing to do so remains to be seen.

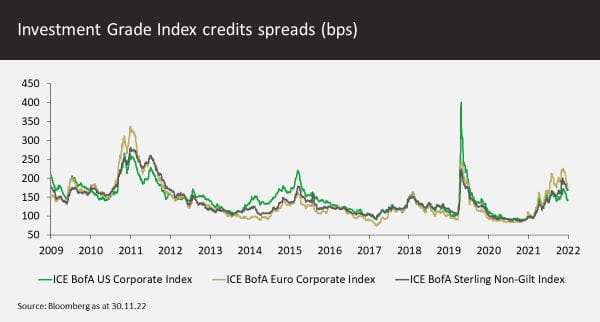

Following an impressive rally in recent weeks we have decided to be more active in credit, reducing our overweight. Overall exposure was around 90%, split between 60% in investment grade and 30% in high yield. At the end of November we reduced investment grade exposure to 50%, our neutral level. At a 25% net weighting, our high yield exposure remains above our 20% neutral exposure; the holdings have a strong quality bias and low cyclicality.

Strategically, we still like credit and now have a small overweight of about 5% rather than 20%. Our central case is that the recession will be mild, but there is considerable uncertainty around that. Couple that uncertainty with the extra liquidity premium needed as central banks shrink their balance sheets and we require more generous credit spreads to have a larger overweight. Thus, we have reduced credit risk and will await a better valuation opportunity to increase weightings again.

Macroeconomics

Using JPMorgan as a guide, as we approach the end of the year the consensus forecast for real global GDP growth in 2022 is around 2.9%, while the US is 1.9%. For 2023, consensus forecasts see a slowing in global GDP growth to 1.6%, US GDP growth to 1%, Euro area 0.1% (with Germany mildly negative), UK -0.6% and China seeing growth at 4%. Growth is expected from China as it emerges from Covid-19 restrictions. The extent to which China emerges from pandemic conditions clearly represents an uncertainty in forecasts related to Chinese and global GDP growth, and indeed global inflation.

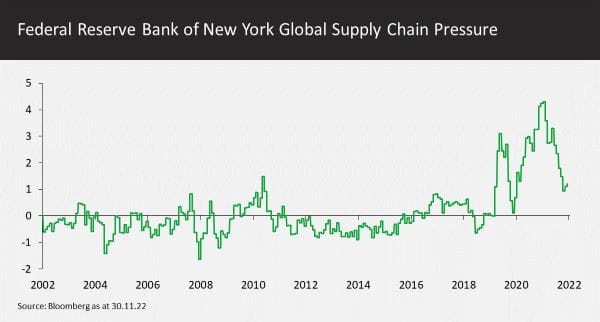

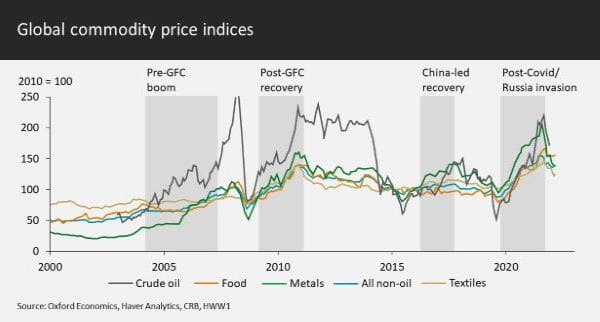

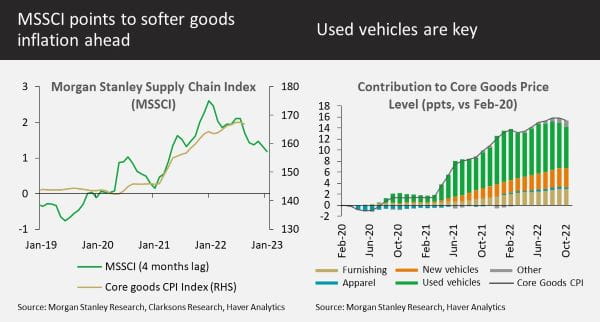

Next year, consumer price inflation in the US is expected to drop to 4.1% (from 8.1%). In Europe, it is expected to move from 8.5% to 5.8%. Supply chain pressure is receding and we know from previous charts in our quarterly strategy output the important role supply-sensitive factors have played in stoking inflation. Meanwhile, commodity prices across the board have fallen. For example, Brent oil by the end of November sat in the low-to-mid $80’s, having averaged over $100 so far this year.

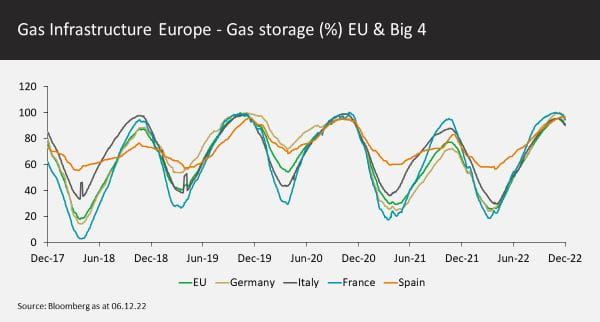

An update on gas storage in Europe as we approach the main winter months shows an optimistic picture for this winter, with full storage helped by mild weather and voluntary efficiency measures. This is good news but may also help the cause of those of a more hawkish view on the ECB – less chance of a recession, so let’s deal with inflation more aggressively.

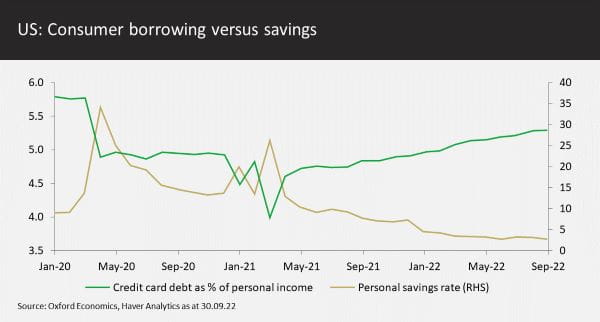

Consumption: Post-pandemic, we have viewed the savings rate as playing an important role in sustaining US consumption during a period of heightened inflation and negative real wage growth. To date, savings have eroded, and probably will only really last another couple of quarters. What is clear is many US consumers continue to use credit to sustain their standard of living.

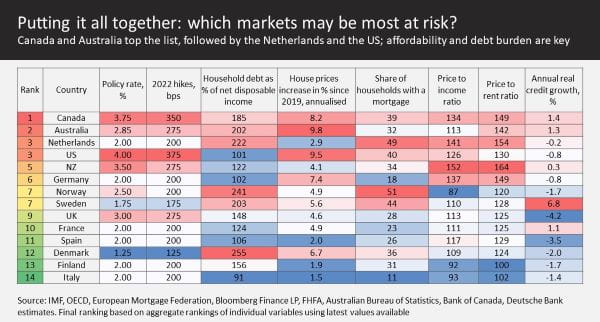

House prices feed into consumer confidence. With rising rates, it’s clear developed market housing prices have peaked and a drop in house prices feels inevitable, particularly after the post-pandemic boom. We found the following work from Deutsche Bank quite useful in assessing which countries might be most sensitive to the housing market in this cycle. With, for example, a big move in rates, the rapid rise in house prices through the pandemic and a relatively large proportion of households with a mortgage, we can see the US is exposed, though not quite as much as Canada and Australia (where high commodity prices probably played a big role). European markets like Germany, UK and Sweden are also clearly exposed to a drop in house prices.

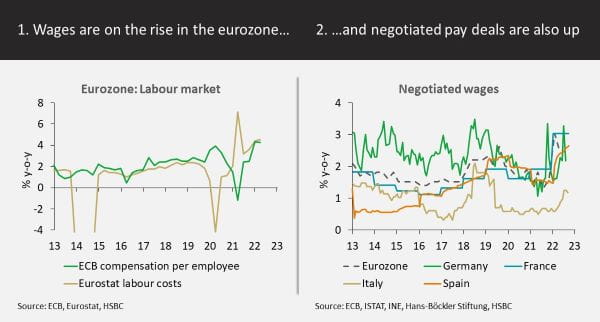

Employment: We are, of course, still very focussed on the health of the US job market, which we believe will play a crucial role in how quickly the Fed is able to get inflation back to target and how aggressively it will need to act to achieve this. In Europe, recent wage negotiations point to 3-5% wage inflation (for existing roles), but high single-digit wage inflation for those changing jobs. The Fed would be happy with this type of wage inflation, which may be supportive of those of a more dovish view in the ECB.

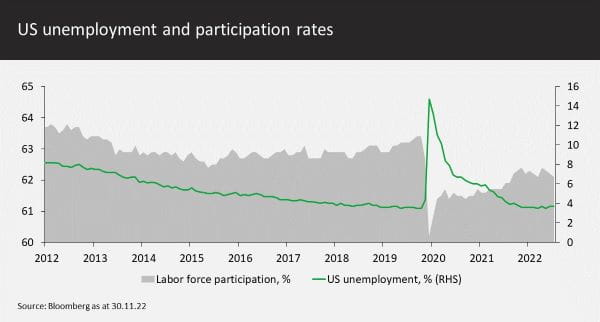

In the US, the participation rate remains a bit of a conundrum for Jay Powell, though perhaps there is some sign of an improvement. For example, the number of 35-44 year-olds still out of the work force post-pandemic is slowly falling. Moreover, the number of 55+ in the workforce is slowly increasing. Another source of labour in the US could be migration, which is slowly moving back to trend.

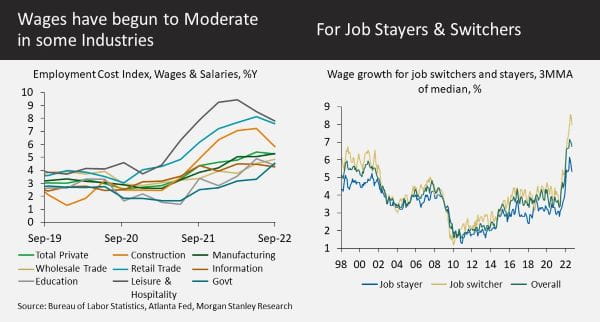

There are signs that wages have begun to moderate in some industries, but like in Europe, those changing jobs still command bigger wage hikes.

Overall, though, the labour market remains imbalanced: there is excess demand relative to supply. This is the key reason we believe it is too early for an aforementioned dovish pivot. Until developed economy central banks are confident that labour markets are more balanced, they will keep tightening monetary policy. The pace of tightening will slow but the target is to reduce wage inflation to prevent inflationary forces from being self-fulfilling. It will be very hard to rebalance the labour market without engineering a recession.

Inflation: We have already spent some time in this note on the areas where inflationary pressures are abating. We believe goods inflation will continue to drop. Moreover, areas where there have been particular issues, such as in used cars, are clearly improving.

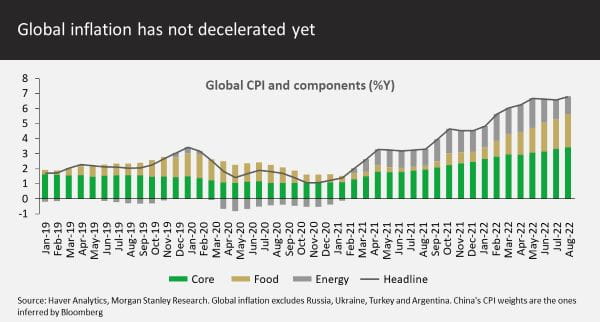

Global inflation looks, to us, a little more stubborn than the US. French inflation in November surprised slightly to the upside (7.1%) but matched the prior month. EU harmonised inflation for November came in at 10%, down from 10.4% the prior month.

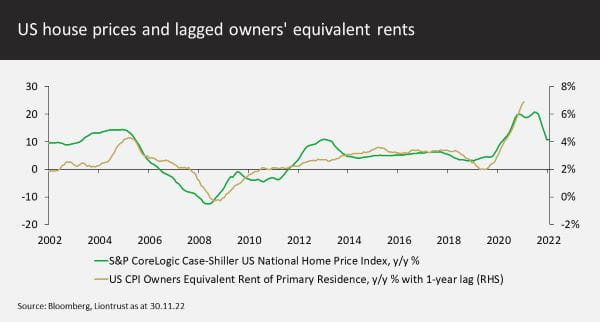

We have been keen to develop a better understanding of how falling house prices feed into housing costs. Shelter, which is mainly rents and owners’ equivalent rents (OER), accounts for ~40% of core CPI, and therefore will play a major role in the path of inflation in the US. The data suggests a twelve month lag, though we have some caution around this given the Fed is still some way from being in a position to cut interest rates. This means mortgage rates still look expensive relative to renting and may prevent material disinflation in rental costs.

So, with goods prices due to keep falling and shelter inflation expected to moderate in the summer of 2023, it is broadly only services inflation that will need to be conquered. The main driver of this remains the labour market which we discussed above.

Rates Positioning

Our broad strategy conclusion is that we are happy with our current level of duration of around 5.25 years in the Strategic Bond funds, a little long versus our 4.5 years neutral level. We added duration throughout the year, into rising rates, and were as high as 5.5 years roughly around the time of the recent peak in ten year yields at 4.25%.

The market has been very keen to call the end of the hiking cycle and even begin to talk about coming rate cuts, the oft-discussed ‘dovish pivot’. We believe rates have probably peaked, but inflation is not in a steep line downwards and the Fed is unlikely to throw too much weight behind the idea of the pivot anytime soon. We are therefore happy to retain much more dry powder in rates, in our range of 0-9 years duration.

Whilst credit has been cheap, we have used the capital of the fund to buy corporate bonds and therefore have not had much scope to add those government bond pair trades which require physical bond holdings. We are targeting ~80bps differential between US and Canadian ten year bonds to place a pair trade (long US v short Canada).

Our preference is for the 5-10 year part of the yield curve, having cut an unprofitable steepener in the funds at the start of the year. We maintain a small positive duration exposure to the 30+ years part of the curve even though valuation measures have long pointed to a steepening trade. We continue to monitor this closely, but with recession risks having arguably increased, we remain cautious about re-entering into a large steepening position prematurely.

Spread product

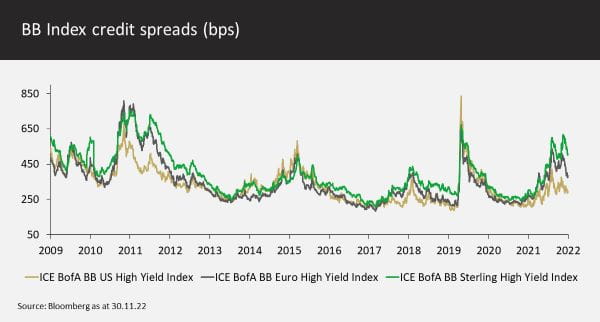

From late-October onwards, credit had a fairly strong rally. For example, US credit spreads have rallied around 30bps and Europe credit indices are 40bps tighter. Spreads are at average levels in the US and about 40bps wider than the post financial crisis norm in Europe. Strategically, we think credit offers long-term value both examining spreads and, particularly, the all-in yield. However, the upcoming recession in 2023 and reduction of central bank liquidity mean that we need to see more of a premium to justify a large overweight position. Given the less obviously attractive valuations, the spectre of recession and the potential for ongoing volatility, we have reduced our long position from 20% to 5%, taking investment grade exposure down to 50% (from 60%) and high yield to 25% (from 30%). This gives the funds the risk budget to be able to buy more credit should valuations improve again during any period of volatility.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.